US OptionsDetailed Quotes

AAL250103C14500

- 2.36

- 0.000.00%

15min DelayClose Jan 3 16:00 ET

0.00High0.00Low

0.00Open2.36Pre Close0 Volume0 Open Interest14.50Strike Price0.00Turnover0.00%IV-7.72%PremiumJan 3, 2025Expiry Date3.77Intrinsic Value100Multiplier-16DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma7.74Leverage Ratio--Theta--Rho--Eff Leverage--Vega

American Airlines Stock Discussion

Hi mooers!

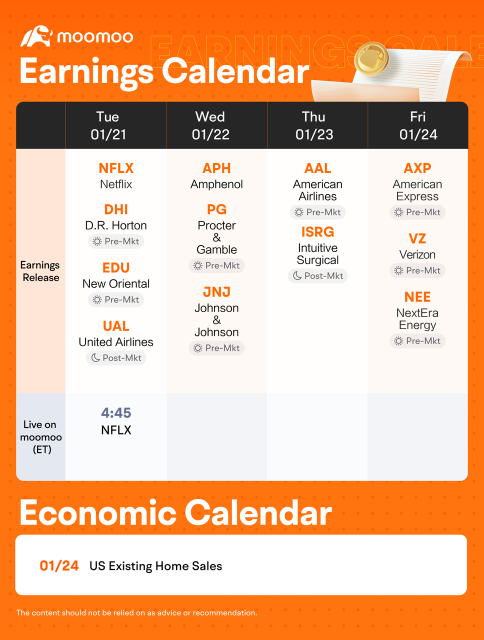

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Netflix (NFLX.US)$, $Johnson & Johnson (JNJ.US)$, $American Airlines (AAL.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings results...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Netflix (NFLX.US)$, $Johnson & Johnson (JNJ.US)$, $American Airlines (AAL.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings results...

10

5

1

Delta's strong performance last Friday and its optimistic outlook have positively impacted the broader U.S. airline industry, with major airline stocks climbing noticeably. $Delta Air Lines (DAL.US)$ surged 9% on Friday, surpassing its 30-day moving average, but saw a slight pullback of 2.76% on Monday. $American Airlines (AAL.US)$ rose 4.4%, $United Airlines (UAL.US)$ increased 3.3%, and $Alaska Air (ALK.US)$...

21

1

6

We all know that Trump's policies have stirred up quite a lot of waves on the economic chessboard. Today, I'd like to chat with you guys about the investment opportunities hidden in the tourism, aviation and manufacturing industries under the influence of his policies.

Aviation Industry: Potential Stocks Driven by the Travel Boom

Once Trump took office, he made considerable efforts to ease regulations ...

Aviation Industry: Potential Stocks Driven by the Travel Boom

Once Trump took office, he made considerable efforts to ease regulations ...

+2

12

$American Airlines (AAL.US)$

this dont look good.

this dont look good.

After the better-than-expected jobs report was released, the Dow was off more than 600 points in Friday. DAL and WBA earnings came in hot, leading to some climbers where it mattered, but overall, markets were down for the day and the week.

After the 4 pm ET close, the $S&P 500 Index (.SPX.US)$ was down 1.54%, the $Dow Jones Industrial Average (.DJI.US)$ fell 1.63%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 1.63%.

Click here for more moomoo produced news!!

MACRO

In ...

After the 4 pm ET close, the $S&P 500 Index (.SPX.US)$ was down 1.54%, the $Dow Jones Industrial Average (.DJI.US)$ fell 1.63%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 1.63%.

Click here for more moomoo produced news!!

MACRO

In ...

33

10

9

Columns First Earnings Show Beats are Back, December Jobs Climbed but Market Falls Friday | Live Stock

Happy Friday traders. It's January 10th, and we still have not had a full trading week this year. The market is falling, but the S&P 500 at least closed positive for the first five trading sessions of the new year Wednesday, an indicator that tends to mean the index will end the year on a positive note.

Earnings are coming in for a fresh new quarter, we will track as many as we can, last quarter we upda...

Earnings are coming in for a fresh new quarter, we will track as many as we can, last quarter we upda...

19

10

4

Morning Movers

Gapping up

$GameStop (GME.US)$ shares surged over 4%, building on Tuesday's momentum. The video game retailer has experienced gains for four consecutive days, skyrocketing more than 77% year-to-date in 2024.

Shares of $Zoomcar Holdings (ZCAR.US)$ surged in pre-market trading today after the company reported a 43% year-over-year increase in bookings for November 2024, fueled largely by heightened demand during the w...

Gapping up

$GameStop (GME.US)$ shares surged over 4%, building on Tuesday's momentum. The video game retailer has experienced gains for four consecutive days, skyrocketing more than 77% year-to-date in 2024.

Shares of $Zoomcar Holdings (ZCAR.US)$ surged in pre-market trading today after the company reported a 43% year-over-year increase in bookings for November 2024, fueled largely by heightened demand during the w...

22

2

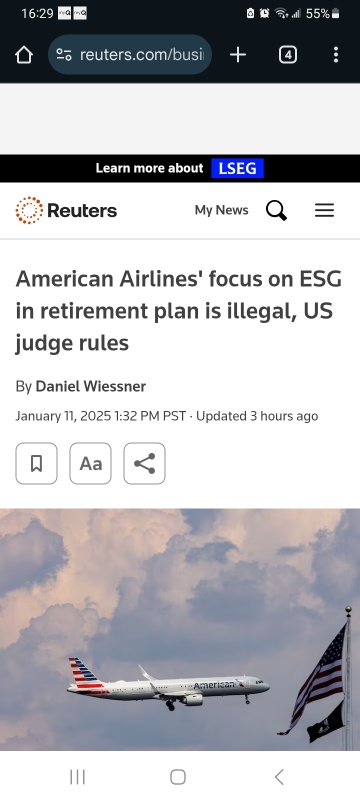

$American Airlines (AAL.US)$ FUD being reported time to play calls!

2

No comment yet

104712493 : Here's an overview of the earnings prospects for Netflix (NFLX), Johnson & Johnson (JNJ), and American Airlines Group Inc. (AAL):

Netflix (NFLX):

Netflix is scheduled to report its fourth-quarter earnings on January 21, 2025. The company's stock has appreciated nearly 80% over the past year, underscoring its leading position in the streaming industry. Analysts anticipate that Netflix will continue to bolster its revenue through strategic price increases and the expansion of its ad-supported subscription tiers. The introduction of live events and sports content is also expected to attract and retain subscribers. However, challenges such as foreign exchange fluctuations and the residual effects of industry disruptions, including the 2023 writers and actors strikes, may impact financial performance.

Johnson & Johnson (JNJ):

Johnson & Johnson is set to release its earnings on January 21, 2025. The company has historically demonstrated stable performance, driven primarily by its pharmaceutical division. Recent developments in its innovative medicine segment, particularly with treatments like Tremfya for Crohn’s disease and ulcerative colitis, have shown promising results. While J&J maintains a solid balance sheet and consistent return on capital, it faces potential headwinds from global healthcare supply chain disruptions and geopolitical risks. Investors will be keen to assess how recent divestments and the pharmaceutical pipeline influence future earnings growth.

American Airlines Group Inc. (AAL):

American Airlines is expected to report its earnings on January 23, 2025. The airline industry has been experiencing a rebound, with carriers like Delta Air Lines forecasting a strong year ahead, driven by demand for premium-class seats and upsell opportunities. Analysts anticipate that American Airlines will reflect similar trends, benefiting from the resurgence in corporate travel and growth in international routes. However, the company must navigate challenges such as fluctuating fuel costs and competitive pressures within the industry.

Overall, while each company operates in distinct sectors, they share common themes of leveraging strategic initiatives to drive growth amid external challenges

ZnWC :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Buy n Die Together❤ :

Lucas Cheah : $Netflix (NFLX.US)$

Netflix’s earnings prospects are strong, driven by international expansion, the ad-supported tier, and content investments. Its push into mobile-only plans in markets like India and Africa has broadened its subscriber base. For example, its ad-supported subscription tier is expected to add billions in revenue annually by attracting cost-sensitive users. However, rising competition and high content costs remain challenges.

$Johnson & Johnson (JNJ.US)$

J&J’s earnings are supported by its diversified business model, spanning pharmaceuticals, medical devices, and consumer health products. The separation of its consumer health division (Kenvue) allows J&J to focus on high-margin pharmaceutical and med-tech innovations. For instance, its oncology and immunology drugs, such as Darzalex, continue to drive growth. Risks include potential litigation costs and competitive pressures in its key markets.

$American Airlines (AAL.US)$

American Airlines faces mixed earnings prospects. While strong travel demand and higher ticket prices have boosted revenues, rising fuel costs and high debt levels weigh on profitability. The company’s focus on optimizing capacity and expanding international routes offers growth potential. For example, robust demand for transatlantic travel has supported revenue in its premium cabins. However, economic uncertainty and operational costs remain key risks.

Each company offers unique opportunities and risks, making them suitable for investors with specific objectives, from growth (Netflix) to stability (J&J) or cyclical recovery (AAL).

Lazy Cat Invests : Netflix (NFLX):

Netflix’s earnings prospect appears positive. The stock has tripled in value from 2023 to the end of 2024. Analysts have been adjusting their ratings and price targets, with some firms like Seaport Res Ptn upgrading Netflix to a “strong buy”. However, there are mixed views, as some analysts have also lowered their price targets, indicating potential challenges in meeting high expectations. Overall, the sentiment around Netflix is cautiously optimistic, with expectations of continued growth.

Johnson & Johnson (JNJ):

Johnson & Johnson has a history of surpassing Wall Street’s earnings expectations over the past decade. Recent strategic moves, such as the acquisition of Intra-Cellular Therapies for $14.6 billion, highlight JNJ’s efforts to strengthen its position in the biotechnology sector. Analysts have varied opinions on the stock, with some maintaining a “buy” rating while others have adjusted their price targets.

American Airlines (AAL):

American Airlines is set to report its fourth-quarter earnings on January 23, 2025. Analysts expect a significant year-over-year profit increase of over 120%, driven by strong holiday travel demand. The company is anticipated to benefit from the recovery in corporate travel, although it faces execution risks in regaining market share. The overall outlook for AAL is positive, with analysts recommending a “buy” rating.