No Data

AU AngloGold Ashanti

- 23.690

- +0.030+0.13%

- 23.690

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

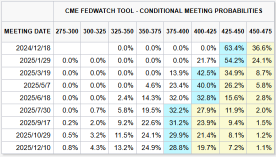

What does the Federal Reserve's "Skip" mean for the market?

Citi Research found that during the period when the Federal Reserve pauses interest rate cuts, the U.S. stock market usually performs well, but the sustainability of the rise depends on whether economic weakness leads to a restart of policy easing; U.S. Treasury rates usually rise at the pause or end of the cycle; for the dollar, if the interest rate cuts are only paused, the dollar performs laterally, if it is the last interest rate cut, the dollar will rise; after the pause, regardless of whether the easing cycle continues, Gold prices usually rise.

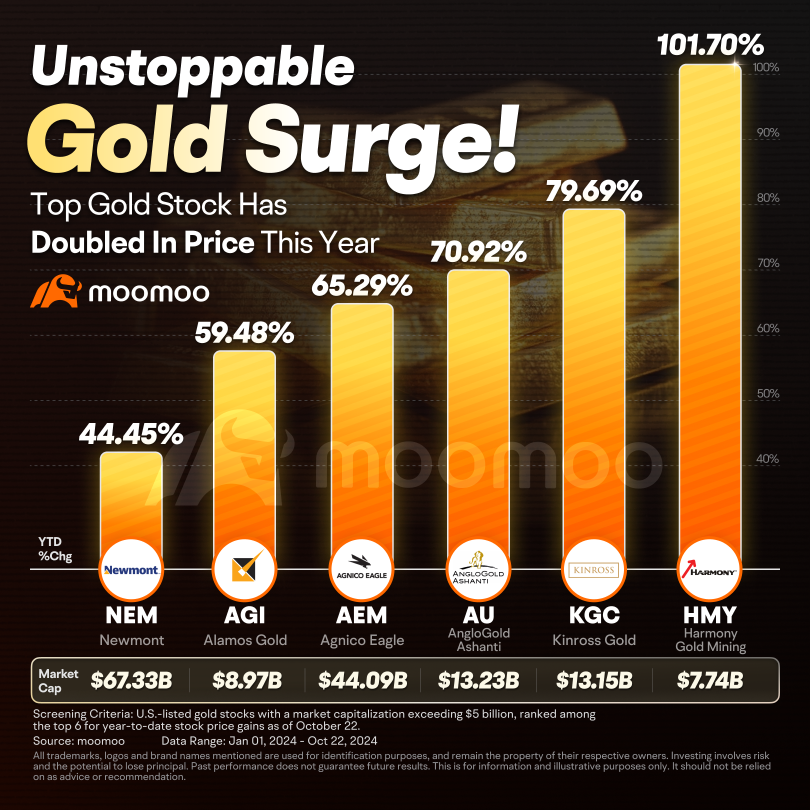

Billionaire John Paulson Bullish On Gold Miners, Including This Penny Stock

Express News | Anglogold Ashanti PLC : BMO Resumes Coverage With Outperform Rating; Price Target $40 Vs $34

AngloGold Ashanti Plc Announces Board Committee and Board Role Changes

Express News | Anglogold Ashanti PLC Announces Board Committee and Board Role Changes

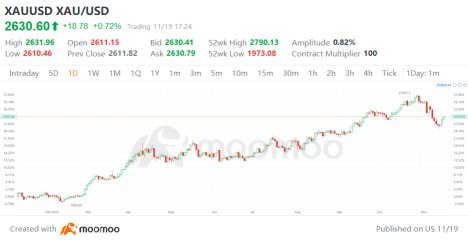

Gold Prices Rebound From Fed-driven Rout, Hawkish Comments Cloud Outlook

Comments

Gold rebounded on Monday, snapping a six-day losing streak, driven by a pause in the dollar’s rise and renewed safe-haven dem...

No Data

10baggerbamm : if you are a gold bug and believe that gold will hit 2800 2900-3000 then you need to give serious consideration to the leveraged ETF NUGT. it has just built a base it is in the upward trend it sold off from over 60 to $37 it's back up to 41 right now as a result of gold being up 2 days in a row now that we have escalating tensions with Ukraine and Russia gold is back in favor.. we all know gold never vanishes it never goes away for any extended period of time frame.. that being said if you believe that gold will continue to appreciate then this ETF offers you the greatest upside potential return of any other gold related investment.

102188459 : Tq

MoiseWalumba : Good