No Data

9201 Japan Airlines

- 2678.0

- 0.00.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Asahi, MonotaRO ETC (additional) Rating

Upgrades - Bullish Code Stock Name Securities Company Previous Change After -------------------------------------------------------------- <4385> Mercari Morgan Stanley "Equal Weight" "Overweight" Downgrades - Bearish Code Stock Name Securities Company Previous Change After ----------------------------------------------------------------- <3

The Nikkei average is up about 190 yen, continuing a steady trend after turning upward = 21st morning session.

On the 21st at around 10:07 AM, the Nikkei average stock price is moving at around 37,943 yen, about 190 yen higher than the previous business day. At 10:06 AM, it reached 37,947.36 yen, up 195.48 yen. In the morning, following the slight decline in the NY Dow and Nasdaq Index ETF in the US stock market on the 20th local time, selling was prioritized. However, it seems that the aggressive selling was limited and buying to secure March Dividends supported a turnaround. The movement has remained robust since then.

Rating information (Target Price change - Part 1) = JAL, RideLy ETC.

◎ Nomura Securities (3 tiers: Buy > neutral > Reduce) JAL <9201.T> -- "Buy" → "Buy", 3600 yen → 3700 yen National Guarantee <7164.T> -- "neutral" → "neutral", 6000 yen → 6100 yen NISSHO <7915.T> -- "neutral" → "neutral", 1750 yen → 1510 yen ◎ Daiwa Securities (5 tiers: 1 > 2 > 3 > 4 > 5) Ridley C <2585.T> -- "2" → "2", 2700 yen →

Japan Airlines Cuts Revenue Forecast for Fiscal 2025

List of conversion stocks [List of parabolic signal conversion stocks]

○ List of Stocks for Buy Change Market Code Stock Name Closing Price SAR Tokyo Main Board <1812> Kashima 3125 <1820> Nishimatsu Construction 50264816 <1946> Toenek 1011957 <1950> Japan Electric Utility 21992096 <1951> Exeo Group 17691711 <2121> MIXI 34203290 <2154> Open UP 18681756 <25

Kakaku.com, upward revision on March 25, operating profit 29.2 billion yen, up from 28.5 billion yen.

Kakaku.com <2371> announced a revision of its financial estimates for the fiscal year ending in March 2025. Revenue has been revised upward from 74 billion yen to 78 billion yen, and operating profit has been raised from 28.5 billion yen to 29.2 billion yen. Sales and profits from the Tabelog and Job Box businesses have remained stronger than expected. 【Positive Evaluation】 <8977> Hankyu REIT Revision | <8131> Mitsuuroko HD Revision 【Hold】 <7273> Ikuyo Revision | <7173> Tokyo Kiraboshi Revision <2371> Kakaku.com Revision | <62

Comments

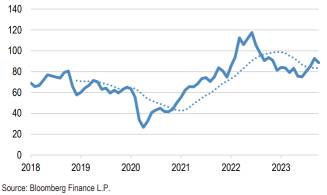

With oil prices continuing to decline, differing views on the outlook have emerged. On the one hand, the IEA believes the market will remain well supplied with the organisation expecting surpluses into next year even if OPEC+ production cuts are extended. However, with demand growth relatively robust, the expectation from

other news sources is that the cartel could actu...