US OptionsDetailed Quotes

BITO241206P27000

- 0.95

- 0.000.00%

15min DelayTrading Dec 6 16:00 ET

0.00High0.00Low

0.00Open0.95Pre Close0 Volume0 Open Interest27.00Strike Price0.00Turnover9013.27%IV-1.01%PremiumDec 6, 2024Expiry Date1.21Intrinsic Value100Multiplier-5DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type-0.6623Delta0.2050Gamma27.15Leverage Ratio-1595.8856Theta0.0000Rho-17.98Eff Leverage0.0001Vega

ProShares Bitcoin ETF Stock Discussion

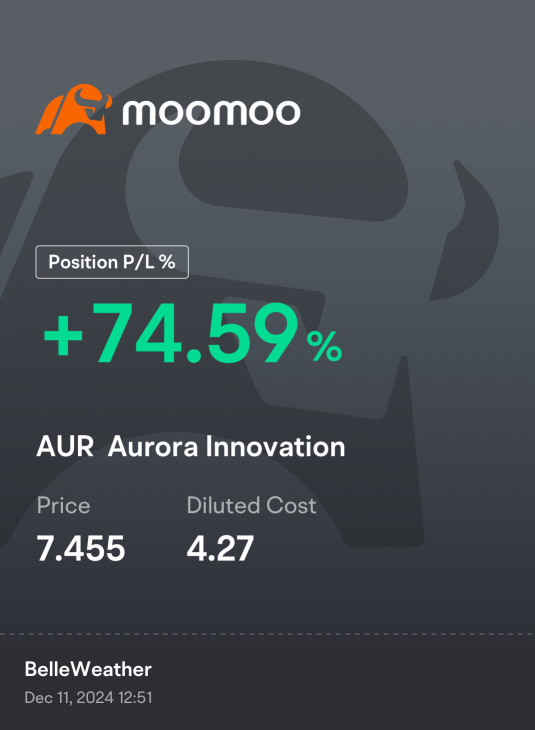

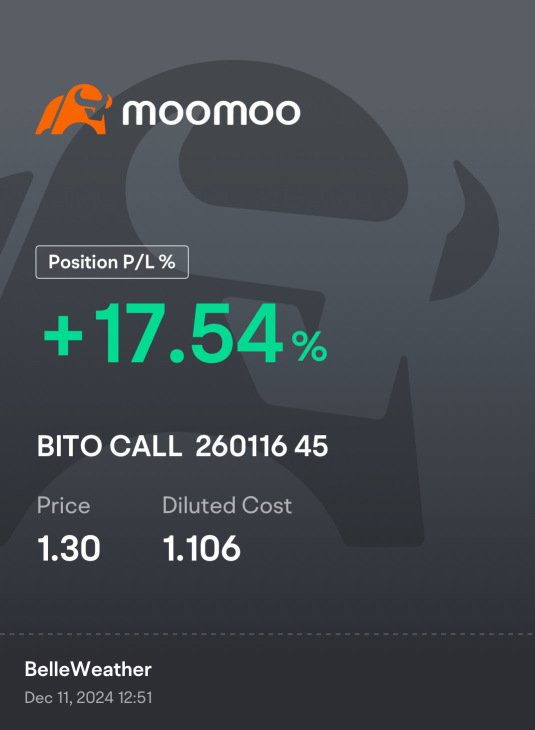

Taking profit on some AUR and closing some BITO positions to hedge with VIX calls and some puts on large positions.

Opened a very speculative position in $Tilray Brands (TLRY.US)$ (calls and LEAPS calls - IV is high, so not much but a bit of fun.

Opened a very speculative position in $Tilray Brands (TLRY.US)$ (calls and LEAPS calls - IV is high, so not much but a bit of fun.

7

4

$ProShares Bitcoin ETF (BITO.US)$

Need to pay 30% tax for the monthly dividend?

Need to pay 30% tax for the monthly dividend?

4

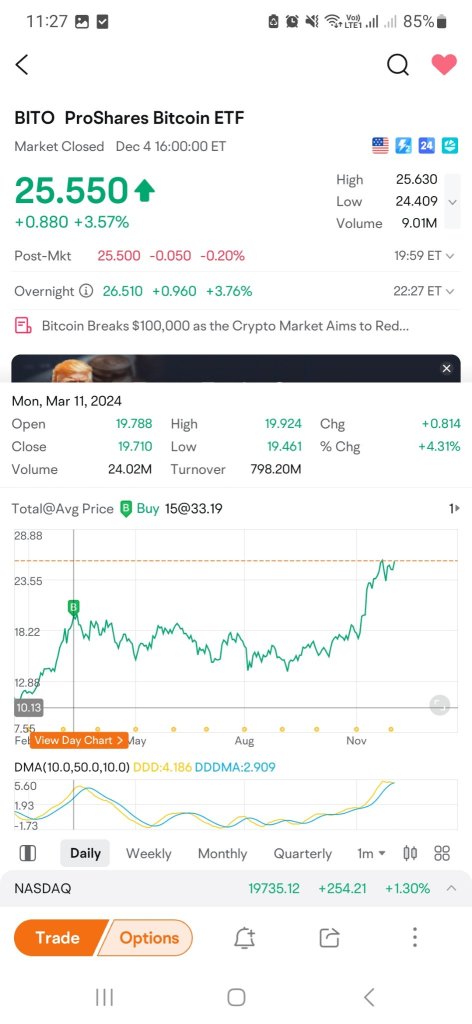

anyone held this since Mar 2024? it was $33+ when I bought it, but the graph on moomoo shows that it was $19+ in Mar 2024 now 😨

$ProShares Bitcoin ETF (BITO.US)$

$ProShares Bitcoin ETF (BITO.US)$

1

$ProShares Bitcoin ETF (BITO.US)$ good dividend and still going strong after ex

1

$ProShares Bitcoin ETF (BITO.US)$ Amazing how the dividend yield went up almost 3% right after market open on ex date. Watch dividend yield crawl back up to 60 ish% only for them to dunk on your heads.

2

$ProShares Bitcoin ETF (BITO.US)$ lousy etf. Little dividend payout despite higher bitcoin prices. I think fund manager may be losing money by shorting bitcoin futures.

2

2

No comment yet

Growth Investor27 : TLRY beer part of it's buisness is worth $2.70 a share alone

BelleWeather OP Growth Investor27 : Agreed, the company is undervalued by many metrics. I think shares are absolutely reasonable, given valuation, cash position, catalysts and etc. But I bought calls with very high IV premium,, which I find fun, but can’t recommend.

rennymc BelleWeather OP : I don’t trade options. Can you please explain what “buying calls with very high IV premium” means? Thanks!

BelleWeather OP rennymc : Long calls are options contracts that give the buyer the right to buy shares (usually 100 of them,) at a certain price, called the strike, by a certain date, called the expiry. The cost is called the premium, and in part it depends on how much the price is expected to move, or the volatility. When unknowns become known, this volatility drops, along with the premium, unless the share price makes an unexpectedly large move. So, I overpaid, basically, but am hoping the change in share price makes up for it.