No Data

US Stock MarketDetailed Quotes

BB BlackBerry

- 3.770

- -0.150-3.83%

Close Mar 31 16:00 ET

- 3.770

- 0.000-0.01%

Post 19:48 ET

2.23BMarket Cap-17.95P/E (TTM)

3.830High3.660Low19.39MVolume3.750Open3.920Pre Close72.56MTurnover3.57%Turnover RatioLossP/E (Static)591.58MShares6.24052wk High3.08P/B2.05BFloat Cap2.01052wk Low--Dividend TTM543.78MShs Float236.660Historical High--Div YieldTTM4.33%Amplitude2.010Historical Low3.742Avg Price1Lot Size

Post-Market

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Tesla, Nvidia, Palantir, CoreWeave, Moderna, LPL Financial: Biggest Stock Movers

CIBC Maintains BlackBerry(BB.US) With Buy Rating, Raises Target Price to $7

BlackBerry Q4 FY2025 earnings conference call

Earnings Preview: BlackBerry to Report Financial Results Post-market on April 02

Canadian Stock Movers for Thursday | Corus Entertainment Inc Was the Top Gainer; Cannabis Led Gains

This Stock Could Be the Best Investment of the Decade

Comments

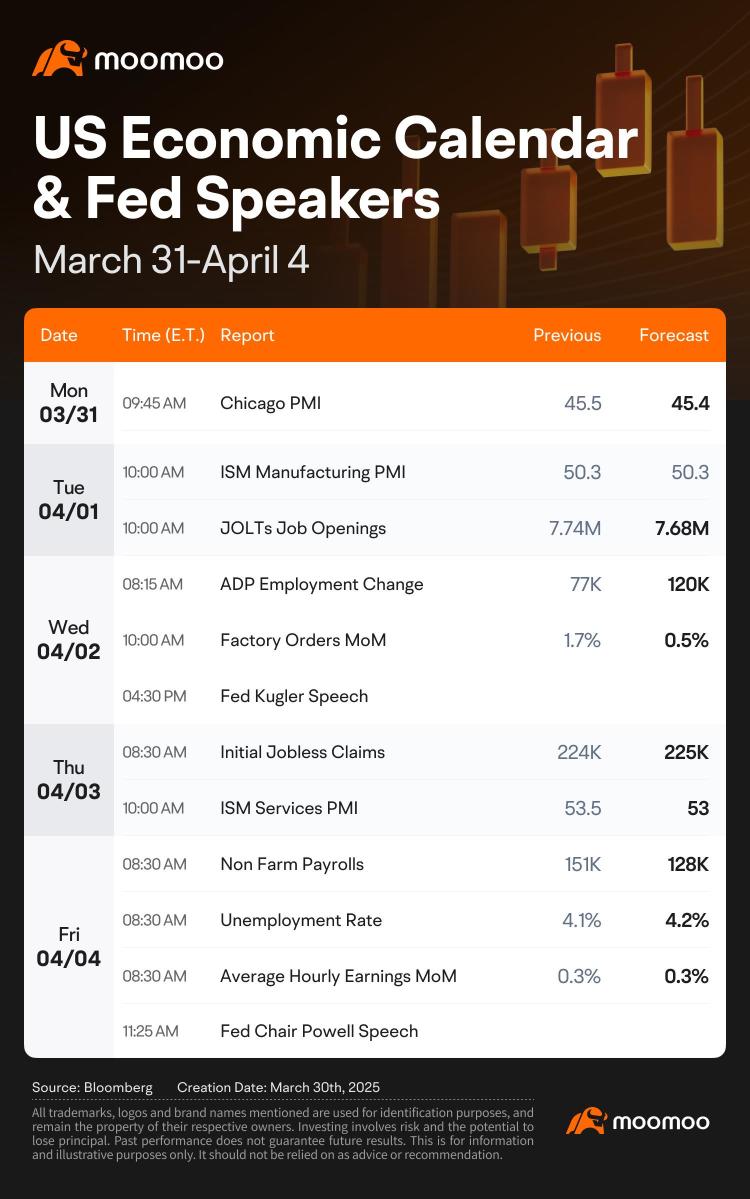

Hi mooers!

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $BlackBerry (BB.US)$ and $UniFirst (UNF.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings re...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $BlackBerry (BB.US)$ and $UniFirst (UNF.US)$ are releasing their earnings. How will the market react to the companies' results? Let's make a guess!

For more companies' detailed earnings re...

10

3

Earnings Preview

The upcoming week's earnings calendar is relatively calm, with notable midcap $Loar Holdings (LOAR.US)$ , an aircraft and defense component manufacturer, reporting Monday before the market opens. Despite debuting strongly in 2024, Loar's stock hasn't bounced back following significant selling in December, even with revenue growth of 25% to 32% over the past five quarters. For the December quarter, the...

The upcoming week's earnings calendar is relatively calm, with notable midcap $Loar Holdings (LOAR.US)$ , an aircraft and defense component manufacturer, reporting Monday before the market opens. Despite debuting strongly in 2024, Loar's stock hasn't bounced back following significant selling in December, even with revenue growth of 25% to 32% over the past five quarters. For the December quarter, the...

+3

34

9

9

$BlackBerry (BB.US)$ Been 20 years since I last heard of this company. Didn't realise it's still alive. Brings me back memories...

3

1

$BlackBerry (BB.US)$ $BlackBerry Ltd (BB.CA)$

BlackBerry Q4 FY2025 earnings conference call is scheduled for April 2 at 8:00 AM ET /April 2 at 8:00 PM SGT /April 2 at 11:00 PM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from BlackBerry's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This pres...

BlackBerry Q4 FY2025 earnings conference call is scheduled for April 2 at 8:00 AM ET /April 2 at 8:00 PM SGT /April 2 at 11:00 PM AEST. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from BlackBerry's Q4 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what managements have to say!

Disclaimer:

This pres...

BlackBerry Q4 FY2025 earnings conference call

Apr 2 07:00

Book

Book 7

Read more

Market Insights

Best Growth Stocks Best Growth Stocks

Spot stocks with huge growth potential and solid financial standing. Spot stocks with huge growth potential and solid financial standing.

Skyrye7 : The earnings prospects for BlackBerry (BB) and UniFirst (UNF) will be impacted by several key factors:

BlackBerry (BB):

1. IoT & Cybersecurity Growth:

BlackBerry's IoT business (automotive software, embedded systems) is expected to grow, but competition from tech giants like Microsoft and Google could impact its market share.

Cybersecurity revenues depend on demand for enterprise security solutions. If businesses cut IT spending, BlackBerry may struggle.

2. Licensing Revenue Decline:

BlackBerry’s licensing segment, which includes patents and intellectual property, has been shrinking. A continued decline will negatively affect overall revenue.

3. Macro-Economic Conditions:

High inflation and economic slowdowns could reduce enterprise spending on BlackBerry’s security and software products.

Interest rate hikes might impact tech stock valuations, making investors cautious.

4. Cylance Business & Restructuring:

BlackBerry is exploring options for its Cylance cybersecurity unit, including a sale. If sold at a loss, it could negatively impact earnings.

The company is undergoing restructuring to focus on core businesses. Cost-cutting measures may improve profitability.

5. AI & New Tech Integration:

Increased investment in AI-driven cybersecurity solutions may help BlackBerry compete, but execution risks remain.

UniFirst (UNF):

1. Labor & Operational Costs:

Rising wages, transportation expenses, and raw material costs could pressure margins. UniFirst may need to raise prices to maintain profitability.

2. Economic Conditions & Industrial Demand:

UniFirst provides uniform rental services to industries like manufacturing, healthcare, and hospitality. A slowdown in these sectors would lower demand.

If unemployment rises, fewer businesses will need uniform services.

3. Competition & Pricing Power:

UniFirst competes with Cintas and Aramark. If competitors lower prices, UniFirst may face margin pressure.

4. Expansion & Acquisitions:

UniFirst has been acquiring regional uniform rental businesses to expand its market presence. Successful acquisitions could boost revenue.

5. Customer Retention & Contract Renewals:

Losing major contracts could hurt revenue growth. Strong customer retention is key to stable earnings.

Conclusion:

BlackBerry’s earnings will depend on its ability to grow IoT and cybersecurity while managing licensing revenue declines. AI adoption and restructuring efforts will be critical.

UniFirst’s earnings will hinge on cost control, industrial demand, and competition. If economic conditions weaken, uniform rental demand could slow.

Tonyco : Not a great week for earnings with Trump Dumping all over.

$Flexible Solutions (FSI.US)$

88H8H88 : My Take:

BlackBerry: Likely to see volatility, with upward momentum if IoT/Cybersecurity execution improves, but skepticism around profitability persists.

UniFirst: Reaction hinges on cost management and macroeconomic data. Investors may adopt a wait-and-see approach until clearer industrial trends emerge.