US Stock MarketDetailed Quotes

BCS Barclays

- 15.360

- -0.030-0.19%

Close Mar 31 16:00 ET

- 15.460

- +0.100+0.65%

Pre 06:52 ET

54.98BMarket Cap8.54P/E (TTM)

15.400High14.975Low17.80MVolume15.050Open15.390Pre Close271.25MTurnover0.53%Turnover Ratio8.54P/E (Static)3.58BShares16.33852wk High0.59P/B51.43BFloat Cap8.67452wk Low0.35Dividend TTM3.35BShs Float38.178Historical High2.29%Div YieldTTM2.76%Amplitude1.576Historical Low15.237Avg Price1Lot Size

Barclays Stock Forum

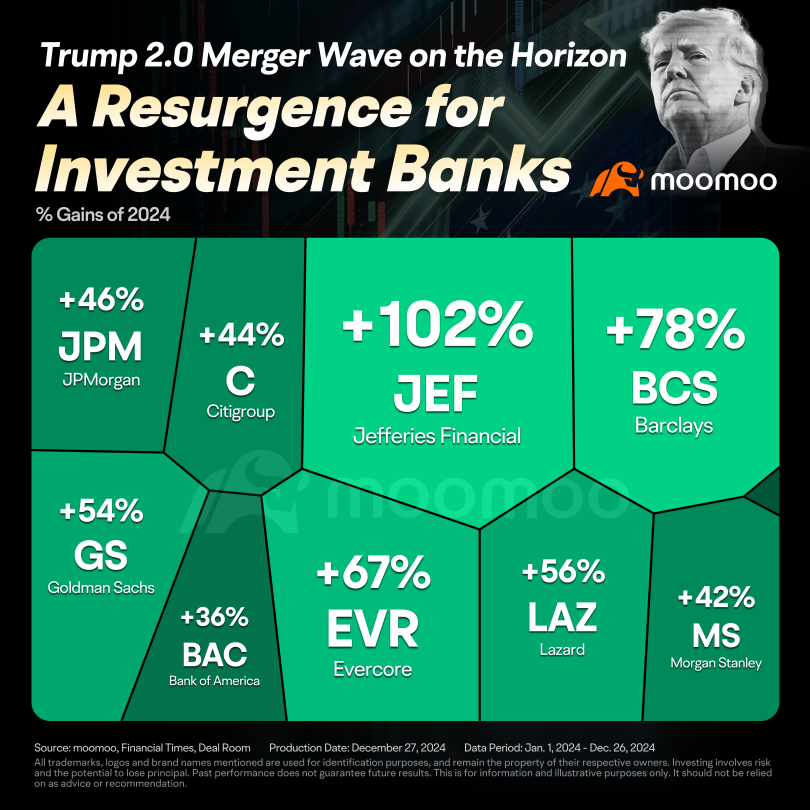

Deregulation was a hallmark of Trump's policy framework, and his previous term saw M&A-friendly regulatory reforms. With Trump poised for a White House comeback and an M&A market primed to rebound, many market observers foresee a surge in deals over the coming years.

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...

62

5

29

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

a few reports coming soon…!!

what could be worse?

keep holding…

this is because of treasury increment man the economy is still strong

T. Rowe Price's fixed income department CIO: the 10-year U.S. Treasury yield may touch 5% within six months.

a few reports coming soon…!!

what could be worse?

keep holding…

this is because of treasury increment man the economy is still strong

T. Rowe Price's fixed income department CIO: the 10-year U.S. Treasury yield may touch 5% within six months.

3

3

LEARN THE CYCLES so you don’t get misguided by emotions. Get Taught Up so You don’t get Caught Up.

Ex: Most people don’t even know Dark Pools exist

(like what happened with $Barclays (BCS.US)$ getting fined $453 million in 2012 with the situation with LX Liquidity Cross)

$SPDR® Portfolio S&P 500® ETF $Fidelity MSCI Information Tech ETF $Fidelity MSCI Health Care ETF $GraniteShares 2x Long NVDA Daily ETF $Nvidia Corporation $Sirius Xm $Palantir Technologies Inc $Carvana

Ex: Most people don’t even know Dark Pools exist

(like what happened with $Barclays (BCS.US)$ getting fined $453 million in 2012 with the situation with LX Liquidity Cross)

$SPDR® Portfolio S&P 500® ETF $Fidelity MSCI Information Tech ETF $Fidelity MSCI Health Care ETF $GraniteShares 2x Long NVDA Daily ETF $Nvidia Corporation $Sirius Xm $Palantir Technologies Inc $Carvana

10

3

$Grab Holdings (GRAB.US)$, a leading Southeast Asian tech conglomerate, continues to redefine the everyday super app landscape. The platform's diverse offerings span from facilitating transportation through ride-hailing to satisfying cravings with food delivery, alongside ventures into e-commerce and a suite of fintech solutions. The company is expected to release Q2 2024 earnings report on 2024/8/15 ET before bell.

As the company's core business, d...

As the company's core business, d...

29

6

22

No comment yet

and rooting for you Future Multimillionaire.

and rooting for you Future Multimillionaire.

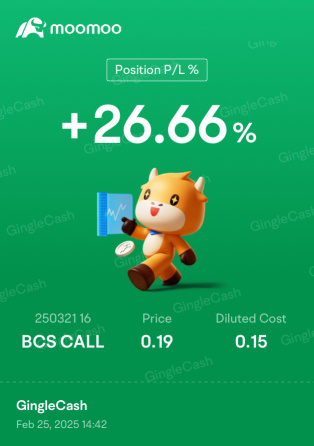

GingleCash OP : sold at .55, waiting to repeat! These I’ve found if you’re not greedy, you can profit multiple times with this one. TryN best I know how…trial and error. not as volatile as others patience is key and loading up when cheap w/profit %.

%.