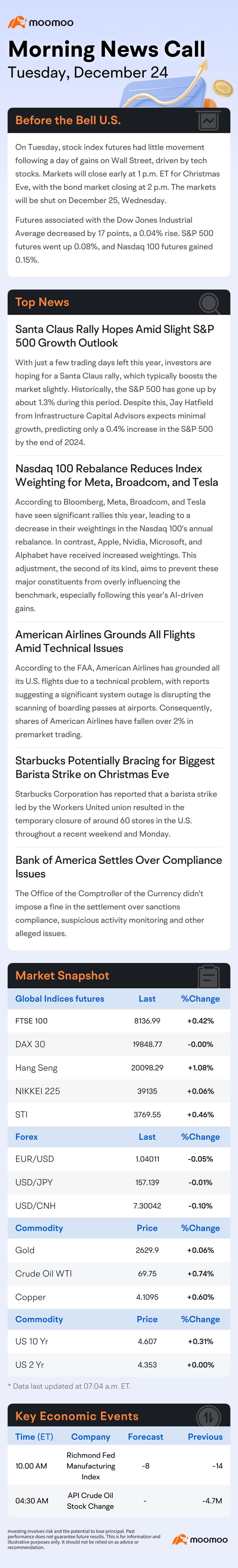

No Data

BAC250110P57000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Merrill Launches Ultra-High-Net-Worth Advisory Group

Daily short sale tracking: NVIDIA's short volume increased by 13 million, with a short sale ratio of 10%

Today's Analyst Rating | UBS Upgrades Bank of America to Buy, Salesforce Price Target Raised to $400 by Needham

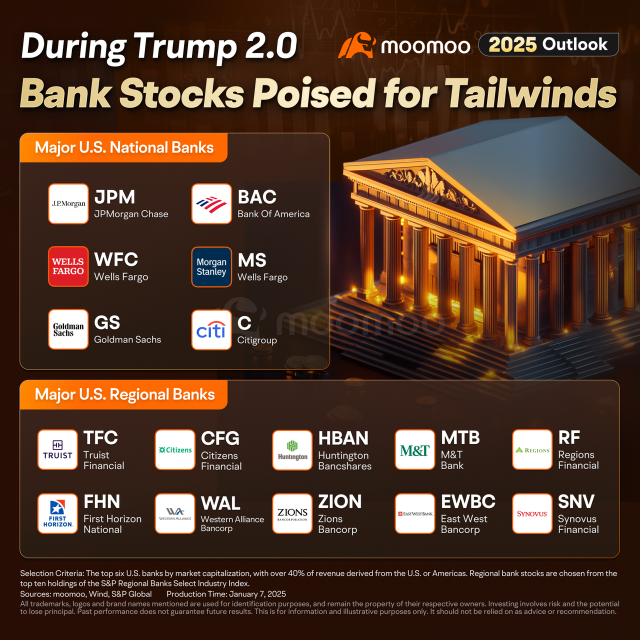

Yield Curve Normalization, Cheap Valuation, EPS Growth To Boost Banks In 2025: Truist Initiates Coverage On These 14 Regional Names

Bank of America Securities: Downgrades the ratings of China Shenhua Energy and Yankuang Energy, prefers PETROCHINA.

Bank of America Securities released a research report recommending investors choose defensively positioned state-owned enterprises. The bank is Bullish on PETROCHINA (00857), which has strong Cash flow, maintaining a "Buy" rating and lowering the Target Price by 3% to 7.8 HKD. The report states that this year is Bearish on the Coal Industry and China Shenhua Energy (01088), due to expected limited growth in coal demand, high inventory levels historically, and ongoing import threats. The bank forecasts that this year's thermal coal price will be 720 RMB per ton (a year-on-year decrease of 16%), and spot prices will be lower than contract prices from the second to the third quarter, while coking coal prices will be 1 per ton.

Bank of America Securities: Maintains a "buy" rating on AIA, with a target price of 92.2 Hong Kong dollars.

Bank of America Securities released a research report stating that it maintains a 'Buy' rating for AIA (01299), with a Target Price of 92.2 Hong Kong dollars. The bank expects that AIA China's new business value profit margin will reach 56% in 2024 and 55% in 2025, higher than 51% in 2023. In addition to benefiting from lower insurance costs and guaranteed interest rates, the bank believes that the strong growth in AIA China's retirement insurance sales is the main driving force. The report states that according to domestic media reports, AIA China's first-year premium income for retirement insurance from January to October 2024 exceeded 2.4 billion yuan, ranking first among peers. Although

Comments

Following the announcement, bank stocks broadly gained, with $Citigroup (C.US)$ and $Morgan Stanley (MS.US)$ rising more than 2%, and regional banks $Synovus Financial (SNV.US)$ and $East West Bancorp (EWBC.US)$ climbing ...

With a brand new year ahead of us, do work out some plans for your investment and trading.

Stay grounded as we might not have another strong year like the last 2 years. Stay cautious, stick to your plan and you should be fine!

$MicroStrategy (MSTR.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Super Micro Computer (SMCI.US)$ $Meta Platforms (META.US)$ $Disney (DIS.US)$ $Bank of America (BAC.US)$ $CrowdStrike (CRWD.US)$ $Adobe (ADBE.US)$ $Enphase Energy (ENPH.US)$ $Visa (V.US)$ $SoFi Technologies (SOFI.US)$ $GlobalFoundries (GFS.US)$ $UnitedHealth (UNH.US)$