No Data

ADP Automatic Data Processing

- 286.850

- -5.040-1.73%

- 289.670

- +2.820+0.98%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Weekly Buzz: CES Came and Brought the Pain? That's Unexpected

Wall Street Today: Labor Gains Hurt a Hurting Market

First Earnings Show Beats are Back, December Jobs Climbed but Market Falls Friday | Live Stock

ISG Study Says Need for Flexibility Is Driving Demand for AI-Powered Payroll Platforms

Gold prices rose slightly as investors await Friday's non-farm payroll report.

Despite the strong dollar, gold prices rose slightly in early trading as investors sought safe-haven Assets amid increasing market uncertainty. December's ADP employment data in the USA was weaker than expected, providing some support for the Federal Reserve's potential to be less cautious regarding interest rate cuts. However, the Federal Reserve's meeting minutes released on Wednesday showed that officials currently intend to keep interest rates stable, indicating they see risks of inflation being higher than expected, partly due to the uncertainty surrounding President-elect Trump's policies. Paul Ashworth of Capital Economics stated, "The current median interest rate forecast indicates a total cut of only 50 basis points this year."

The central parity rate of the RMB against the US dollar is reported at 7.1886, up by 1 point.

On January 9, the RMB middle rate against the USD was reported at 7.1886, an increase of 1 point. Federal Reserve meeting minutes: many officials believe that caution is needed in the "next few quarters". The Federal Reserve released the minutes of the December monetary policy meeting. The minutes indicate that participants stated if the data performs as expected, it would be appropriate to continue gradually moving toward a more neutral policy stance; the Federal Reserve is at or near the point suitable for slowing the pace of easing; many officials believe that caution is needed in the "next few quarters". The "little non-farm" unexpectedly fell short of expectations! On Wednesday, the ADP employment report, known as the "little non-farm", showed that in December of last year, the USA...

Comments

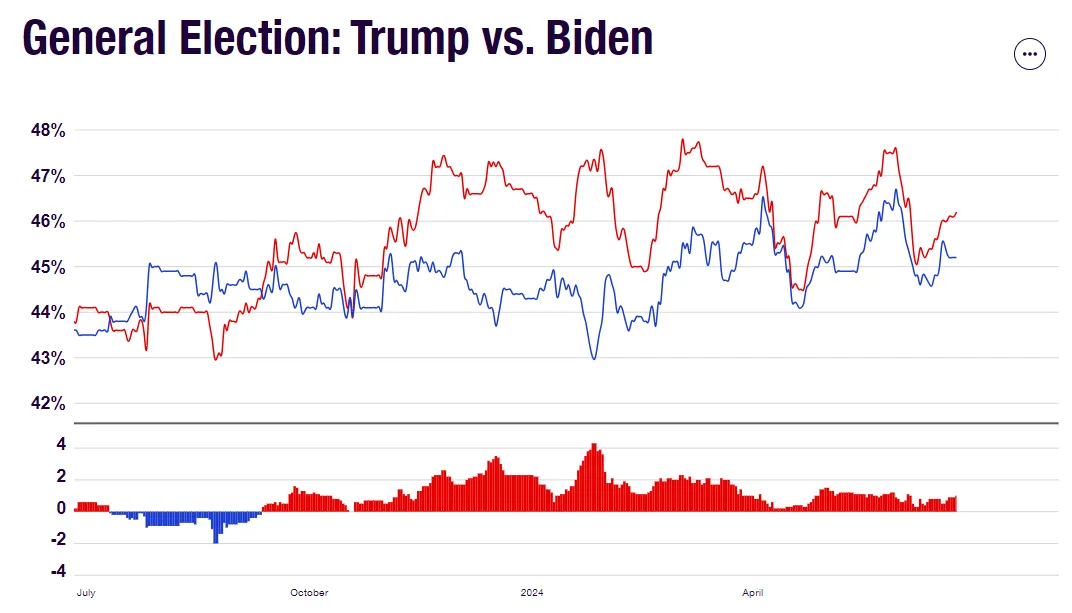

The debate is important because it's an opportunity for...

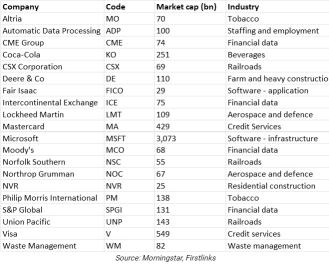

$GameStop (GME.US)$ $Altria (MO.US)$ $Automatic Data Processing (ADP.US)$ $Coca-Cola (KO.US)$

No Data

also trumps a convicted felon, that’s a real good look.

also trumps a convicted felon, that’s a real good look.