No Data

BAC Bank of America

- 41.355

- +0.105+0.25%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

PNC Financial Upgraded to Buy at HSBC After Post-election Slump

On the eve of performance announcements, US bank stocks are experiencing their worst quarterly performance since the crisis of 2023.

Bank of America stocks have experienced their worst quarter since the crisis crash in 2023.

HSBC Adjusts Price Target on Bank of America to $51 From $53, Maintains Buy Rating

Bank of America Securities: Lowered the Target Price for MAOYAN ENT to HKD 10.5, reiterating "Buy" as earnings are expected to recover this year.

Bank of America Securities released a Research Report stating that MAOYAN ENT (01896) will meet performance expectations for 2024. The declaration of a final dividend of 32 Hong Kong cents per share surprised investors. The rich film product line is expected to support the recovery of the content business. The rating remains "Buy," with the Target Price reduced from 11 Hong Kong dollars to 10.5 Hong Kong dollars, anticipating a rebound in this year's box office in China, while MAOYAN ENT's profitability is expected to recover this year.

Bank of America Securities: Agricultural Bank Of China’s profit growth and provisions coverage ratio lead the industry, reiterating the "Buy" rating.

Bank of America Securities released a Research Report stating that Agricultural Bank Of China (01288) is expected to see a 4.7% year-on-year increase in net profit in 2024, reaching 282.1 billion yuan, which is 3.8% higher than the bank's previous forecast. The dividend per share is projected to grow 4.8% year-on-year to 24.2 cents, with the Listed in Hong Kong dividend ROI reaching 5.5%. Considering that Agricultural Bank performs better than its peers in terms of profit growth and provision coverage ratio, Bank of America Securities reaffirms a Buy rating for the bank and raises the profit forecast for 2025 to 2026 by 0% to 4%, while lowering the cost of equity (COE) forecast by 50 basis points to 14%.

Bank of America Securities: Lowers SEAZEN's Target Price to HKD 2.2 and reiterates a "Neutral" rating.

Bank of America Securities released a Research Report estimating that SEAZEN (01030) contributed more than 2 billion yuan in core profit from leasing income last year, while the Real Estate Development Business is expected to record a net loss of 1.5 billion yuan. Looking ahead, SEAZEN is expected to transform into a company primarily focused on Commercial Property operations with Real Estate Sales as a secondary business. It is believed that after the completion of existing Real Estate Development projects, profitability could reach 2 billion yuan after 2027. The earnings forecasts for 2025 to 2027 have been adjusted upward, maintaining a 'neutral' rating, with the Target Price revised down from HKD 2.35 to HKD 2.20.

Comments

now switching to one of the most undervalued stock $Alphabet-A (GOOGL.US)$ with a small call position just in case the tariffs get doubled down. Will buy more in the dip.

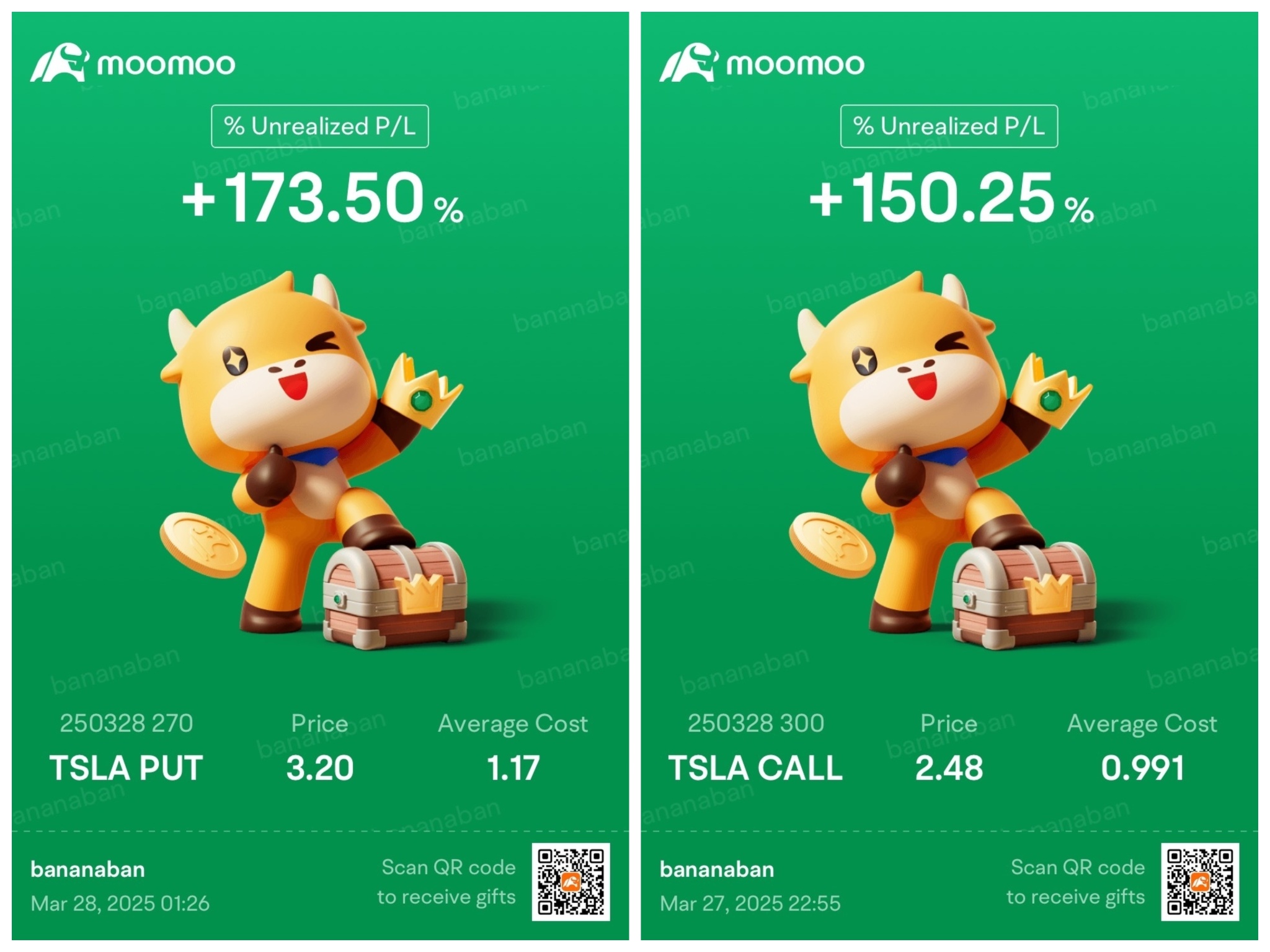

Last week, the market faced heightened volatility driven by escalating trade tensions, mixed economic data, and concerns about tariffs. The week began with a glimmer of optimism, especially after $Tesla (TSLA.US)$ experienced a significant rally, jumping by 12% on Monday, marking its best single-day performance since the election aftermath. However, the enthusiasm was short-lived as Trump proposed a 25% tariff on autom...

BearishBurden : bold