No Data

9984 SoftBank Group

- 8586.0

- +36.0+0.42%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock ranking - toyota motor and others generally favored for buying, Chicago is 255 yen higher than Osaka at 38,595 yen.

ADR (American Depositary Receipt) Japanese stocks, when converted to Tokyo Stock Exchange comparison (1 dollar = 154.85 yen), Orlando <4661>, Toyota Motor <7203>, DISCO <6146>, Itochu Corporation <8001>, SoftBank Group <9984>, Honda Motor Co., Ltd. <7267>, Orix <8591>, etc., are rising, with a general buying preference. Chicago Nikkei 225 futures settlement price is 255 yen higher at 38,595 yen compared to Osaka daytime price. The US stock market continues to rise. The Dow Jones Industrial Average is up 426.16 dollars at 44.

On the 22nd, the New York market continued to rise [Closing of the New York market].

[NYDow・NasDaq・cme (Table)] NYDOW; 19003.65; +31.23 Nasdaq; 44296.51; +426.16 CME225; 38595; +255 (TSE Ratio) [NY Market Data] The New York market continued to rise on the 22nd. The Dow gained 426.16 points to close at 44,296.51, while the Nasdaq rose 31.23 points to 19,003.65. With improvements in manufacturing and service sector PMI, there is buying expectations for a soft landing.

The U.S. stock market continued to rise, responding positively to strong earnings from retail companies (22nd).

Chicago Nikkei Average Futures (CME) on the 22nd DEC24 O 38290 (dollar-denominated) H 38670 L 38075 C 38620 TSE comparison +280 (Evening comparison +40) Vol 4971 DEC24 O 38260 (yen-denominated) H 38645 L 38045 C 38595 TSE comparison +255 (Evening comparison +15) Vol 18766 American Depositary Receipt Overview (ADR) on the 22nd In the ADR market, compared to the Tokyo Stock Exchange (converted at 1 dollar to 154.85 yen)

Nikkei average contribution ranking (pre-close) ~ Nikkei average rebounds for the first time in 3 days, with Fast Retailing and Toshibha Electric pushing up about 113 yen with 2 stocks.

As of the market close on the 22nd, the number of rising and falling stocks in the Nikkei Average was 172 rising, 50 falling, and 3 unchanged. The Nikkei Average rebounded, closing the morning session at 38,415.32 yen, up 389.15 yen (+1.02%) from the previous day (with an estimated volume of 0.8 billion 10 million shares). On the 21st, the US stock market rose. The dow inc was up 461.88 dollars at 43,870.35 dollars, and the nasdaq finished trading up 6.28 points at 18,972.42. Geopolitical risks are escalating.

SoftBank G --- Rebound supported by the 75-day line and the 52-week line.

After a 5-day rebound. The adjustment strengthened towards the previous high of 9,842 yen set on November 13th, breaking through the 25-day line, 200-day line, and dropping to the 75-day line. Today, the 75-day line is likely to be perceived as a support level, making it easier for rebound-targeted buying to enter. In terms of weekly shape, although it fell below the 13-week line, the upward-trending 52-week line is being recognized as a support line.

ADR Japanese stock rankings - overall buying dominance including Orient Land, Chicago at 38,230 yen, 190 yen higher than Osaka.

Japanese stocks of ADR (american depositary receipt) compared to the Tokyo Stock Exchange (calculated at 154.51 yen per dollar), such as Orion Land <4661>, Mitsubishi Corporation <8058>, komatsu <6301>, Disco <6146>, Tokyo Electron <8035>, SoftBank Group <9984>, Mizuho Financial Group <8411>, have risen, with buying pressure prevailing overall. The settlement price of the Chicago Nikkei 225 futures is 38,230 yen, which is 190 yen higher than during the Osaka day session. The US stock market has risen, with the dow inc gaining 461.88 dollars.

Comments

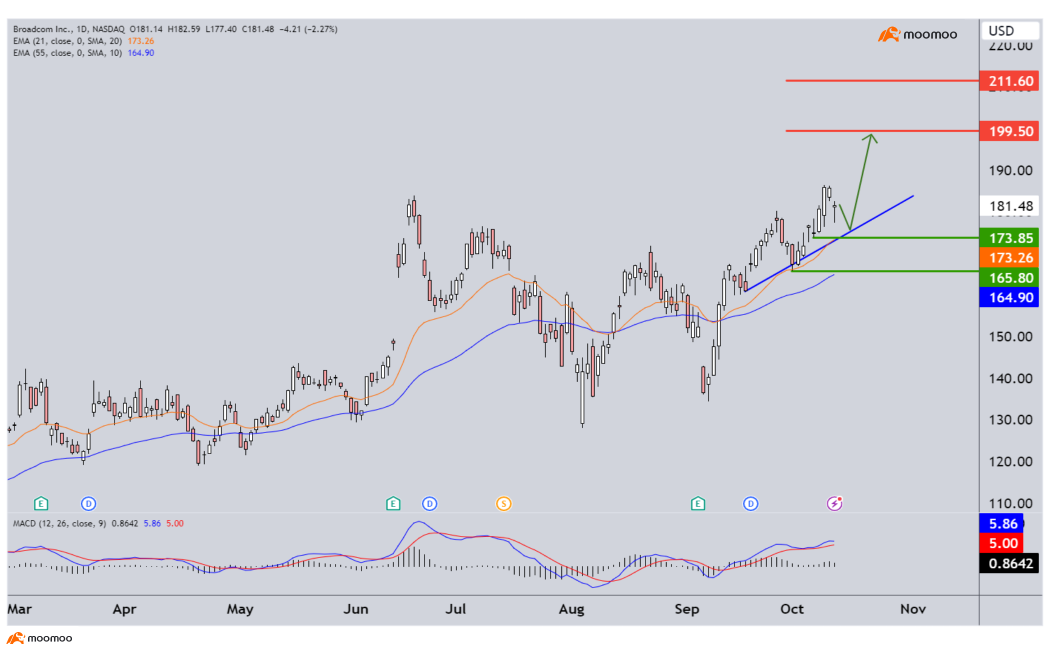

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We turn bullish as price pushed above 5810 resistance level. As long as price holds above its resistance-turned-support level at 5810, we expect price to continue pushing towards 5860 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 sup...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]As expected, market pushed lower reaching previous target before rebounding sharply. We turn neutral for now given the wild swings in prices. With price consolidating between 5580.25 resistance and 5539.25 support. A candlestick close above 5580.25 resistance will open further rise towards next resistance at 5665.

Alternatively:...

【United States】

Data from the U.S. Census Bureau shows that in July, new housing starts in the United States fell by 6.8% month-over-month, with an annualized rate dropping to 1.238 million units. This figure is lower than the market expectation of 1.33 million units and marks the largest decline since March. This contrasts with the revised 1.1% increase from the previous month.

US Jobless Claims, Business Activity Keep Economy On Gradual...

Analysis

Price Target

No Data

No Data

SSS AhHuatKopi SSS : Thanks for the constant updates !

54088 FROM MBS : 3299

103356238jenny tan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)