No Data

US Stock MarketDetailed Quotes

BAC Bank of America

- 41.730

- +0.480+1.16%

Close Mar 31 16:00 ET

- 41.710

- -0.020-0.05%

Post 20:01 ET

317.34BMarket Cap13.00P/E (TTM)

41.895High40.605Low36.39MVolume40.780Open41.250Pre Close1.51BTurnover0.48%Turnover Ratio13.00P/E (Static)7.60BShares47.67952wk High1.16P/B316.25BFloat Cap33.32652wk Low1.00Dividend TTM7.58BShs Float47.679Historical High2.40%Div YieldTTM3.13%Amplitude1.985Historical Low41.425Avg Price1Lot Size

Full Hours

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Bank of America Options Spot-On: On March 31st, 130.34K Contracts Were Traded, With 2.53 Million Open Interest

OCC Withdraws From Climate Principles for Large Banks

10 Financials Stocks With Whale Alerts In Today's Session

PNC Financial Upgraded to Buy at HSBC After Post-election Slump

On the eve of performance announcements, US bank stocks are experiencing their worst quarterly performance since the crisis of 2023.

Bank of America stocks have experienced their worst quarter since the crisis crash in 2023.

HSBC Adjusts Price Target on Bank of America to $51 From $53, Maintains Buy Rating

Comments

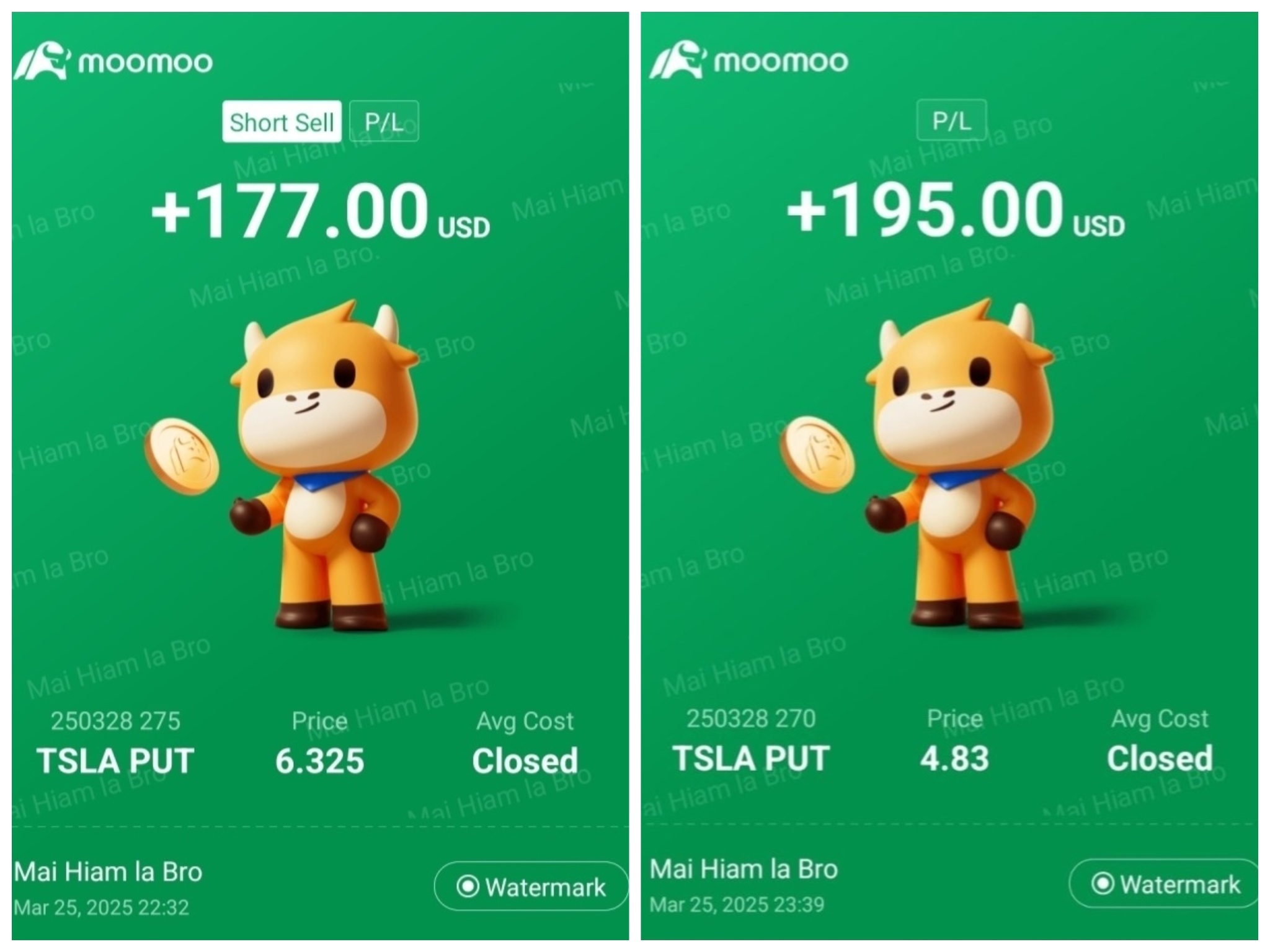

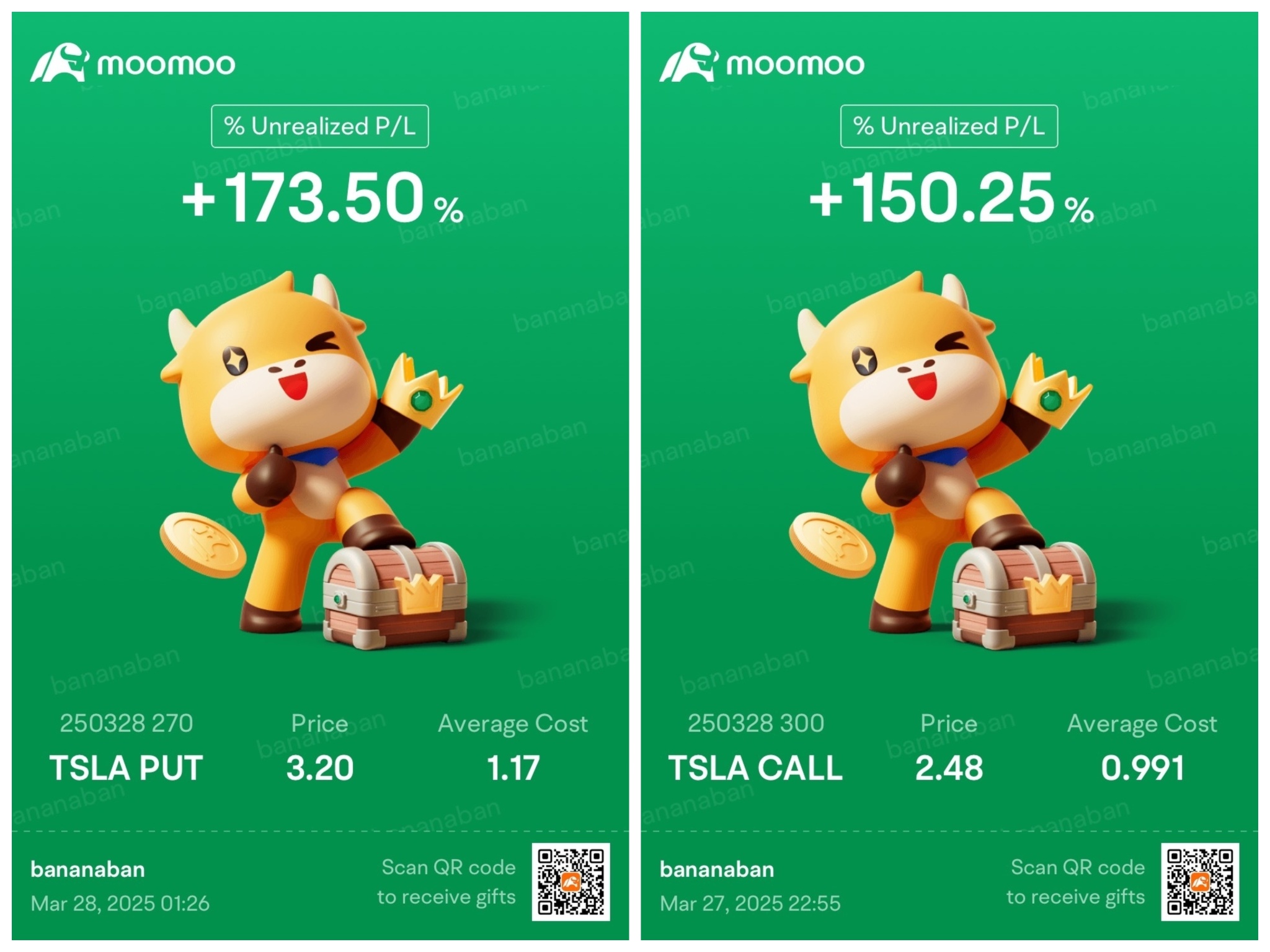

$Bank of America (BAC.US)$ had a good run of 150% locked gains.

now switching to one of the most undervalued stock $Alphabet-A (GOOGL.US)$ with a small call position just in case the tariffs get doubled down. Will buy more in the dip.

now switching to one of the most undervalued stock $Alphabet-A (GOOGL.US)$ with a small call position just in case the tariffs get doubled down. Will buy more in the dip.

3

1

$Bank of America (BAC.US)$ didn't fall as much as the index. But I will lock in my gains anyway in case of a reversal.

2

Last week, the market faced heightened volatility driven by escalating trade tensions, mixed economic data, and concerns about tariffs. The week began with a glimmer of optimism, especially after $Tesla (TSLA.US)$ experienced a significant rally, jumping by 12% on Monday, marking its best single-day performance since the election aftermath. However, the enthusiasm was short-lived as Trump proposed a 25% tariff on autom...

+13

44

22

13

WOW!!!!

Read more

BearishBurden : bold