US Stock MarketDetailed Quotes

ALL Allstate

- 207.070

- +0.620+0.30%

Close Mar 31 16:00 ET

- 207.070

- 0.0000.00%

Pre 08:38 ET

54.88BMarket Cap12.19P/E (TTM)

208.460High205.090Low1.93MVolume206.040Open206.450Pre Close398.74MTurnover0.73%Turnover Ratio12.19P/E (Static)265.03MShares212.91052wk High2.82P/B54.50BFloat Cap154.42952wk Low3.68Dividend TTM263.20MShs Float212.910Historical High1.78%Div YieldTTM1.63%Amplitude9.360Historical Low206.981Avg Price1Lot Size

Allstate Stock Forum

$Allstate (ALL.US)$ how low will it go next week? 🤔

2

1

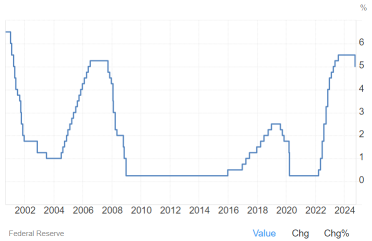

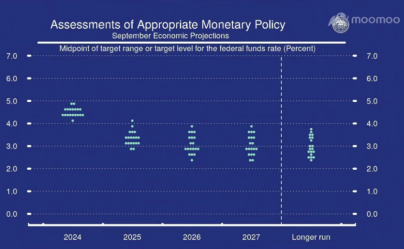

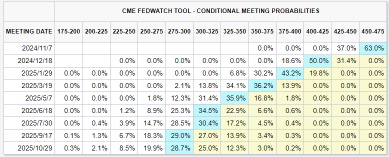

The Federal Reserve on Wednesday implemented its first rate cut in over four years, reducing the benchmark rate by 50 basis points to a range of 4.75%-5%.

The move surpassed Wall Street's expectations. Analysts had generally anticipated a 25 basis point cut, while the futures market had priced in a 61% probability of a 50 basis point cut and a 39% probability of a 25 basis point reduction.

Market Response to First Rate Cut

St...

The move surpassed Wall Street's expectations. Analysts had generally anticipated a 25 basis point cut, while the futures market had priced in a 61% probability of a 50 basis point cut and a 39% probability of a 25 basis point reduction.

Market Response to First Rate Cut

St...

+7

75

9

84

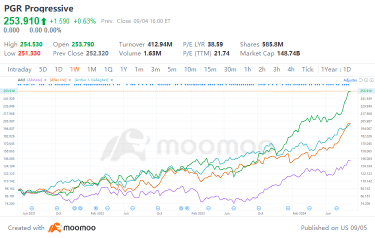

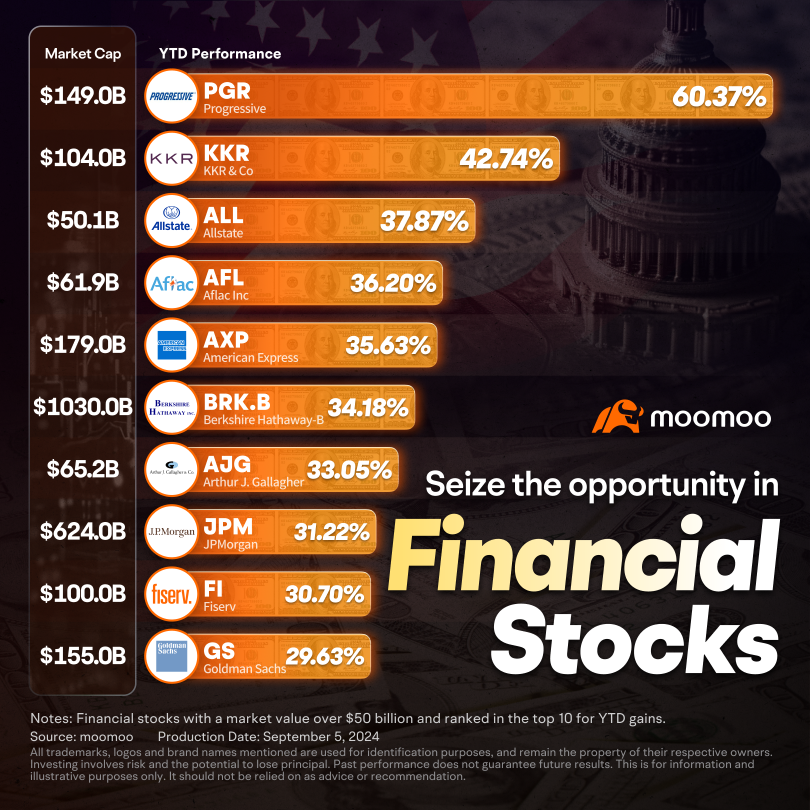

Financial stocks were once not favored by many investors, but this seems to be changing. The S&P Financial Select Sector Index has risen about 21% so far this year, outperforming the $S&P 500 Index (.SPX.US)$'s gain of 15.73%.

Source: S&P Global

According to Dave Donabedian, the CIO of CIBC’s private wealth division, “sticky money is flowing into the sector for the first time in a long time.” The reasons for this, he says, include investors looki...

Source: S&P Global

According to Dave Donabedian, the CIO of CIBC’s private wealth division, “sticky money is flowing into the sector for the first time in a long time.” The reasons for this, he says, include investors looki...

30

5

14

Morning Movers

Gapping up

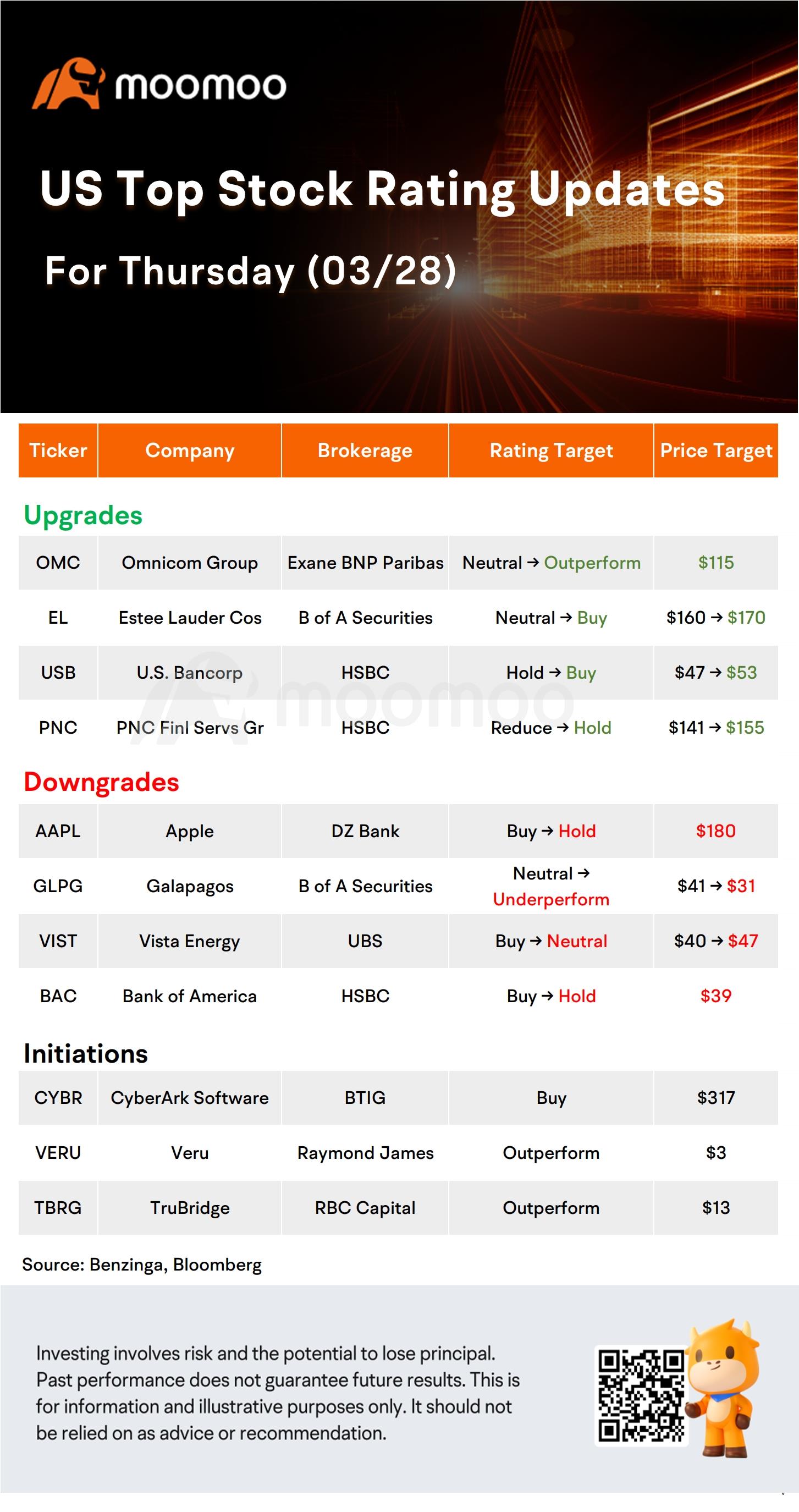

$Estee Lauder (EL.US)$ Shares soared over 3% following an upgrade to buy from neutral by Bank of America, which referenced the company's profitability recovery efforts, new products, and growing market share in the prestige beauty sector.

$Allstate (ALL.US)$ The insurance stock climbed 0.9% after HSBC raised its rating to buy from hold, with analyst Vikram Gandhi commending the company's "decisive management...

Gapping up

$Estee Lauder (EL.US)$ Shares soared over 3% following an upgrade to buy from neutral by Bank of America, which referenced the company's profitability recovery efforts, new products, and growing market share in the prestige beauty sector.

$Allstate (ALL.US)$ The insurance stock climbed 0.9% after HSBC raised its rating to buy from hold, with analyst Vikram Gandhi commending the company's "decisive management...

20

3

Progressive could be set for ad spending growth in 2024 due to stable underwriting. Insurers like Progressive, Allstate, and Travelers rally, suggesting possible future gains.

1

The auto insurance industry experienced a challenging post-pandemic era. Many insurers have struggled to keep pace with elevated used-car prices, worsening frequency and severity of accidents, and higher costs tied to medical claims and litigation related to accidents. The Travelers Companies' shares have fallen 5.72% this year, and Allstate Insurance shares dropped 16.06% year to date.

It's well known that Warren Buffett has a soft spot for auto insurer ...

It's well known that Warren Buffett has a soft spot for auto insurer ...

+2

13

1

2

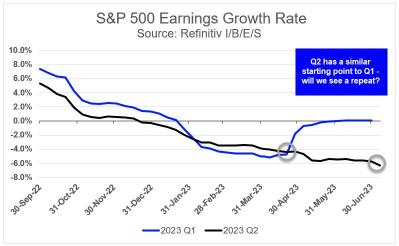

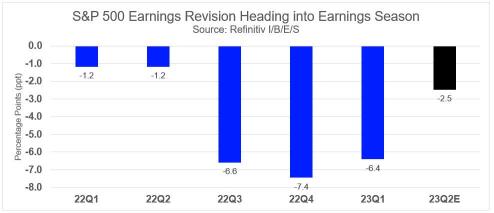

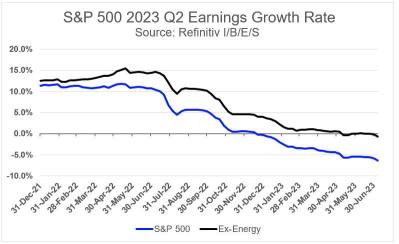

Analysts are bracing for a potentially grim Q2 earnings season, with companies preparing to report their performance for the April quarter later this week. According to FactSet, market experts predict that earnings will see a decline of 7.2% year-over-year, which is even worse than the expected 4-7% decline forecasted on March 31.

The current market conditions have set the stage for another challenging quarter, with Q2 exhibiting notable similarities t...

The current market conditions have set the stage for another challenging quarter, with Q2 exhibiting notable similarities t...

+4

21

16

No comment yet

Chef007 : 100

Mo-ooo : 175, 170