US OptionsDetailed Quotes

AVAV250117C180000

- 0.02

- -0.04-66.67%

15min DelayClose Jan 17 16:00 ET

0.06High0.02Low

0.05Open0.06Pre Close7 Volume521 Open Interest180.00Strike Price28.00Turnover2263.75%IV6.68%PremiumJan 17, 2025Expiry Date0.00Intrinsic Value100Multiplier-2DDays to Expiry0.02Extrinsic Value100Contract SizeAmericanOptions Type0.0122Delta0.0067Gamma8437.00Leverage Ratio-119.5440Theta0.0000Rho103.15Eff Leverage0.0001Vega

AeroVironment Stock Discussion

$AeroVironment (AVAV.US)$ so I need to sleep and worried waking up to a wiped out account.

1

3

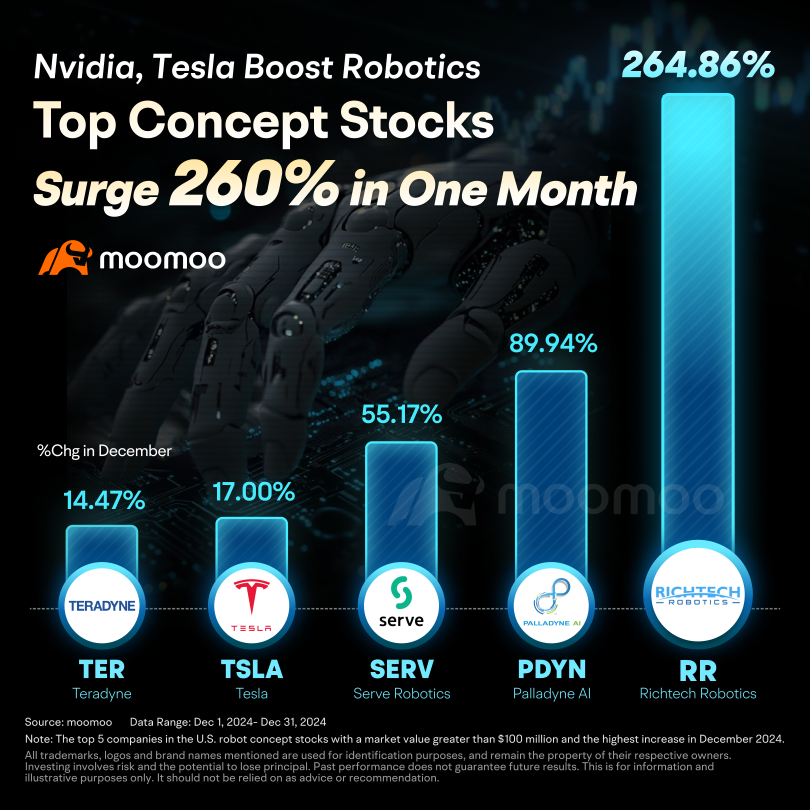

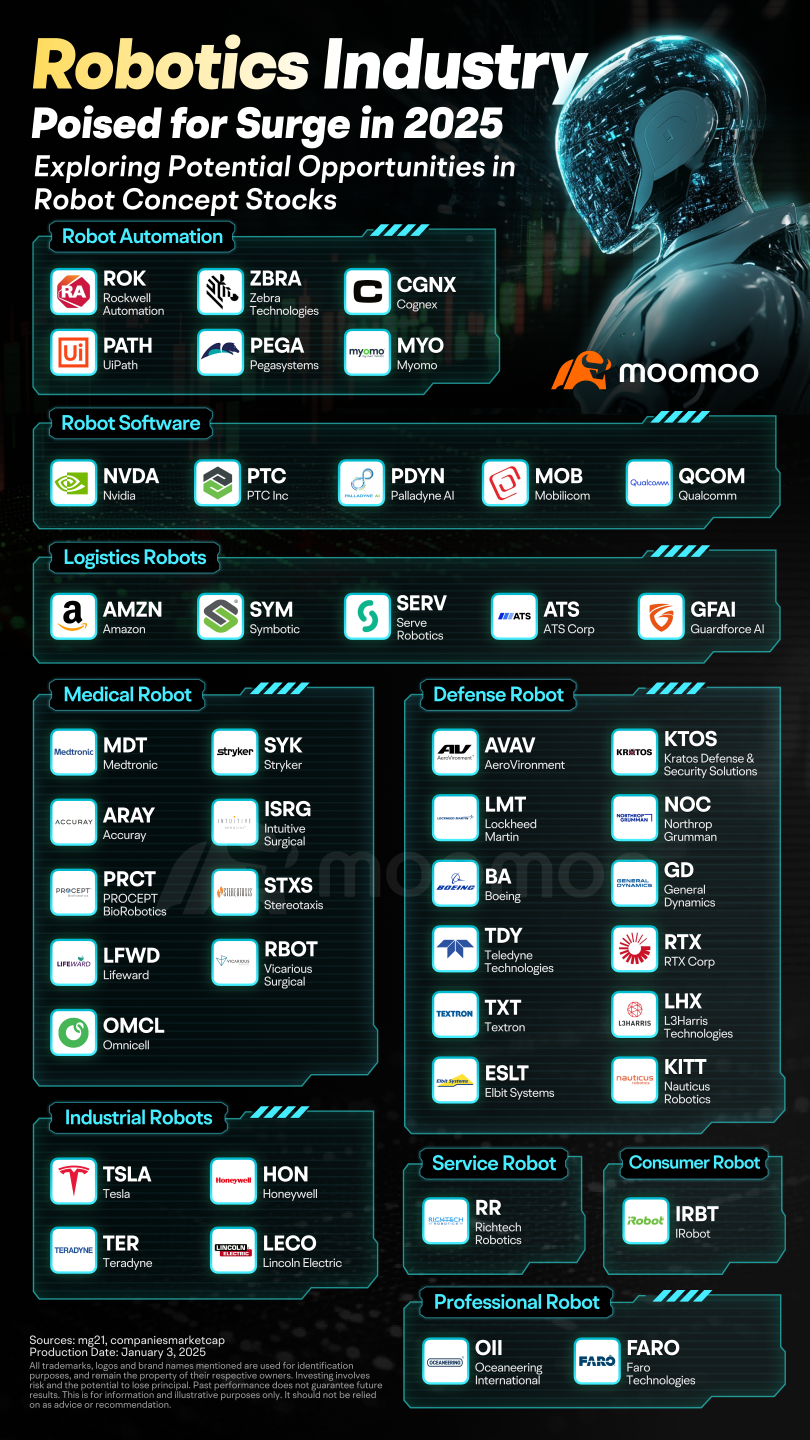

Scheduled to officially start on January 7, 2025, the Consumer Electronics Show (CES)—a premier tech event that showcases both current products and futuristic concepts from large and small tech firms—once again captured global attention.

At CES 2025, $NVIDIA (NVDA.US)$ is undoubtedly one of the brightest stars on stage. Jensen Huang will personally showcase the company's latest breakthroughs in AI, robotics...

At CES 2025, $NVIDIA (NVDA.US)$ is undoubtedly one of the brightest stars on stage. Jensen Huang will personally showcase the company's latest breakthroughs in AI, robotics...

115

8

188

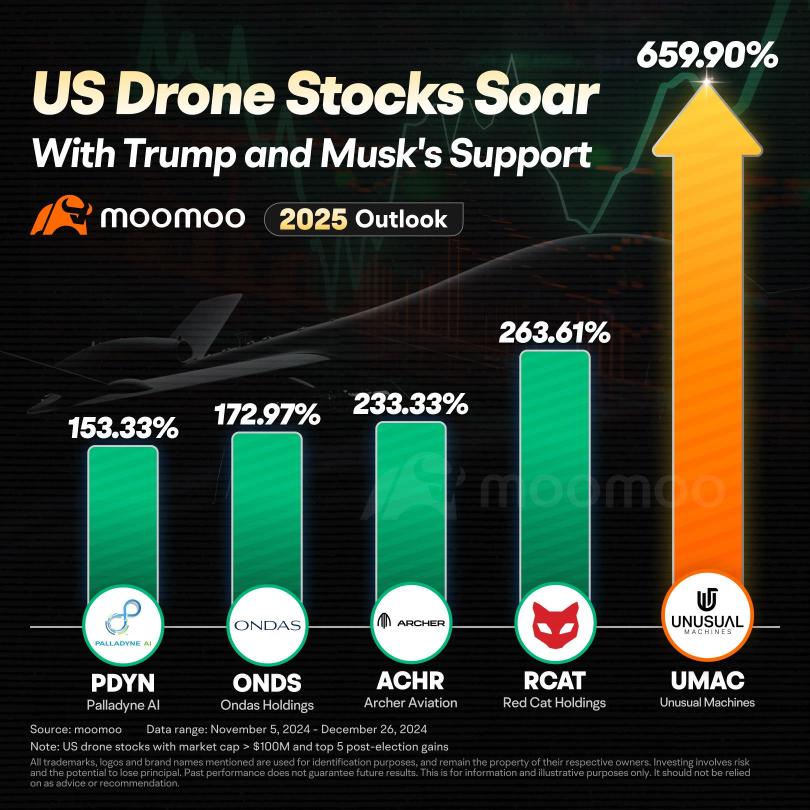

As President-elect Donald Trump's inauguration approaches on January 20th (EST), investors are preparing for the Trump 2.0 era.

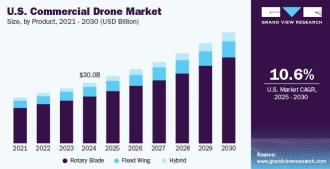

Looking at Trump and his cabinet, U.S. drone stocks are poised for a boom during the Trump 2.0 era.

The primary difference between drones and electric vertical takeoff and landing (eVTOL) lies in whether they are manned. While some eVTOL companies propose starting with cargo transport before moving to passenger transport,...

Looking at Trump and his cabinet, U.S. drone stocks are poised for a boom during the Trump 2.0 era.

The primary difference between drones and electric vertical takeoff and landing (eVTOL) lies in whether they are manned. While some eVTOL companies propose starting with cargo transport before moving to passenger transport,...

44

7

63

The Nasdaq hit another record high as markets closed mixed on Monday. At 4:01 p.m. ET, the $Nasdaq Composite Index (.IXIC.US)$ finished up 1.24% to 20,173. The $Dow Jones Industrial Average (.DJI.US)$ closed off 0.25%, falling for its eighth consecutive day. This represents its long streak of declines since 2018. The $S&P 500 Index (.SPX.US)$ was up 0.33%

$Apple (AAPL.US)$, $Alphabet-A (GOOGL.US)$, ...

$Apple (AAPL.US)$, $Alphabet-A (GOOGL.US)$, ...

23

1

8

$AeroVironment (AVAV.US)$ if it doesn't hold 148 next stops 127

1

Banks: $JPMorgan (JPM.US)$ $Wells Fargo & Co (WFC.US)$ $Bank of America (BAC.US)$

Capital Markets: $UP Fintech (TIGR.US)$ $Cipher Mining (CIFR.US)$ $CleanSpark (CLSK.US)$

Biotechnology: $Genfit (GNFT.US)$ $Spyre Therapeutics (SYRE.US)$ $Krystal Biotech (KRYS.US)$

Software: $Verb Technology (VERB.US)$ $SurgePays (SURG.US)$ $Uber Technologies (UBER.US)$

Asset Management: $Westwood Holdings (WHG.US)$ $BrightSphere Investment (BSIG.US)$ $Blackrock (BLK.US)$

Specialty Industrial Machinery: $JE Cleantech Holdings Limited (JCSE.US)$ $Taylor Devices (TAYD.US)$ $CSW Industrials (CSWI.US)$

���������...

Capital Markets: $UP Fintech (TIGR.US)$ $Cipher Mining (CIFR.US)$ $CleanSpark (CLSK.US)$

Biotechnology: $Genfit (GNFT.US)$ $Spyre Therapeutics (SYRE.US)$ $Krystal Biotech (KRYS.US)$

Software: $Verb Technology (VERB.US)$ $SurgePays (SURG.US)$ $Uber Technologies (UBER.US)$

Asset Management: $Westwood Holdings (WHG.US)$ $BrightSphere Investment (BSIG.US)$ $Blackrock (BLK.US)$

Specialty Industrial Machinery: $JE Cleantech Holdings Limited (JCSE.US)$ $Taylor Devices (TAYD.US)$ $CSW Industrials (CSWI.US)$

���������...

4

1

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ $Russell 2000 Index (.RUT.US)$ $S&P 500 Index (.SPX.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $C3.ai (AI.US)$ $AeroVironment (AVAV.US)$ $Hewlett Packard Enterprise (HPE.US)$ $Verint Systems (VRNT.US)$ $ChargePoint (CHPT.US)$

From YouTube

3

2

No comment yet

Kevin888 : Sorry to hear that. When the market is scared last week, you should start selling calls to prevent losses when the price is high, and when there is a big jump down to the market buy in. The most important thing is just setup a price loss target which will sell ur stock at that point, for me the stop loss is 150 the support a little bit below that(doing so which makes my sleep better in case of big crashes). Right now, i think the stock are either oscillating or going up(for this stock), I do think the market is overreacing and good entry point(contain bias may be wrong; this is for other stocks), need to expect the news on 15th cpi out to see if market is panic, and also expect the earnings month

Red Marker OP Kevin888 : totally understand that we cannot panic and let emotions rule. my other stocksnare almost free falling. do you think this is a long hold type of stock?

Kevin888 Red Marker OP : I don't know for other stocks, but I think this stock has a bit potential which I will long hold this, and I bought it at the bottom, my stop loss is 150