No Data

AIA S&P Asia 50 Index Ishares

- 68.780

- -0.460-0.66%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

In November, the MLF volume continued to shrink. Previously, the 500 billion buy-back reverse repurchase has released medium-term liquidity ahead of schedule. The industry expects the reserve requirement ratio cut to be implemented faster.

①The funding operation mode of shortening and lengthening funds continues. On the one hand, the central bank continues to reduce the MLF operations volume, reduce the existing stock to mitigate its impact on the liquidity market. On the other hand, short-term funds continue to be net injected to hedge against cross-month fund pressure, strengthening the guiding position of reverse repurchase agreements on market interest rates. ②Local government bonds are centrally supplied, and the MLF is likely to see a quicker implementation under the reduced volume environment.

"Post-85s" take control of Alibaba again.

Army group operations.

Alibaba CEO Wu Yongming integrates domestic and overseas e-commerce, appointing Jiang Fan to take charge.

Merge.

Rare! This rural commercial bank is offering a 5-year fixed deposit interest rate of 1.5%, which is lower than the 1.55% level of state-owned banks. It is referred to as a "case" in the industry.

①Recently, Wuxiang Rural Commercial Bank adjusted the deposit execution interest rates, lowering the execution interest rates for personal fixed-term deposits of two years, three years, and five years to 1.5%, with the five-year execution interest rate being lowered below the lowest level of the state-owned banks' published rates. ②The phenomenon of the aforementioned rural commercial bank reducing rates beyond the mid- to long-term levels of state-owned banks is still considered an isolated case.

Banks' dormant account cleanup is gradually extending to corporate accounts. This rural commercial bank announced that it will clean up long-suspended accounts of units, and many other banks are also handling this.

On the morning of November 20, Jinchang Rural Commercial Bank announced that it will clean up and close some unit bank settlement accounts that have been inactive for a long time. Recently, some banks have adopted similar practices to Jinchang Rural Commercial Bank, including Dangyang Rural Commercial Bank, China Construction Bank Weifang Branch, Bank of Nanjing.

The unchanged LPR in November meets market expectations. Industry insiders do not rule out the possibility of further interest rate cuts next year along with the reverse repurchase rate.

① By the end of the year, the economic running is expected to continue its upward trend, with policy interest rates likely to remain stable and LPR quote also expected to stay unchanged. ② There is a high possibility of further reductions in deposit rates in the future, coupled with the issuance of special treasury bonds to support large state-owned commercial banks in replenishing their core tier one capital, which is expected to gradually alleviate the interest spread and operational pressure for commercial banks. It is possible that next year the LPR quote may be accompanied by further interest rate cuts on reverse repurchase agreements.

Comments

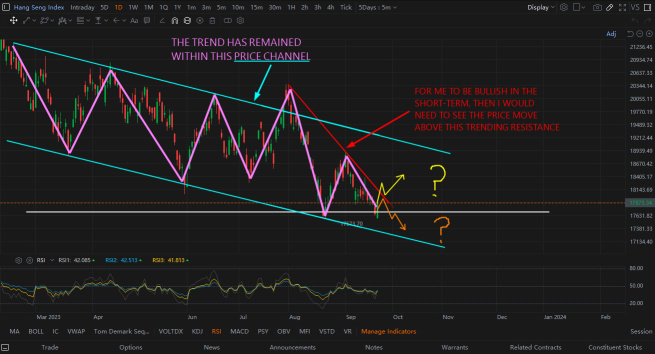

Silver Lining?

The market is beginning to look more and more bearish lately. But stocks can't fall forever. Typically, after a major selloff, you could expect a slight rebound in price as short swing traders take up profit and investors buy up shares at a relative discount.

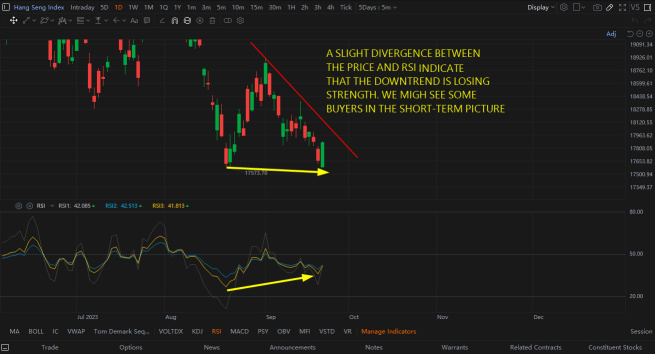

This might be what is happening in the Hang Seng Index today as we have a possible silver lining in the technical picture.

Technical Outlook

In the...

If you followed my previous post about bearish patterns popping up around the market, then I've got another one for you. Check out the previous post in the link below.

Another Bearish Technical Development

When sentiment in equity marktes worldwide is turning bearish, then you will see a lot of the more bearish technical patterns showing up in the charts. Here is an example below with the Hang Seng Index. A head and s...

$Alibaba (BABA.US)$

Macro

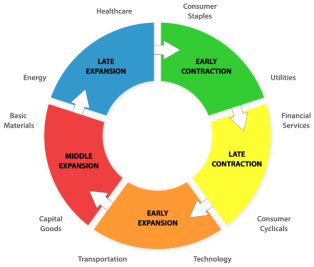

Currently, the chinese economy is not exactly the strongest economy, but it has been showing signs of slight expansion based on some of the more recent data.

Investors are mostly worried about the chines...

Macro Picture

Chinese economic data continues to come in stagnant. So far, I dont see anything major within the data recently that looks dovish for Chinese markets. Sometimes, the stock market will defy the economic data, but at the moment, the Hang Seng Index looks stagnant, just like the economic data.

It seems like everybody is waiting for a big stimulus announcement before the market can go bullish again. The last major stimulus package sent chine...

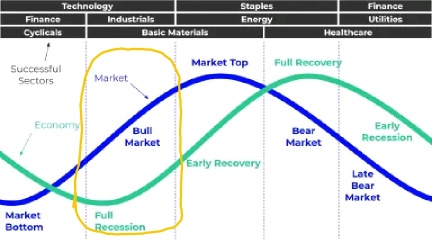

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

SpyderCall OP : @102640653

I'm still bearish at the moment. I need to see more upside. But if there was a solid technical level to buy in, then the fib levels are great for that. I still need to see more upside

SpyderCall OP SpyderCall OP : I'm checking out tencent and baba. give me a few minutes for those

102640653 : Agreed I’m also waiting for the first zone to be broken 18550-18620. I am also looking at sse index as hangseng just closely follow its movement. It’s just like sse is leading its way n the rest of the index mainly china a50, hangseng follows together . Thanks .

102640653 : Just look at sse movement . Good movement with China a50 but hongkong slow to follow in afternoon .

102640653 : Usually in afternoon trade hangseng would be consolidating n after 3 will make some moves but today is exceptional. Something more is there . All the heavyweight r picking up again after lunch . Just keep. An eye open.

View more comments...