No Data

BIL SPDR Bloomberg Barclays 1-3 Month T-Bill ETF

- 91.525

- +0.005+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Treasury Yields Hover Near 4-month Highs as Attention Turns to Fed

"Bond Vigilantes" target Trump, the "anchor of global asset pricing" dances again.

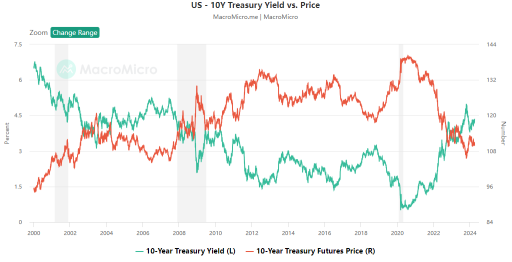

The financial markets believe that Trump's policies may lead to inflation and increase federal debt, causing US bond interest rates to rise.

Treasury Debt Gets 'Punched in Face' After Trump Win. What to Do With Bonds Now

Fed's Confidence in Flagging Rate Cuts 'Might Wane' as Trump's Economic Impact Unfolds

Trump's 'Second Impeachment', inflation risk still ignored by the market? Experts: Don't underestimate it too much.

Bloomberg macroeconomic strategist Simon White believes that while it is generally believed that Trump's policies will fuel inflation in the USA, the market currently still underestimates the inflation outlook. He stated that, based on risk adjustment, inflation-linked bonds remain one of the best assets to combat rising inflation.

Trump secures the White House! The US bond market is undergoing a huge wave, and the Fed's policy is facing a major test.

①Republican presidential candidate Trump secures election victory, Republicans win Senate control; ②U.S. 10-year Treasury notes yield surged by 18 basis points, 2-year U.S. Treasury notes yield rebounded to a high since August, USD index soared by 180 points. ③Republican control of the Senate may lead to a shift in economic policy, increasing deficits and inflation, sparking market concerns about the Fed's future room for interest rate cuts.

Comments

The release of the U.S. Consumer Price Index (CPI) data for August has once again confirmed market expectations regarding inflation trends.The year-over-year growth rate of the overall CPI has fallen to 2.5%, while core CPI remains stable. This not only indicates that market supply and demand are gradually balancing, but also provides investors with a good opportunity to rea...

In a text book manner, it was options expiry day April 19 so the market' pull back from its record all time highs was naturally going to be exacerbated. Shorts were exercised, the ASX200 $S&P/ASX 200 (.XJO.AU)$ dropped 0.98% on Friday, and then rose up 1.1% on Monday April 22, with market participants e...

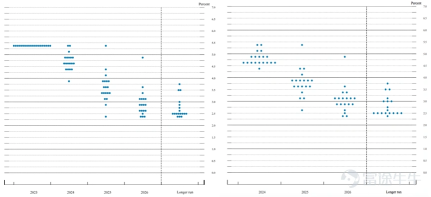

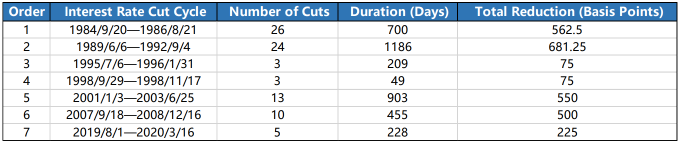

When central banks embark on an easing cyc...

Nasdaq 100 $Invesco QQQ Trust (QQQ.US)$ : +52%

S&P 500 $SPDR S&P 500 ETF (SPY.US)$ : +24%

Developed ex-US $Vanguard FTSE Developed Markets ETF (VEA.US)$ : +15%

Small Caps $iShares Russell 2000 ETF (IWM.US)$ : +12%

Gold $SPDR Gold ETF (GLD.US)$ : +11%

REITs $Vanguard Real Estate ETF (VNQ.US)$ : +9%

Emerging Markets $Vanguard FTSE Emerging Markets ETF (VWO.US)$ : +6%

Cash $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ : +4.7%

US Bonds $iShares Core US Aggregate Bond ETF (AGG.US)$ : +4.5%��...

Alen Kok : o

太泪了 : Now buy got dividen?