No Data

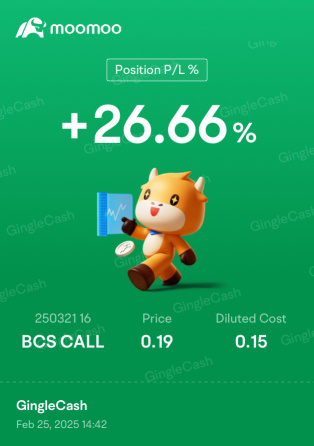

BCS Barclays

- 16.060

- -0.190-1.17%

- 16.090

- +0.030+0.19%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Barclays Bank PLC Updates Announcement of 3 Cash Tender Offers and Consent Solicitations

Wall Street's most pessimistic forecast: Barclays significantly lowers the S&P 500 target to 5,900 points.

On Wednesday, the Barclays Analyst team significantly lowered the 2025 S&P 500 Index target from 6,600 points to 5,900 points, which is the lowest expectation among major Wall Street investment banks. This adjustment is primarily based on two key factors: the impact of Trump's tariffs and the deterioration of macroeconomic data. According to Barclays, Trump's new round of tariffs could reduce the EPS of S&P 500 constituents by 8.5 to 12 cents in 2025, a downward adjustment of 6%-9% compared to earlier expectations. The Industrial (average tariff exposure of 14%) and Consumer (11%) Sectors are the hardest hit. The deterioration of macroeconomic data has also led to the bank's...

Barclays: The Monetary Authority of Singapore may further ease policies this year.

Three members of Barclays' Emerging Markets research department stated in a research report that the Monetary Authority of Singapore may further ease policies this year. Barclays currently predicts that the slope of the nominal effective Exchange Rates policy Range will be lowered by another 50 basis points in the second half of the year, targeting a reduction to zero. Previously, Barclays recently adjusted its baseline forecast scenario, reducing the slope of the policy Range by 50 basis points in April to an estimated 0.5%. These three members indicated that although Singapore's CPI data has been affected by some factors, including the base effect from last year's increase in the Goods and Services Tax, month-on-month inflation is slowing down.

Barclays Lowers Henkel's Estimates on Expected Decline in Consumer Volume

According to a Deutsche Bank survey, the probability of a recession in the USA is 43%. Wall Street warns that Trump's policies pose a risk of stagflation.

According to a survey conducted by Deutsche Bank, the possibility of the USA economy entering a recession is nearly fifty-fifty, which raises more questions about the direction of the USA economy. Between March 17 and 20, the average view from 400 respondents indicated that there is about a 43% probability that the USA economy will experience a slowdown in growth over the next 12 months. Although the unemployment rate is at a low level and most data indicate that the USA economy continues to grow even if the growth rate is slowing, the survey results further confirm the messages conveyed by various sentiment surveys, which show that consumers and business leaders are increasingly worried about the risks of economic slowdown or recession.

Models indicate that the USA's debt ceiling could be breached as early as mid-July.

The U.S. Bipartisan Policy Center stated that a model released on Monday shows that if Congress does not take action, the United States could breach the debt ceiling sometime between mid-July and October. The institution also mentioned that while the possibility is low, if this year's tax revenue falls short of expectations, the so-called "X date" could arrive in early June. The U.S. Treasury has not predicted when the X date will occur, at which point the federal government would not have the authority to fulfill payment obligations. Wall Street estimates that the X date could occur as early as the end of May (according to BNP Paribas) and as late as the end of August or in the third quarter (according to Bank of America, Barclays, and TD Securities).

Comments

Unlock the Full List

GingleCash OP : sold at .55, waiting to repeat! These I’ve found if you’re not greedy, you can profit multiple times with this one. TryN best I know how…trial and error. not as volatile as others patience is key and loading up when cheap w/profit %.

%.