No Data

9023 Tokyo Metro

- 1592.0

- +8.5+0.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average starts up 132 yen, with Sumitomo Realty and Socionext rising, ETC.

[Nikkei Average and TOPIX (Table)] Nikkei Average; 39,589.65; +132.16 TOPIX; 2,742.39; +4.06 [Opening Overview] On the 17th, the Nikkei Average opened with a rise of 132.16 yen to 39,589.65, rebounding for the first time in three days. The US stock market on the previous day, the 16th, showed mixed results. The Dow Inc decreased by 110.58 dollars to 43,717.48 dollars, while the Nasdaq rose by 247.17 points to 20,173.89 and concluded the trading.

JP Movers | Socionext Rose 8.10%, Leading Nikkei 225 Components, Disco Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Socionext(6526.JP) being the top gainer today, rising 8.10% to close at 2817.0 yen. In addition, the top loser was Yamato Holdings(9064.JP),falling 4.25% to end at 1757.0 yen.

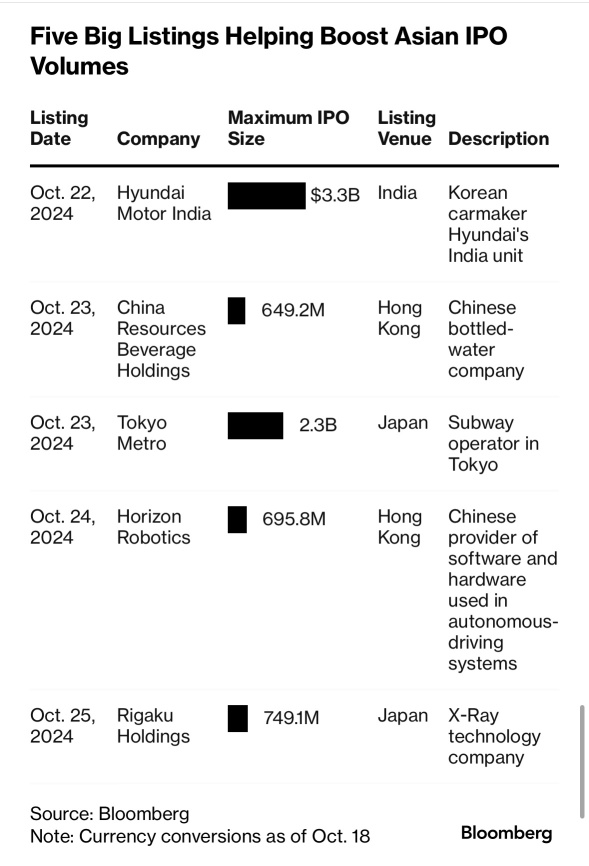

Stock blogger Sana Sae: Thoroughly scrutinize trend themes if hosting an ipos festival! My focus stock is... [FISCO Social Reporter]

The following is a comment written by the individual investor "Sanasae" (blog: 'Sanasae's Beautiful Investment Life'), who is a Fisco Social Reporter. At Fisco, we are committed to collaborating with individuals who actively share information to provide a wider range of information to investors.-----------*Written on December 4, 2024, at 11 AM. Hello everyone, good evening. Finally, the market that seems to excite individual investors has arrived. Yes, it's the end-of-year 'ipos festival.'

List of converted stocks (Part 2) [List of converted stocks for Parabolic Signal]

○ List of stocks that have transformed to sell in the market Code Company Name Closing Price SAR Main Board <1786> Oriental Shiraishi 381 397 <2491> V Commerce 11291155 <262A> Intermestic 24542733 <2935> Pickles HD 10211064 <3561> Power Source HD 10311129 <3675> Cross Marketing 654706 <3915> Telus Sky 192420

Emerging markets outlook: Will the search for interlude stocks continue, or will funds flow towards core stocks?

This week, large cap stocks on the main board are being actively traded while the emerging markets are on the rise. During the same period, the Nikkei average showed a decline of -0.20%, whereas the growth market index rose by +0.51% and the Growth Market 250 index increased by +0.91%, highlighting the strength of the emerging markets. In the USA, expectations for an interest rate cut at the December Federal Open Market Committee (FOMC) meeting have strengthened, while in japan, expectations for an interest rate hike at the December monetary policy decision meeting of the Bank of Japan have increased, leading to a heightened awareness of the narrowing interest rate gap between japan and the USA.

Stocks that moved the day before part 2: japan microelectronics, power fasteners, headwaters, etc.

Stock name <Code> 29th closing price vs. previous day's price Japan Micronics <6871> 3735 -150 pressured by the downward trend of semiconductor-related stocks. Nissan Motor Co. <7201> 358.9 -15.0 Moody's downgraded the rating outlook. Fanuc Corp <6954> 3887 -48 Selling pressure based on some reports related to EMC malpractice. Isuzu Motors <7202> 1997.0 -38.0 Automobile stocks are viewed as weak due to the progress of the strong yen. Tokyo Metro <9023> 1660.