No Data

AU250117C38000

- 0.15

- 0.000.00%

- 5D

- Daily

News

With the inflation expectations strengthening, gold prices are rising, and the Copper LC price difference is widening again.

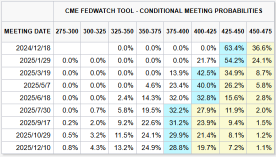

Last week, the market continued to move toward the narrative of strong economic resilience, a solid labor market, and increasing re-inflation expectations, with both gold and copper strengthening. Initially, there were concerns in the market about Trump imposing tariffs on refined copper imports, which widened the price gap between COMEX copper and other regions, and the rebound in COMEX copper prices was particularly pronounced. Subsequently, crude oil rebounded sharply due to concerns over the USA's sanctions on Iran, coupled with strong non-farm payroll data on Friday and hawkish statements from Federal Reserve officials, leading to a continued reduction in market expectations for interest rate cuts from the Federal Reserve this year.

Top Gap Ups and Downs on Friday: TM, CEG, SMFG and More

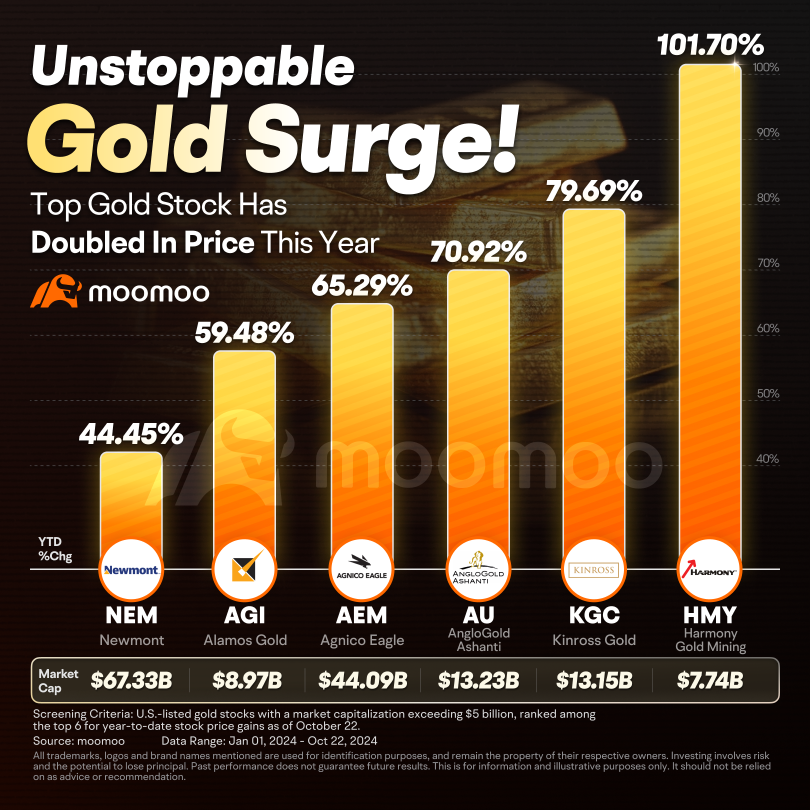

Are Basic Materials Stocks Lagging AngloGold Ashanti PLC (AU) This Year?

Express News | Altius Minerals: Tribunal Determined Lands Subject to Co's Royalty Include Those Within Base Aoi & Some Areas of Mineral Lands Held by Aga

Express News | Altius Provides Silicon Royalty Arbitration Update

NYSE Copper and Silver surged significantly, with "tariff fears" bringing about the "USA Metal premium".

Market worries about the uncertainty of Trump's trade policy have led to a premium of over $0.9 per ounce for Silver Futures on the NYSE compared to London spot silver, nearing the peak from December last year, while the premium for Copper Futures also reached $623 per ton.

Comments

Gold rebounded on Monday, snapping a six-day losing streak, driven by a pause in the dollar’s rise and renewed safe-haven dem...

10baggerbamm : if you are a gold bug and believe that gold will hit 2800 2900-3000 then you need to give serious consideration to the leveraged ETF NUGT. it has just built a base it is in the upward trend it sold off from over 60 to $37 it's back up to 41 right now as a result of gold being up 2 days in a row now that we have escalating tensions with Ukraine and Russia gold is back in favor.. we all know gold never vanishes it never goes away for any extended period of time frame.. that being said if you believe that gold will continue to appreciate then this ETF offers you the greatest upside potential return of any other gold related investment.

102188459 : Tq

MoiseWalumba : Good