No Data

BBJP JPMorgan BetaBuilders Japan ETF

- 58.340

- -0.010-0.02%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

List of cloud penetration stocks [Ichimoku Kinko Hyo - List of cloud penetration stocks]

○ List of stocks that surpassed cloud market Code Company Name Closing Price Leading Span A Leading Span B Tokyo Main Board <1887> Japan National Development 513 501.75 507 <1968> Taihei Electric 4995 4858.75 4950 <1980> Dai Dan 3940 3898.75 3877.5 <2594> Key Coffee 2047 2039.75 2040 <2752> Fujio Food 1188 1103.7

As it approaches 38,000 yen, the heaviness of the upper range comes into focus.

The Nikkei average fell slightly, ending trading at 37,677.06 yen, down 74.82 yen (with an estimated Volume of 2.6 billion 60 million shares). In the morning, influenced by the decline of U.S. stocks from the previous day and a pause in the depreciation of the yen, selling started out first. However, after the opening, it was bought back at a low, and by the end of the first half, it was purchased up to 37,968.02 yen. When the good earnings outlook from U.S. semiconductor memory giant Micron Technology Inc was conveyed, some semiconductor-related stocks were bought. Additionally, against the backdrop of expectations for further interest rate hikes by the Bank of Japan, there was anticipation for an improvement in profit margins.

Stocks that moved and those that were traded in the front market.

*Tokyo Kiraboshi <7173> 6170 +710 upward revision of performance and Dividends forecast. *Nanto Bank <8367> 4210 +425 announced a substantial increase in Dividends due to a change in its dividend policy. *Stanley Electric <6923> 2962.5 +275.5 City Index Eleventh has emerged as a major Shareholder. *Gan Ltd <6047> 638 +56 announced its first Dividends payment. *Mercari <4385> 2610 +159 investment judgment by Morgan Stanley MUFG Securities.

Express News | Reported Earlier, Japan National Core Consumer Price Index (YoY) For February 3.0% Vs. 2.9% Est.; 3.2% Prior

Asahi, MonotaRO ETC (additional) Rating

Upgrades - Bullish Code Stock Name Securities Company Previous Change After -------------------------------------------------------------- <4385> Mercari Morgan Stanley "Equal Weight" "Overweight" Downgrades - Bearish Code Stock Name Securities Company Previous Change After ----------------------------------------------------------------- <3

SBI Securities (before closing) has a strong Sell for Mitsubishi Corporation and a strong Buy for Mitsubishi Heavy Industries.

Sell Code Stock Name Transaction Amount (7011) Mitsubishi Heavy Industries 38,626,542,061 (5803) Fujikura 26,600,358,781 (8306) Mitsubishi UFJ Financial Group 19,997,540,150 (7012) Kawasaki Heavy Industries 14,461,582,720 (7013) IHI 11,333,718,950 (6857) Advantest 10,916,882,074 (1570

Comments

What do you think is the primary cause of this week's stock market dips?

That's all for today, and always remember to DYODD (Do your own due diligence) when making any kind of investment.

Thank you and Godspeed!

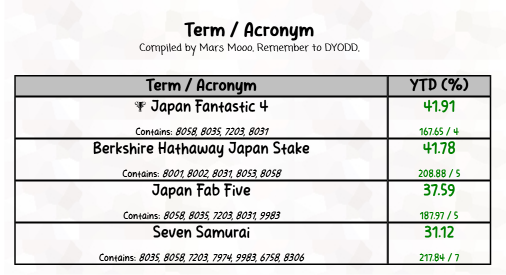

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when makin...

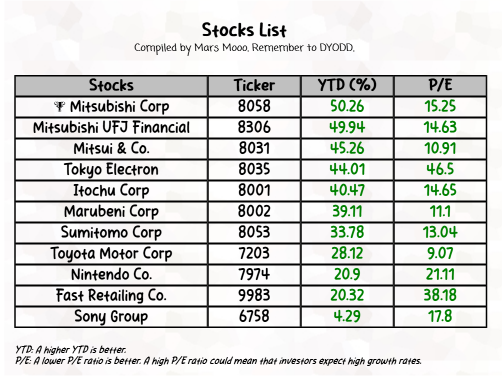

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when mak...

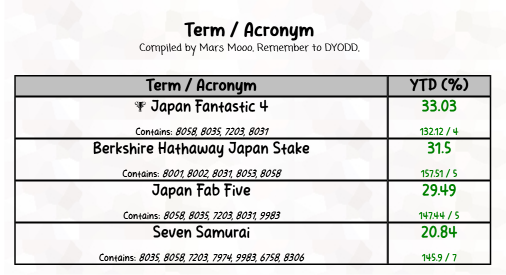

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when maki...

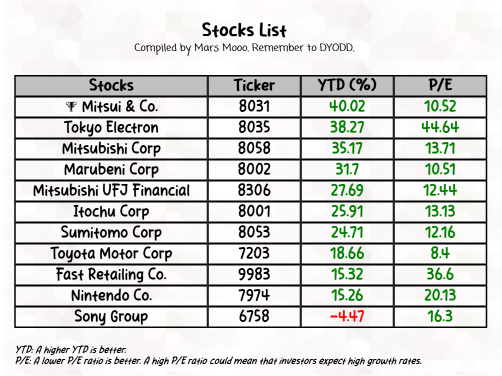

A short overview of equal weighted Seven Samurai (*1), Berkshire Hathaway Japan Stake, the Fab Five, and the Fantastic 4 YTD performance, rounded to 2 decimal places.

A quick overview of the stocks and their YTD performance inside them is provided below.

Do you think their YTD will continue to rise next week

That's all for today, and always remember to DYODD (Do your own due diligence) when maki...

熊猫猪墩儿 : The probability of the Democratic Party being re-elected declined, and future political uncertainty increased, so Wall Street, led by the Democratic Party, chose to sell off and stop making a profit.

Mars Mooo OP 熊猫猪墩儿 :

Cui Nyonya Kueh : eh you USD why you come seahum

Cui Nyonya Kueh : I think it's us unemployment + chip.

Cui Nyonya Kueh : can buy card for me![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...