No Data

9023 Tokyo Metro

- 1800

- +5+0.28%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Today's flows: 11/26 Nintendo saw an inflow of JPY¥ 2.74 billion, Advantest saw an outflow of JPY¥ 9.63 billion

On November 26th, the TSE Main Market saw an inflow of JPY¥ 771.02 billion and an outflow of JPY¥ 910.81 billion.$Nintendo(7974.JP)$, $Mitsui E&S(7003.JP)$ and $East Japan Railway(9020.JP)$ were net

The Nikkei average started 183 yen lower, with declines in Hitachi, Tokio Marine, etc.

[Nikkei Average Stock Price・TOPIX (Table)] Nikkei Average; 38,596.76; -183.38 TOPIX; 2,703.90; -11.70 [Opening Overview] On the 26th, the Nikkei Average opened 183.38 yen lower at 38,596.76 yen, falling for the first time in three days. The US stock market continued to rise on the 25th, with the dow inc up by 440.06 dollars at 44,736.57 dollars, and the nasdaq closing up by 51.19 points at 19,054.84. President Trump is expected to be the next Secretary of the Treasury.

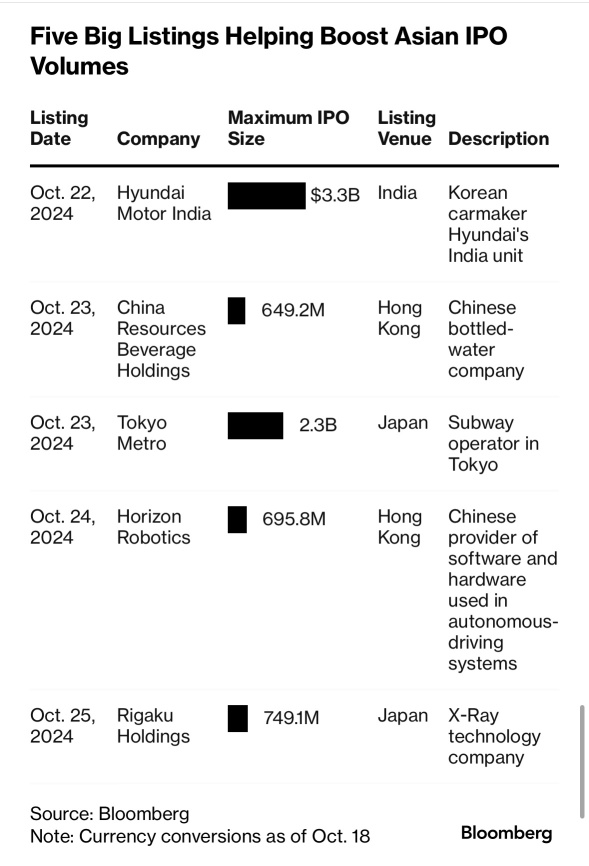

Every Comnet, Tokyo Metro◆Hot stocks from Fisco today◆

Maikomu Net <8908> announced a revision of the second quarter financial estimates. The operating profit has been revised upward from 0.16 billion yen to 0.215 billion yen. In the real estate solution business, the performance of the real estate management department is progressing smoothly, and in the student life solution business, the extracurricular activities solution department is doing well. The human resources solution department is not progressing as expected in terms of orders related to recruitment support systems, and is anticipated to fall below the plan. Tokyo Metro <9023> closed higher in yesterday's trading.

Three points to watch in the first half of the session – assessing the impact of nvidia's decline despite the positive sentiment from rising U.S. stocks.

In the morning session on the 26th, it is worth noting the following three points: - Pay attention to the impact of the rise in US stocks and the decline of Nvidia - Ricoh, upward revision on 25/3 from 52 billion yen to 61 billion yen - Points of interest in the morning session: Shimadzu Corporation, efficiency improvement in aircraft equipment production, aiming for a 20% cost reduction by the 2030 fiscal year - Pay attention to the impact of the rise in US stocks and the decline of Nvidia On the 26th, the Japanese stock market is likely to see a market development where the standoff intensifies after starting with buying momentum. On the 25th, the US market saw the Dow Jones Industrial Average rise by 440 points.

Tokyo Metro --- Be aware of the replaced target materials.

Yesterday, the stock continued to rise, updating the all-time high. As the supply and demand ease due to this high price update, there is a possibility that buying interest may strengthen again. It is thought that profit-taking sell may easily occur due to the previous day's high price update, but the target for replacing the price range between the 1780 yen set on the day after the IPO and the low of 1605 yen set the following day is 1955 yen.

Emerging markets outlook: Will the bargain hunting continue during intermissions, with the Growth 250 Index keeping an eye on the 200-day moving average

■The emerging markets with many domestic demand stocks showed a relatively strong performance this week. While the Nikkei Average fell by -0.93% during the same period, the Growth Market Index rose by +1.71% and the Growth Market 250 Index increased by +1.42%, highlighting the strength of the emerging markets. Concerns over negative impacts from the upcoming Trump administration weighed on the main board market, but the emerging markets with many domestic demand stocks remained relatively stable. Attention was drawn to Nvidia's earnings and the trend of extended hours trading.

Analysis

Price Target

No Data

No Data