US Stock MarketDetailed Quotes

AIR AAR Corp

- 58.460

- -9.890-14.47%

Trading Mar 28 13:40 ET

2.10BMarket Cap-162.39P/E (TTM)

65.085High56.020Low832.86KVolume65.560Open68.350Pre Close49.07MTurnover2.38%Turnover Ratio45.32P/E (Static)35.91MShares76.34052wk High1.78P/B2.05BFloat Cap54.71052wk Low--Dividend TTM35.00MShs Float76.340Historical High--Div YieldTTM13.26%Amplitude2.629Historical Low58.921Avg Price1Lot Size

AAR Corp Stock Forum

Hey there, long time no see! With Trump back in office, let’s dive into some stocks that could ride the wave of his legislation.

If you’re hungry for more updates, join our community of over 700 members! Everyone’s welcome—check it out here: Join the server Trader’s Tavern with us

Alright, let’s get into it! Here are a few small-cap stocks I’ve got my eye on for the next few months.

$The GEO Group Inc (GEO.US)$ - A real estate investment trust specializing in the design and managem...

If you’re hungry for more updates, join our community of over 700 members! Everyone’s welcome—check it out here: Join the server Trader’s Tavern with us

Alright, let’s get into it! Here are a few small-cap stocks I’ve got my eye on for the next few months.

$The GEO Group Inc (GEO.US)$ - A real estate investment trust specializing in the design and managem...

13

2

8

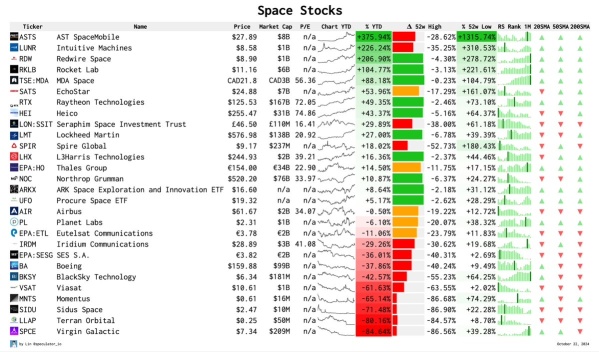

A List of Space Stocks: Copied from Lin posted in X

Launch Services Providers

$RKLB Rocket Lab $Rocket Lab (RKLB.US)$

$SPCE Virgin Galactic $Virgin Galactic (SPCE.US)$

Space Infrastructure and Services

$LUNR Intuitive Machines $Intuitive Machines (LUNR.US)$

$RDW Redwire Space $Redwire (RDW.US)$

$MNTS Momentus $Momentus (MNTS.US)$

$LLAP Terran Orbital

$SIDU Sidus Space $Sidus Space (SIDU.US)$

Satellite Communications

$ASTS AST SpaceMobile $AST SpaceMobile (ASTS.US)$

$SATS EchoStar $EchoStar (SATS.US)$ $IRDM Iri...

Launch Services Providers

$RKLB Rocket Lab $Rocket Lab (RKLB.US)$

$SPCE Virgin Galactic $Virgin Galactic (SPCE.US)$

Space Infrastructure and Services

$LUNR Intuitive Machines $Intuitive Machines (LUNR.US)$

$RDW Redwire Space $Redwire (RDW.US)$

$MNTS Momentus $Momentus (MNTS.US)$

$LLAP Terran Orbital

$SIDU Sidus Space $Sidus Space (SIDU.US)$

Satellite Communications

$ASTS AST SpaceMobile $AST SpaceMobile (ASTS.US)$

$SATS EchoStar $EchoStar (SATS.US)$ $IRDM Iri...

19

3

4

Hi, mooers!

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!![]()

This week, various companies including $AAR Corp (AIR.US)$ , $Costco (COST.US)$ and $BlackBerry (BB.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings releases, check out Moo earnings hub!

Rewards

![]() An equal s...

An equal s...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

This week, various companies including $AAR Corp (AIR.US)$ , $Costco (COST.US)$ and $BlackBerry (BB.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings releases, check out Moo earnings hub!

Rewards

15

10

5

AAR's Chairman, President and CEO, John M. Holmes, believes that Edwards' financial experience will be integral in executing the company's growth strategy and delivering further value to shareholders. Edwards himself is committed to supporting the advancement of AAR's growth strategy.

1

The sale is a transformative divestiture for Triumph, delivering immediate value to the company and stakeholders. It's expected to accelerate Triumph's deleveraging progress and improve its market growth capacity.

1

Despite AAR Corp.'s high P/E ratio, investors hesitate to sell due to expected earnings growth surpassing the market. High P/E ratio indicates investor trust in future performance, implying stable share price if earnings projections hold.

With retail trade in December traditional one of the strongest months for sales growth, it is worthwhile considering the listed Australian and NZ travel companies, retail brands and shopping trolley fillers, all of which, will likely see a sales and earnings boost and potential share price growth. From Black Friday sales, to Chrissy shopping, to arrivals in Australia lifting, we cover the food, grocery and ‘gr...

22

2

John M. Holmes, CEO of AAR, praises Nolen's unique skills set for enhancing the company's safety-first culture and strategy execution. Nolen appreciates AAR's proactive safety approach and values alignment.

$AAR Corp (AIR.US)$ $Amarin (AMRN.US)$ $Apellis Pharmaceuticals (APLS.US)$ $Aqua Metals (AQMS.US)$ $GreenPower Motor (GP.US)$ $Gorilla Technology (GRRR.US)$ $Interactive Brokers (IBKR.US)$ $Masimo (MASI.US)$ $Hitek Global (HKIT.US)$ $Hyperfine (HYPR.US)$ $Novartis AG (NVS.US)$ $Omnicom Group (OMC.US)$ $Prologis (PLD.US)$ $Pioneer Natural Resources (PXD.US)$ $Startek (SRT.US)$

1

3

Gapping up

In reaction to earnings/guidance:

• $Conagra Brands (CAG.US)$ +3.1%

• $Constellation Brands (STZ.US)$ +2.1%

Other news:

• $Coursera (COUR.US)$ +3.3% (names new COO)

• $International Game Technology (IGT.US)$ +2.8% (signs new 10-yr scratch ticket printing and services contract with Texas)

• $Aldeyra Therapeutics (ALDX.US)$ +2.3% (Achieves Primary Endpoint in Part 1 of Phase 3 GUARD Trial of ADX-2191)

• $Gol Intelligent Airlines (GOL.US)$ +1.5% (re...

In reaction to earnings/guidance:

• $Conagra Brands (CAG.US)$ +3.1%

• $Constellation Brands (STZ.US)$ +2.1%

Other news:

• $Coursera (COUR.US)$ +3.3% (names new COO)

• $International Game Technology (IGT.US)$ +2.8% (signs new 10-yr scratch ticket printing and services contract with Texas)

• $Aldeyra Therapeutics (ALDX.US)$ +2.3% (Achieves Primary Endpoint in Part 1 of Phase 3 GUARD Trial of ADX-2191)

• $Gol Intelligent Airlines (GOL.US)$ +1.5% (re...

19

3

No comment yet

Market Insights

Fed Rate Cut Beneficiaries Fed Rate Cut Beneficiaries

Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data. Stocks that are expected to benefit from a Federal Reserve rate cut. Information is provided by Futu and is a non-exhaustive list of all thematic stocks for reference purposes only.

This section presents the top 5 stocks in Fed Rate Cut Beneficiaries, ranked from highest to lowest based on real-time market data.

. He did the rate cut.... poor guy, market still crash...

. He did the rate cut.... poor guy, market still crash...

Lnova : thx

SpeedyStud OP Lnova : np!