No Data

BCS Barclays

- 15.360

- -0.030-0.19%

- 15.440

- +0.080+0.52%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The risk of recession is rising! Goldman Sachs significantly cuts the S&P 500 Index target, marking the second adjustment this month.

Goldman Sachs strategists have lowered their S&P 500 Index target for the second time this month, citing rising recession risks and uncertainty related to tariffs. The team led by David Kostin now expects the index to be around 5,700 points by the end of the year, down from a previous forecast of 6,200 points. According to data collected by the institutions, the new target means the S&P 500 Index will rise only 2% from last Friday's close, making it one of the lowest indices on Wall Street. Kostin wrote in the report: "Slowing economic growth and rising uncertainty have led to a higher risk premium for stocks and lower valuation multiples."

Trump stated that he is looking forward to April 2, while Global investors are on high alert.

President Donald Trump said he is looking forward to April 2. However, global stock investors feel differently. The Trump administration is expected to announce a series of so-called reciprocal tariffs against USA trade partners on Wednesday, which may bring another heavy blow to the market. Trump mentioned that the related measures would be "loose," but given that the content of the next round of tariff plans remains unclear, Fund managers remain cautiously competitive. The automobile tariffs announced by Trump last week have severely impacted global Industry Stocks, which may indicate potential future volatility. Institutions forecast that due to the scale of the announced content, with the possibility of significantly increased tariffs on imports from certain countries, the future will be affected.

The trade war exacerbates the economic risks in the USA, with US bonds outperforming the US stock market in the first quarter.

The escalating Global trade war is exacerbating the risk of a sharp slowdown in USA economic growth and affecting investors' portfolios. Affected by a series of tariff policies from USA President Donald Trump, both Stocks and Bonds experienced significant fluctuations in the first three months of this year. However, in this context, one thing is becoming increasingly clear: even as the dollar's status as a safe haven is weakening, Bonds are a better bet compared to Stocks. The performance of US Bonds outperformed Stocks this quarter, with an increase expected to exceed 2%, while the S&P 500 Index is down about 5%. This marks the first time since the COVID-19 pandemic began in March 2020 that the stock market has experienced such a span of three months.

Weekend headlines: Trump threatens to impose secondary tariffs on Russia and Iran. Gold continues to reach new highs. Goldman Sachs raises the probability of a recession in the USA. xAI acquired X.

For more global financial News, please visit the 7×24 hours real-time financial news. Last week market review: All three major stock indexes recorded declines this week. Uncertainty around tariffs and inflation data has raised concerns. On March 28, the top 20 trading volumes in the US stock market: Trump's tariffs and consumer downgrade caused Lululemon to drop 14%. On Friday, China Concept Stocks generally fell, with Taiwan Semiconductor down 1.78% and Alibaba down 2.36%. US WTI Crude Oil rose 1.6% this week, marking the third consecutive week of increases. International Gold continues to reach historical highs, and COMEX Silver Futures accumulated nearly 4% increase this week. Major European stock indexes collectively declined, Germany.

Barclays: The scale of mergers and acquisitions in India will rise with fluctuations in the stock market.

Arun Saigal, head of financing and mergers and acquisitions at Barclays India branch, stated that in the context of stock market volatility, the volume of mergers and acquisitions in India could rebound in the next 12 to 18 months. Saigal said at the "Mint" India Investment Summit held in Mumbai on Saturday: "If you are a company looking to raise funds and wanting to exit an investment, this market volatility may not necessarily be beneficial, and mergers and acquisitions can indeed provide certainty." Saigal mentioned that as valuations decline, the inflow of mergers and acquisitions into India, particularly those from financial investors, may increase. Saigal pointed out that in recent years, due to stock

What is the impact of Trump's significant increase in Autos tariffs? The cost of purchasing a vehicle for USA consumers may soar by thousands of dollars.

Wall Street Analysts pointed out that the Trump administration's new policy to significantly raise import tariffs on automobiles could lead to price increases for both imported and domestic vehicles for USA consumers. Trump previously announced a 25% tariff on imported Passenger Vehicles, light trucks, and key Auto Parts such as engines, transmissions, and powertrains. Several Institutions' analysts expect that, based on the proportion of imported vehicle parts, the cost for consumers to purchase cars may increase by $4,000 to $15,000 per vehicle. This tariff policy will take effect at midnight on April 3, and Trump stated that it will be implemented permanently. However, there are exception clauses: according to the US-Mexico-Canada Agreement.

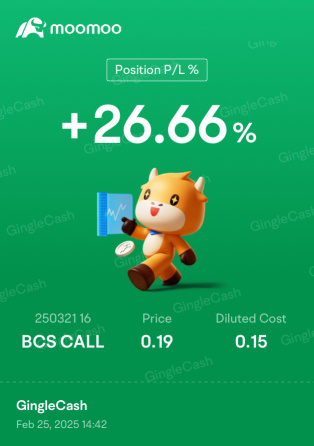

GingleCash OP : sold at .55, waiting to repeat! These I’ve found if you’re not greedy, you can profit multiple times with this one. TryN best I know how…trial and error. not as volatile as others patience is key and loading up when cheap w/profit %.

%.