No Data

BEKE KE Holdings

- 20.690

- +0.310+1.52%

- 20.670

- -0.020-0.10%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Statistics on Capital Trend of Hong Kong Stock Connect (T+2) | March 27

Capital Trend of Hong Kong Stock Connect | March 27.

KE Holdings-W (02423.HK) spent 8 million USD to repurchase 1.165 million shares on March 25.

Gelonghui, March 26丨 KE Holdings-W (02423.HK) announced that on March 25, it spent 8 million USD to repurchase 1.165 million shares.

KE Holdings-W (02423.HK) spent 8 million USD to repurchase 1.152 million shares on March 24.

Gelonghui, March 25丨KE Holdings-W (02423.HK) announced that on March 24, 2025, it spent 8 million USD to repurchase 1.152 million shares.

In 2024, the number of active brokers at KE Holdings reached 0.445 million, continuously increasing benefits for consumers, service providers, and store owners.

On March 18, KE Holdings announced its financial results for the fourth quarter and the entire year of 2024. In the fourth quarter of 2024, KE Holdings achieved a total transaction volume (GTV) of 1,143.8 billion yuan (RMB, the same below), a year-on-year increase of 55.5%, net income of 31.1 billion yuan, a year-on-year increase of 54.1%, and adjusted net profit of 1.344 billion yuan. KE Holdings co-founder, Chairman, and CEO Peng Yongdong stated: "In the past year, China's Real Estate Industry has accelerated towards a new stage, with customer demand shifting towards minimizing decision-making risks and pursuing housing quality. We empower service providers with Technology, building the capacity for optimal decision-making solutions, and driving the Industry.

KE Holdings To Go Ex-Dividend On April 9th, 2025 With 0.36 USD Dividend Per Share

KE Holdings (NYSE:BEKE) Sees 12% Price Increase Over Quarter Despite Net Income Drop

Comments

Gapping Up

$Five Below (FIVE.US)$'s stock soared 9.9% after the company reported fourth-quarter adjusted earnings that surpassed analysts' estimates and a 3% drop in same-store sales, smaller than the expected 3.3% decline. The teen-centric discount retailer also forecasted first-quarter revenue of $905 million to $925 million, above the $897 million estimate.

$Carvana (CVNA.US)$ stocks increased by 3.1% to $180.34 f...

BEKE is expected to show a rise in quarterly revenue of 37.1% increase to CNY27.693 billion from CNY20.2 billion a year ago.

The consensus EPS estimate is expected for KE Holdings to come in at CNY1.77 per share or 24 cents.

KE Holdings (BEKE) Last Positive Earnings Call Gave Inves...

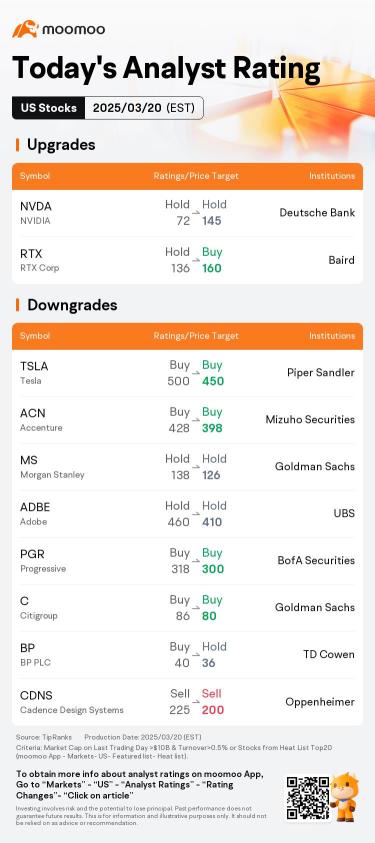

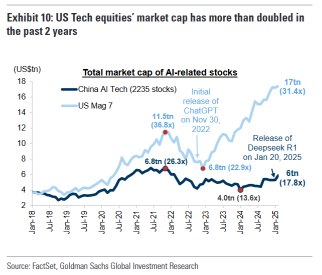

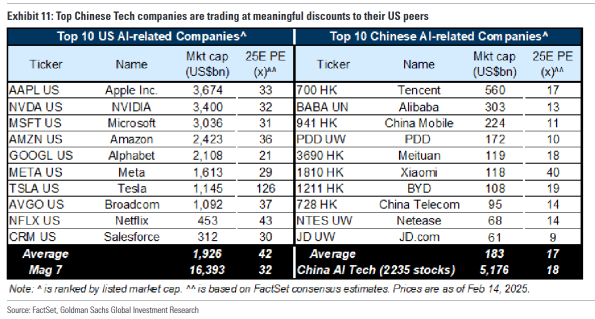

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

By midday Thursday in Asia, Alibaba confirmed a partnership with Apple Inc. to develop AI features for iPhones in China, sending its stock up m...

The U.S. stock market, in its second bullish year, repeatedly shattered records. Nvidia claimed the crown, tech giants reigned supreme, and AI continued to fuel the market's ascent. Globally, interest rates took a downturn amidst ongoing g...

70926697 : Thanks

Eugh : yay i finally outpaced all of my loses

GiovannaMM : bingo