No Data

9434 SoftBank

- 213.1

- -1.1-0.51%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Market Chatter: Amid AI Surge, China Unicom (Hong Kong) Ramps Up Computing Power Investment for 2025

ELECOM, ASICS, ETC (additional) Rating

Downgrade - Bearish Code Stock Name Brokerage Company Previous Change After-------------------------------------------------------------<9204> Skymark Morgan S "Overweight" "Equal Weight" Target Price Change Code Stock Name Brokerage Company Previous Change After-------------------------------------------------------------<3861

Rating information (Target Price change - part 2) = Earth Pharmaceuticals, Mitsui Chemicals, ETC.

◎Morgan Stanley MUFG Securities (3-tier system: Overweight > Equal Weight > Underweight) Earth Pharmaceuticals <4985.T> --- "Equal Weight" → "Equal Weight", 5,500 yen → 5,400 yen ◎Okasan Securities (3-tier system: Bullish > Hold > Bearish) Mitsui Chemicals <4183.T> --- "Bullish" → "Bullish", 4,500 yen → 4,200 yen NTT <9432.T> --- "Bullish" → "Bullish", 178 yen → 172 yen KDDI <9433.T> --- "Hold"

Berkshire "as promised" increased its Shareholding in Japan's five major trading companies, with an average holding ratio close to 10%.

The shareholding ratios of Mitsui & Co. increased from 8.09% to 9.82%, Mitsubishi Corporation's shareholding rose from 8.31% to 9.67%, Sumitomo Corporation's shareholding increased from 8.23% to 9.29%, Itochu Corporation's shareholding was raised from 7.47% to 8.53%, and Marubeni Corporation's shareholding went up from 8.30% to 9.30%. Munger once stated that Buffett's bet on the Japanese stock market is a "once in a century" opportunity, as the low interest rate environment allows investors to achieve substantial returns at almost zero cost.

Jacks, Yamaha and others [List of stock materials from the newspaper]

* JAX <8584> Mitsubishi UFJ Bank adds 39 billion yen in investment, holding 40% voting rights in MUFG (Nikkankogyo, page 3) -○ * Nippon Steel <5401> promotes market formation for 'GX Steel' domestically, advancing the economic valuation of CO2 reduction during manufacturing (Nikkankogyo, page 3) -○ * Yamaha Motor <7272> extends operations at Hamakita Plant until 2031, postponing the completion within this year (Nikkankogyo, page 3) -○ * SoftBank <9434> acquires part of SHARP CORP Sakai Plant for 100 billion yen (Nikkankogyo, page 3) -○ * Toyota Tsusho <8015> 134.4 billion.

The Nikkei average is up about 120 yen, with trading volume led by Kawasaki Heavy Industries, Mitsubishi Heavy Industries, and Advantest.

Around 2:01 PM on the 13th, the Nikkei average stock price is trading approximately 120 yen higher than the previous day at around 36,940 yen. The afternoon session starts with a sell-off prevailing in the market. Amid pressures from selling that is anticipating a rebound, the foreign exchange market seems to be conscious of the yen strengthening slightly to around 147.80 yen per dollar in the afternoon. The top volume stocks around 2:01 PM (Main Board) are NTT <9432.T>, JDI <6740.T>, Mitsubishi Heavy Industries <7011.T>, and Mitsubishi UFJ <8306.T>.

Comments

The Significance of Corporate Allian...

Key Highlights:

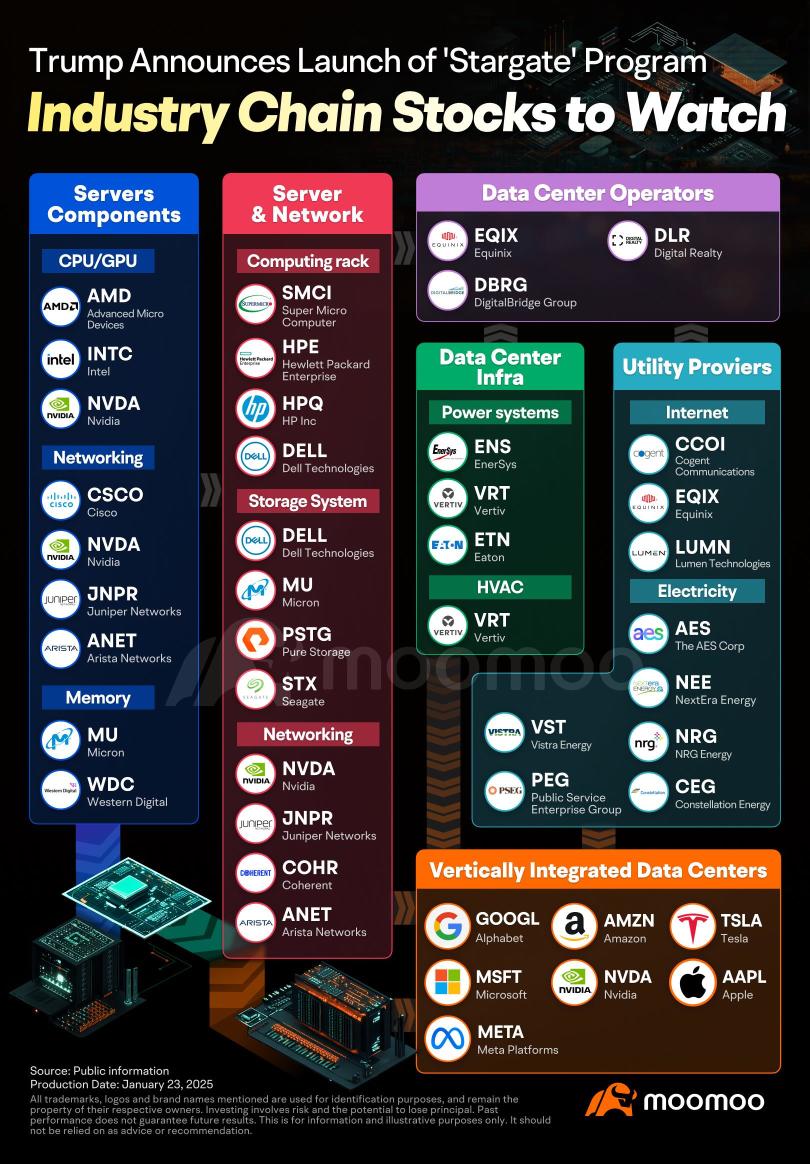

• Formation of Stargate: The partnership, named Stargate, is set to establ...

Do you find it

Yes?

No worries!

Why not try these methods to get rewards bigger

To get rewards bigger than the yield coupon, Mooers may exchange 400 coins for 1000 MooMoo points.

Let's assume Mooers managed to collect 4000 coins. This would mean that Mooers could exchange f...

Buy n Die Together❤ :

105108910 : so greatness

PAUL BIN ANTHONY : very good