US OptionsDetailed Quotes

AIR241220P40000

- 0.00

- 0.000.00%

15min DelayClose Nov 22 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest40.00Strike Price0.00Turnover0.00%IV42.10%PremiumDec 20, 2024Expiry Date0.00Intrinsic Value100Multiplier26DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma345.40Leverage Ratio--Theta--Rho--Eff Leverage--Vega

AAR Corp Stock Discussion

Hi, mooers!

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!![]()

This week, various companies including $AAR Corp (AIR.US)$ , $Costco (COST.US)$ and $BlackBerry (BB.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings releases, check out Moo earnings hub!

Rewards

![]() An equal s...

An equal s...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

This week, various companies including $AAR Corp (AIR.US)$ , $Costco (COST.US)$ and $BlackBerry (BB.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings releases, check out Moo earnings hub!

Rewards

15

10

AAR's Chairman, President and CEO, John M. Holmes, believes that Edwards' financial experience will be integral in executing the company's growth strategy and delivering further value to shareholders. Edwards himself is committed to supporting the advancement of AAR's growth strategy.

1

The sale is a transformative divestiture for Triumph, delivering immediate value to the company and stakeholders. It's expected to accelerate Triumph's deleveraging progress and improve its market growth capacity.

1

Despite AAR Corp.'s high P/E ratio, investors hesitate to sell due to expected earnings growth surpassing the market. High P/E ratio indicates investor trust in future performance, implying stable share price if earnings projections hold.

With retail trade in December traditional one of the strongest months for sales growth, it is worthwhile considering the listed Australian and NZ travel companies, retail brands and shopping trolley fillers, all of which, will likely see a sales and earnings boost and potential share price growth. From Black Friday sales, to Chrissy shopping, to arrivals in Australia lifting, we cover the food, grocery and ‘gr...

22

2

John M. Holmes, CEO of AAR, praises Nolen's unique skills set for enhancing the company's safety-first culture and strategy execution. Nolen appreciates AAR's proactive safety approach and values alignment.

$AAR Corp (AIR.US)$ $Amarin (AMRN.US)$ $Apellis Pharmaceuticals (APLS.US)$ $Aqua Metals (AQMS.US)$ $GreenPower Motor (GP.US)$ $Gorilla Technology (GRRR.US)$ $Interactive Brokers (IBKR.US)$ $Masimo (MASI.US)$ $Hitek Global (HKIT.US)$ $Hyperfine (HYPR.US)$ $Novartis AG (NVS.US)$ $Omnicom Group (OMC.US)$ $Prologis (PLD.US)$ $Pioneer Natural Resources (PXD.US)$ $Startek (SRT.US)$

1

3

Gapping up

In reaction to earnings/guidance:

• $Conagra Brands (CAG.US)$ +3.1%

• $Constellation Brands (STZ.US)$ +2.1%

Other news:

• $Coursera (COUR.US)$ +3.3% (names new COO)

• $International Game Technology (IGT.US)$ +2.8% (signs new 10-yr scratch ticket printing and services contract with Texas)

• $Aldeyra Therapeutics (ALDX.US)$ +2.3% (Achieves Primary Endpoint in Part 1 of Phase 3 GUARD Trial of ADX-2191)

• $Gol Intelligent Airlines (GOL.US)$ +1.5% (re...

In reaction to earnings/guidance:

• $Conagra Brands (CAG.US)$ +3.1%

• $Constellation Brands (STZ.US)$ +2.1%

Other news:

• $Coursera (COUR.US)$ +3.3% (names new COO)

• $International Game Technology (IGT.US)$ +2.8% (signs new 10-yr scratch ticket printing and services contract with Texas)

• $Aldeyra Therapeutics (ALDX.US)$ +2.3% (Achieves Primary Endpoint in Part 1 of Phase 3 GUARD Trial of ADX-2191)

• $Gol Intelligent Airlines (GOL.US)$ +1.5% (re...

19

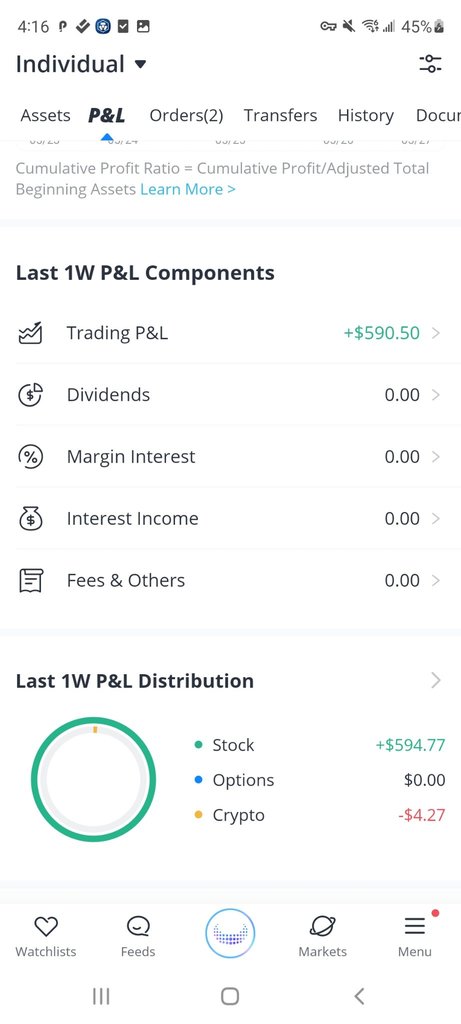

Like I said before..... if I was rich, I'd be filthy fricken rich 🤑 💰 🚀 #godisgood

This is my reward for holding a stock for almost two years... and then my moomoo picks today paid off as well 😉😜 $NVIDIA (NVDA.US)$ $AAR Corp (AIR.US)$ $Macy's (M.US)$ $Big Lots (BIG.US)$ $New York Community Bancorp (NYCB.US)$ changed it up today. Had a good feeling about these, and it went really well! So happy!!! And get to start back at work on Tuesday after three months off without pay...

This is my reward for holding a stock for almost two years... and then my moomoo picks today paid off as well 😉😜 $NVIDIA (NVDA.US)$ $AAR Corp (AIR.US)$ $Macy's (M.US)$ $Big Lots (BIG.US)$ $New York Community Bancorp (NYCB.US)$ changed it up today. Had a good feeling about these, and it went really well! So happy!!! And get to start back at work on Tuesday after three months off without pay...

8

2

$AAR Corp (AIR.US)$ made on ton on paper trading.... looks like it will still head up.... may need to get in on this through the weekend.... we'll 👀 😜

No comment yet

have a great Memorial Day weekend everyone!!!!!!

have a great Memorial Day weekend everyone!!!!!!

102362254 : I guess $Costco (COST.US)$ will end this week with the biggest % gain. Costco is financially strong, with steady revenue growth and high membership renewals. With the holiday season approaching, general sales particularly jewelry sales are expected to rise. Competing with retailers like Walmart and Amazon, Costco stands out by offering high-quality, exclusive pieces at great prices. Their in-store experience and brand trust give them an advantage, making it likely they’ll see strong earrings sales during this period.

mr_cashcow : My vote goes to $Costco (COST.US)$ as overall their performance seems to be positive![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Positive factors:

▲Consistent sales growth: Steady expansion in same-store sales, e-commerce, and international markets

▲Membership model: Stable revenue stream from growing membership base (~110 million)

▲Efficient operations: Ongoing improvements in logistics, supply chain, and inventory management

▲Diversified offerings: Expanding services (pharmacy, optical, tire centers) and private-label products (Kirkland Signature)

▲Global expansion: New store openings and market share gains

Negative factors:

▼Margin pressure: Competition, pricing pressures, and potential tariff impacts

▼E-commerce competition: Amazon, Walmart, and other online retailers

▼Inflation and currency fluctuations: Potential impacts on costs and international sales

A few key metrics:

1. Same-store sales growth: 5-7% (avg.)

2. Membership renewal rate: 90%+ (consistent)

3. Gross margin: 10.5-11% (stable)

4. Operating margin: 4-4.5% (improving)

Disclaimer: All the above are purely for educational purposes & are NOT financial advices, plz DYOR/DD!

Lucas Cheah : $AAR Corp (AIR.US)$ diversified business model, strong recovery in commercial aviation, and stable defense contracts should lead to solid earnings growth over the next several quarters. However, inflationary pressures remain a risk to profitability.

$Costco (COST.US)$ strong brand loyalty, pricing power, and membership-based model position it for continued earnings growth. The retailer is likely to benefit from inflationary trends as consumers seek value, making Costco a solid long-term performer.

$BlackBerry (BB.US)$ future earnings potential hinges on the success of its cybersecurity and IoT business segments. While the company is well-positioned in growing markets, competition and slow revenue growth remain key challenges.

ZnWC : I voted for $Costco (COST.US)$

dynamic-stacker : Earnings Release Performance History:

1. AIR: Average earnings surprise +15.6%, with 75% positive surprises

- Recent trends: Strong revenue growth, expanding gross margins

2. COST: Average earnings surprise +5.5%, with 83% positive surprises

- Recent trends: Consistent sales growth, membership expansion

3. BB: Average earnings surprise -12.1%, with 42% positive surprises

- Recent trends: Mixed results, transitioning from hardware to software focus

Factors Influencing Post-Earnings Performance:

1. AIR:

- Growing demand for travel and short-term rentals

- Expanding offerings (e.g., Airbnb Luxe, Experiences)

- Increasing competition from traditional hospitality and other platforms

2. COST:

- Consistent sales growth, driven by membership expansion and price increases

- Strong logistics and supply chain management

- Dependence on consumer spending and economic conditions

3. BB:

- Transitioning to software-focused business model

- Growing cybersecurity and IoT revenue

- Competition from established players in software and security

Post-Earnings Price Movement:

Historically:

- AIR: Average 5-day post-earnings gain +4.5%

- COST: Average 5-day post-earnings gain +2.5%

- BB: Average 5-day post-earnings gain -1.8%

Ranking:

Based on historical earnings surprise, recent trends, and growth prospects:

1. AIR (Airbnb)

2. COST (Costco)

3. BB (BlackBerry)

View more comments...