CA Stock MarketDetailed Quotes

BB BlackBerry Ltd

- 5.980

- 0.0000.00%

15min DelayMarket Closed Jan 24 16:00 ET

3.54BMarket Cap-20.34P/E (TTM)

6.050High5.920Low1.82MVolume5.980Open5.980Pre Close10.89MTurnover6.23052wk High0.34%Turnover Ratio591.58MShares2.89052wk Low-0.294EPS TTM3.25BFloat Cap150.300Historical HighLossP/E (Static)543.72MShs Float0.751Historical Low-0.299EPS LYR2.17%Amplitude--Dividend TTM3.39P/B1Lot Size--Div YieldTTM

BlackBerry Ltd Stock Forum

Since the Bank of Canada's initial interest rate cut on June 5, 2024, Canada's mainstock index, $S&P/TSX Composite Index (.SPTSX.CA)$, has increased by more than 15%. As of Wednesday, the index climbed 0.12%, closing at 25,311.50.

Read More: BoC Interest Rate Decision Preview: CPI Report Paves Way for BoC Rate Cuts, Tariffs Add Uncertainty

Leading this impressive rally is the Information Technology Sector, which has skyrocketed by 50.88% since...

Read More: BoC Interest Rate Decision Preview: CPI Report Paves Way for BoC Rate Cuts, Tariffs Add Uncertainty

Leading this impressive rally is the Information Technology Sector, which has skyrocketed by 50.88% since...

6

1

2

Overall, the market climbed Monday, in a shortened trading week with a market holiday on Thursday to remember a Peanut Farmer turned President. It is CES tech week, and stocks of that variety tried their best to make the most of the situation- Nvidia CEO Jensen Huang is set to speak on stage at the Las Vegas Industry Conference and likely reveal new products at 9 pm ET.

Just past the 4pm ET close, the $S&P 500 Index (.SPX.US)$ climbed 0...

Just past the 4pm ET close, the $S&P 500 Index (.SPX.US)$ climbed 0...

48

1

2

By the end of the day, the market had regained some ground lost when the FOMC released less promising inflation predictions for 2025 after cutting rates on Wednesday.

At the closing bell 4 pm ET, the S&P 500 climbed 1.28%, the Dow Jones Industrial Average climbed 1.52%, and the Nasdaq Composite Index climbed 1.21%.

MACRO

In macro, Personal Consumption Expenditure numbers came in lower than expected, 2.4% vs 2.5%, but trending higher...

At the closing bell 4 pm ET, the S&P 500 climbed 1.28%, the Dow Jones Industrial Average climbed 1.52%, and the Nasdaq Composite Index climbed 1.21%.

MACRO

In macro, Personal Consumption Expenditure numbers came in lower than expected, 2.4% vs 2.5%, but trending higher...

48

7

3

$BlackBerry (BB.US)$ $BlackBerry Ltd (BB.CA)$

At first glance, why is the next Q4 revenue guidance lower than the Q3 quarter just announced?

The next Q4 revenue guidance excludes the Cylance revenue. Cylance was sold to Artic Wollf last week.

Appreciating this fine point changes your view on BlackBerry to much more bullish.

At first glance, why is the next Q4 revenue guidance lower than the Q3 quarter just announced?

The next Q4 revenue guidance excludes the Cylance revenue. Cylance was sold to Artic Wollf last week.

Appreciating this fine point changes your view on BlackBerry to much more bullish.

2

Hi mooers! ![]()

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!![]()

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $FedEx (FDX.US)$ , $Micron Technology (MU.US)$ , $BlackBerry (BB.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companie...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $FedEx (FDX.US)$ , $Micron Technology (MU.US)$ , $BlackBerry (BB.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companie...

17

8

3

$BlackBerry (BB.US)$ $BlackBerry Ltd (BB.CA)$

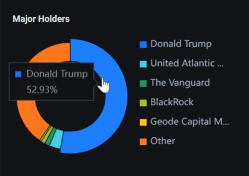

BkackRock filed a Schedule 13G with the Securities and Exchange Commission on September 30, 2024, indicating a significant ownership stake in BlackBerry Ltd. The filing reveals that BlackRock now beneficially owns 30,612,293 shares of BlackBerry's common stock, which represents 5.2% of the company's class of securities.

BkackRock filed a Schedule 13G with the Securities and Exchange Commission on September 30, 2024, indicating a significant ownership stake in BlackBerry Ltd. The filing reveals that BlackRock now beneficially owns 30,612,293 shares of BlackBerry's common stock, which represents 5.2% of the company's class of securities.

4

1

$BlackBerry Ltd (BB.CA)$ BB making a comeback after 16 years?

No comment yet

Ella Ou :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)