No Data

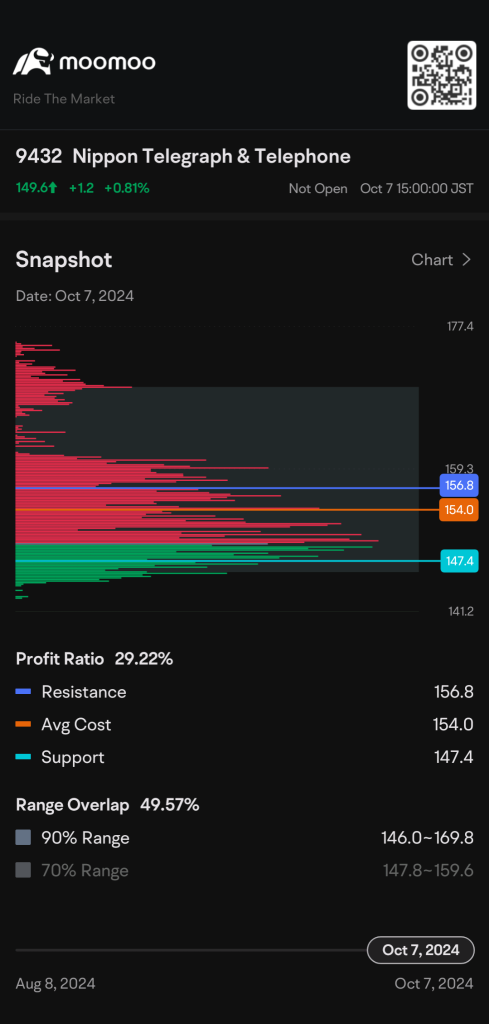

9432 Nippon Telegraph & Telephone

- 152.6

- -1.7-1.10%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Today's flows: 11/27 Kansai Electric Power saw an inflow of JPY¥ 3.59 billion, Toyota Motor saw an outflow of JPY¥ 7.07 billion

On November 27th, the TSE Main Market saw an inflow of JPY¥ 760.76 billion and an outflow of JPY¥ 886.52 billion.$Kansai Electric Power(9503.JP)$, $SoftBank Group(9984.JP)$ and $Fujikura(5803.JP)$

S&P Affirms Nippon Telegraph and Telephone on Solid Earnings From Telecom-Related, IT Service Businesses

Nikkei Average Contribution Ranking (preliminary closing) ~ Nikkei Average significantly extended, with First Retail and East Elec pushing up by about 204 yen for 2 stocks.

At the closing time on the 25th, the number of rising stocks in the Nikkei average constituents was 181, falling stocks were 41, and unchanged stocks were 3. The Nikkei average showed a significant increase. It closed the morning session at 38,868.68 yen, up 584.83 yen (volume approximately 0.9 billion 11.31 million shares). At the end of the trading day, the Dow Jones Industrial Average in the US market last weekend on the 22nd was 426.16 points higher at 44,296.51, and the Nasdaq closed at 19,003.65, up 31.23 points. Due to the improvement in manufacturing and services PMI, the So

Three points to focus on in the latter half of the session – buying is dominant and fluctuating in positive territory.

In the afternoon trade on the 25th, attention will be focused on the following three points. ・The Nikkei average continued to rise significantly, with buy strengths prevailing in positive territory. ・The dollar-yen shows signs of stabilizing after a decline, with some buybacks due to perceived value. ・The top contributor to price increase is Fast Retailing <9983>, while the second is tokyo electron ltd. unsponsored adr <8035>. ■ The Nikkei average continues to rise significantly, with buy strengths prevailing in positive territory. The Nikkei average has surged by 584.83 yen to 38,868.68 yen (volume approximately 0.9 billion, 11.31 million shares) by the end of morning trading on the 22nd.

The Nikkei average continued to rise significantly, moving in the positive territory with buying dominance.

The Nikkei Average continued to rise significantly. It closed the morning session at 38,868.68 yen, up 584.83 yen (with a volume estimate of 9.11 million shares). At the end of last week on the 22nd, the Dow Jones Industrial Average in the USA closed at 44,296.51 dollars, up 426.16 dollars, and the Nasdaq closed at 19,003.65 points, up 31.23 points. The improvement in manufacturing and service industry PMI led to buying interest in expectations of a soft landing, resulting in an increase after the opening. With the decline in long-term interest rates and Gap Inc., Ross Stores.

Three key points to watch in the first half of the session - funds are likely to flow towards economically sensitive stocks, etc.

In the morning session of the 25th, the following three points are worth noting: ■ Money is likely to flow into cyclical stocks and others ■ Mitachi, 25/5 upward revision Operating profit 1.9 billion yen ← 1.8 billion yen ■ Highlights of the morning session: Sumitomo Corporation, Sumitomo Precision Products, MEMS contract manufacturing expansion, acquisition of a US joint venture Money is likely to flow into cyclical stocks and others. The Japanese stock market on the 25th started with buying, but is likely to develop into a market situation where deadlock intensifies. The US market on the 22nd saw the Dow Jones Industrial Average rise by 426 points and the Nasdaq etc.

Comments

Do you find it

Yes?

No worries!

Why not try these methods to get rewards bigger

To get rewards bigger than the yield coupon, Mooers may exchange 400 coins for 1000 MooMoo points.

Let's assume Mooers managed to collect 4000 coins. This would mean that Mooers could exchange f...

As strong as the U.S. economy, Japan Property is probably the best investment in 2023.

Why? Here are 4 reasons as follows:

Besides, even Warren Buffett, via Berkshire Hathaway ( $Berkshire Hathaway-A (BRK.A.US)$ , $Berkshire Hathaway-B (BRK.B.US)$ , $Warren Buffett Portfolio (LIST2999.US)$ ) has increased his holdings of Japanese stocks.

Also, the Nikkei 225 ( $Nikkei 225 (.N225.JP)$ ) YTD performance is 28.51%, much higher than S&P 500 ( $S&P 500 Index (.SPX.US)$ ) YTD of ...

It is also the largest publicly traded company in Japan after $Toyota Motor (7203.JP)$ and $Sony Group (6758.JP)$.

It has a great track record in dishing out dividends. And judging by its stability, it could be one of the stocks that Japanese investors might consider in curating their first stock portfolio.

Here are some important points I picke...

Analysis

Price Target

No Data

No Data