No Data

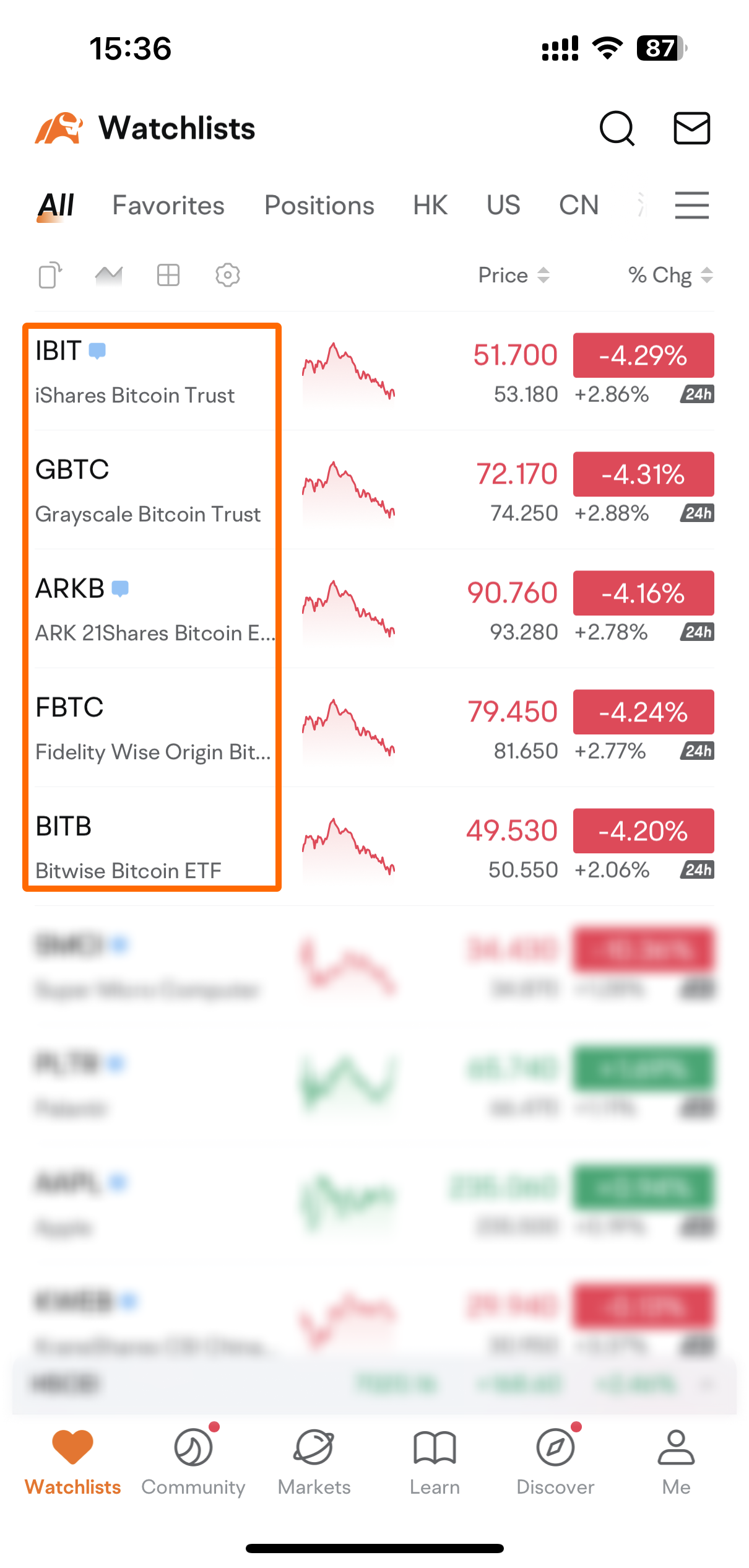

BITB Bitwise Bitcoin ETF

- 55.220

- +2.720+5.18%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Bitcoin Surges Past $100,000, Ethereum, Dogecoin, XRP Follow: 'Slow Grind Up' Or Explosive Rally Ahead?

The Nasdaq hits 20,000 points! Besides US bonds, US investors are buying everything.

After the release of USA's November CPI data on Wednesday, investors seem to have finally "confirmed" that the Federal Reserve's interest rate cut next week is a done deal; financial markets across asset classes on Wednesday also appeared quite uplifting; apart from the decline in USA Treasuries, investors are buying everything else - USA stocks are rising, Gold is rising, the dollar is rising, Crude Oil Product is rising, and Cryptos are rising...

“Bitcoin faith” is once again sublimated! Vancouver, Canada may include Bitcoin in the city's finances

With Trump, who supports Cryptos, being elected as President of the USA and driving Bitcoin prices soaring, Vancouver, Canada has passed a motion that may encourage the use of Bitcoin in the city's finances.

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

How Bitcoin's Demand Zone Holds the Key to Reclaiming $100K

Benzinga Market Summary: Nasdaq Rises Above 20,000 Amid Strength In Tech Stocks, Adobe To Report After The Close, Bitcoin Rises

Comments

The markets anticipated Gensler's departure and a less aggressive crypto regulator. If BTC continues to climb, I think other crypto majors like $Ethereum (ETH.CC)$ need to catch up first. 🌊 Ethereum looks like a steal compared to Bitcoin right now! $XRP (XRP.CC)$ spiked, but profit-taking hit hard at $2.80. $Altos are all over the place....

This is a big win for regular investors like us because it makes investing in Bitcoin that much easier, all within a regulated market.

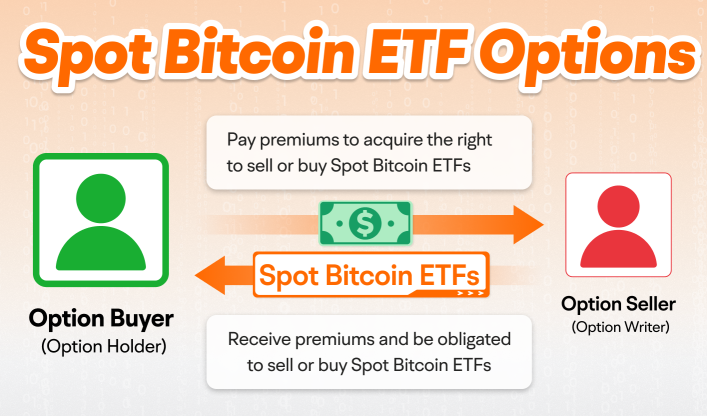

Ⅰ. What are Spot Bitcoin ETF options?

Spot Bitcoin ETFs are a type of ETF that holds bitcoins to track their current or spot price.

Spot Bitcoin ETF options are financial contracts that give you the right, but n...

To navigate the current bullish trend and identify opportunities, this article explores Bitcoin’s outlook from five perspectives:

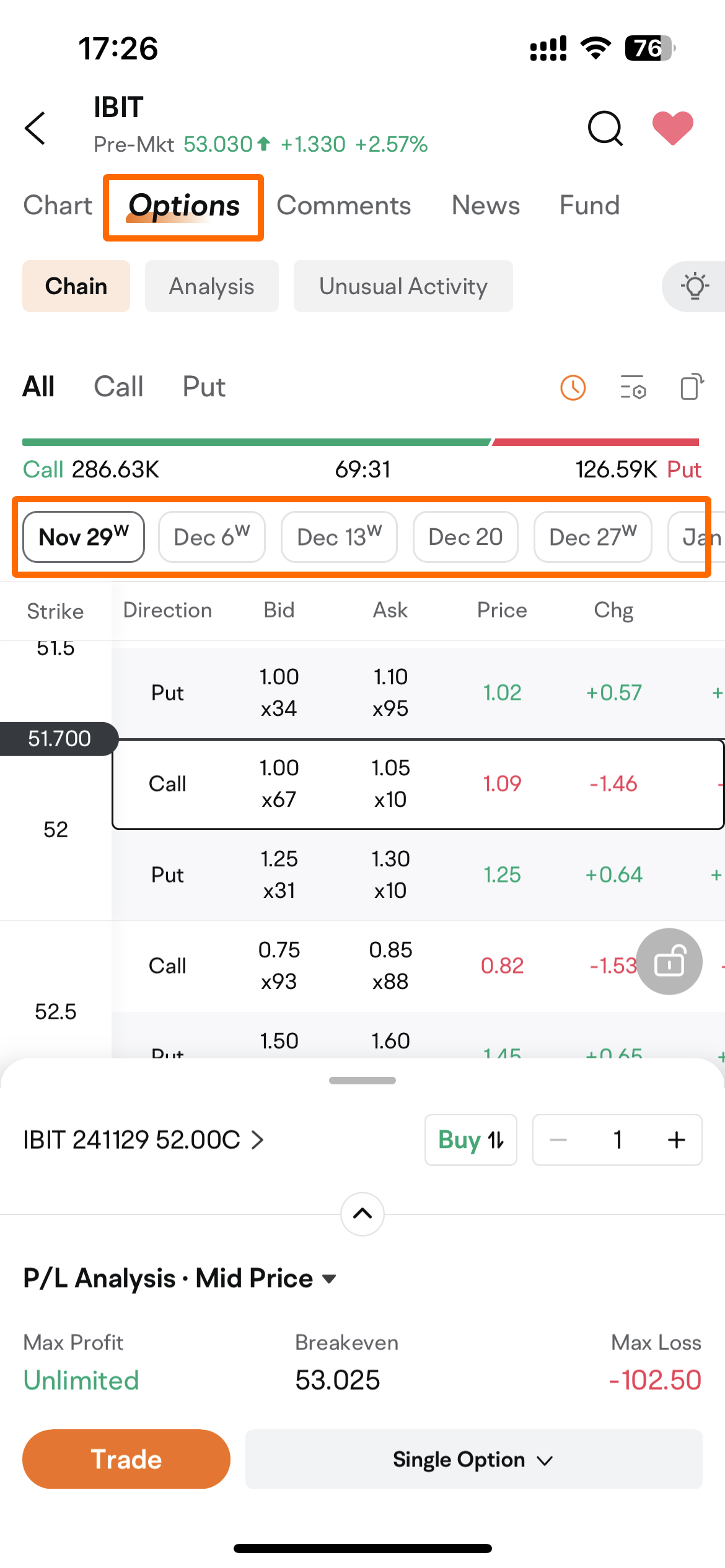

1.The impact of IBIT ETF options on Bitcoin.

2.Trump’s plan to appoint a crypto advocate to lead the SEC...

ASBNellu : Total return will be negligibly different. Lowest expense ratio gonna be the best play