No Data

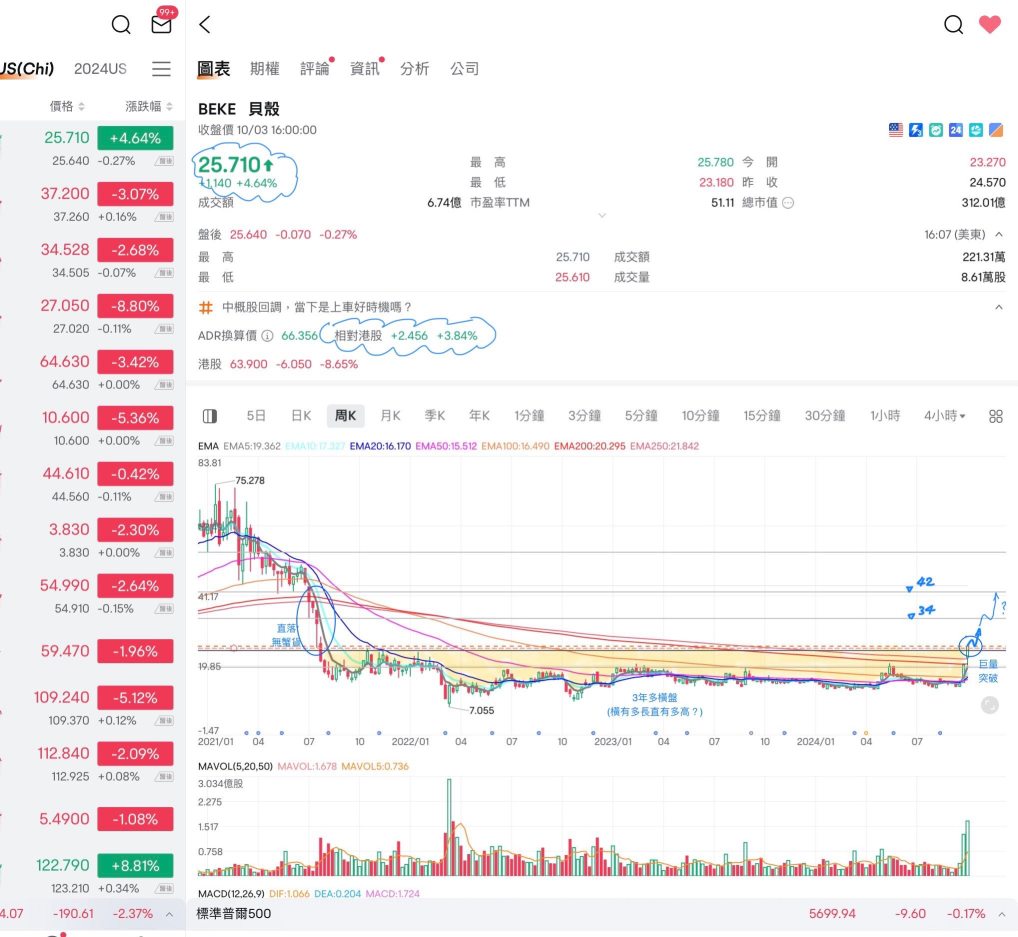

BEKE KE Holdings

- 19.090

- -0.890-4.45%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nomura Raises Price Target on KE Holdings to $23.80 From $21.80, Keeps Buy Rating

BofA Securities Maintains KE Holdings(BEKE.US) With Buy Rating, Maintains Target Price $28

Ping An Securities: Typical urban suburban areas have accumulated inventory and long turnover periods. It is expected that the bottoming out will lag behind the improvement of core areas and good products in the sector.

The path for the real estate industry to "stop falling and stabilize" will follow: "Good products — core areas in first-tier and second-tier cities — stabilization of the national economy — stabilization of the national housing market — stabilization of investment". Low-tier areas (suburbs of second-tier cities + third and fourth-tier cities) are hindered by high inventory levels, leading to a relatively delayed stabilization.

KE Holdings Inc (BEKE) Q3 2024 Earnings Call Highlights: Strong Revenue Growth Amidst Margin ...

Daiwa Capital Markets: Maintain buy rating for ke holdings-W (02423), target price raised to 70 Hong Kong dollars.

ke holdings guidance for the fourth quarter revenue increased by 39% to 44% year-on-year, reaching 28 billion to 29 billion RMB.

Hong Kong stock concept tracking | Hong Kong is expected to reverse the long-standing real estate downturn, with a large increase in real estate transaction volume bullish for intermediaries (including concept stocks)

In 2025, the hot real estate market in Asia may collectively heat up.

Comments

Salesforce Inc (CRM US) $Salesforce (CRM.US)$

Daily Chart -[BULLISH ↗ **]CRM US is pushing higher after breakout out of an ascending wedge pattern. With 284.70 as support, a further push higher towards 1st resistance at 307.45 then next resistance at 317.30 is expected. Technical indicators are advocating for a bullish scenario.

Alternatively: A daily candlestick closing below 284.70 support will see a deeper pullb...

More stabilisation to the property Market will translate into better sales activities on KE holdings app and website portal

Analysis

Price Target

No Data

Business Data

No Data

noworries99 : Good opportunity to buy more lol. BEKE has got nothing to do with trump or international trades