US Stock MarketDetailed Quotes

AMAT Applied Materials

- 150.680

- -2.960-1.93%

Close Mar 26 16:00 ET

- 150.000

- -0.680-0.45%

Pre 07:35 ET

122.42BMarket Cap19.70P/E (TTM)

153.990High149.510Low4.85MVolume153.140Open153.640Pre Close733.00MTurnover0.60%Turnover Ratio17.50P/E (Static)812.44MShares254.21152wk High6.57P/B122.16BFloat Cap145.37052wk Low1.52Dividend TTM810.73MShs Float254.211Historical High1.01%Div YieldTTM2.92%Amplitude3.163Historical Low151.015Avg Price1Lot Size

Applied Materials Stock Forum

any chance can go up?

2

$Applied Materials (AMAT.US)$ Another 200 week moving average test. Might be wrong, I think this company’s culture is not as good as LRCX and KLAC.

3

2

$Applied Materials (AMAT.US)$

red , but still an amazing recovery from -2.2%

red , but still an amazing recovery from -2.2%

$Applied Materials (AMAT.US)$ buy this stock..very cheap right now..if u scared u can buy half..and wait to dca by batch![]()

1

$Applied Materials (AMAT.US)$

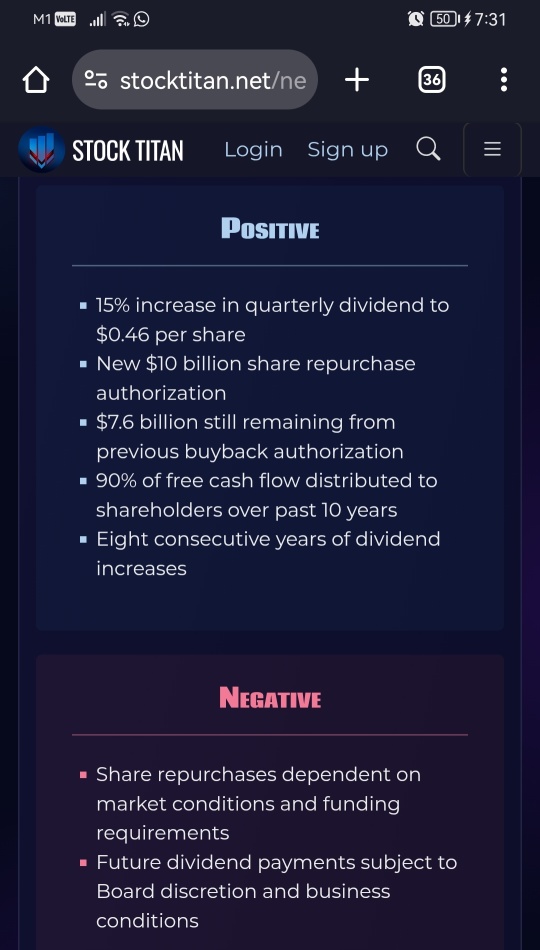

Applied Materials Increases Quarterly Cash Dividend by 15 Percent and Announces New $10 Billion Share Repurchase Authorization

Applied Materials Increases Quarterly Cash Dividend by 15 Percent and Announces New $10 Billion Share Repurchase Authorization

Current Price: $155.68

Intrinsic Value: $207.38 (Safety Margin 24.93%)

Earnings Yield: 4.91%

Dividend Yield: 0.81%

AMAT’s intrinsic value suggests the stock is undervalued by 24.93%, making it an attractive long-term investment.

Investment Strategy:

Accumulate AMAT on dips, targeting a price range of $190-$210 over the next 12-18 months.

Applied Materials (AMAT) Stock Analysis Report

Intrinsic Value: $207.38 (Safety Margin 24.93%)

Earnings Yield: 4.91%

Dividend Yield: 0.81%

AMAT’s intrinsic value suggests the stock is undervalued by 24.93%, making it an attractive long-term investment.

Investment Strategy:

Accumulate AMAT on dips, targeting a price range of $190-$210 over the next 12-18 months.

Applied Materials (AMAT) Stock Analysis Report

$Applied Materials (AMAT.US)$ what the fk going on

2

1

No comment yet

FluctuateEarnings : i think if can close above MA20

Money Man Snr FluctuateEarnings : it closed slight below. Sigh...

154 is 20MA