US OptionsDetailed Quotes

BITX241129C66000

- 0.33

- +0.13+65.00%

15min DelayClose Nov 27 16:00 ET

0.40High0.20Low

0.24Open0.20Pre Close225 Volume337 Open Interest66.00Strike Price5.89KTurnover147.86%IV11.22%PremiumNov 29, 2024Expiry Date0.00Intrinsic Value100Multiplier1DDays to Expiry0.33Extrinsic Value100Contract SizeAmericanOptions Type0.1114Delta0.0396Gamma238.56Leverage Ratio-0.2500Theta0.0002Rho26.58Eff Leverage0.0062Vega

2x Bitcoin Strategy ETF Stock Discussion

$2x Bitcoin Strategy ETF (BITX.US)$ To me, this coin doesn't produce the results I thought I was going to get. Supposed to be a 2x multipler. Purchased Bitx at $50 when Bitcoin was in the low 70's, now Bitcoin is in the low 90's and BITX is trading between 52 and 56. Gary Gensler where are you?

5

3

$2x Bitcoin Strategy ETF (BITX.US)$ By now, I guess most of our bros would be happily collecting at the lower price now, with a much better upside % to go for. Happy hunting.

p.s. Don't fall in love with your trades. They are just numbers. You are here to make profits & make money, not to prove yourself right. Range trading is much more lucrative than picking tops & bottoms or hanging on losing trades just to "hope" it will be better later. You will lose time. And we aren't Warren Buffet who has...

p.s. Don't fall in love with your trades. They are just numbers. You are here to make profits & make money, not to prove yourself right. Range trading is much more lucrative than picking tops & bottoms or hanging on losing trades just to "hope" it will be better later. You will lose time. And we aren't Warren Buffet who has...

16

1

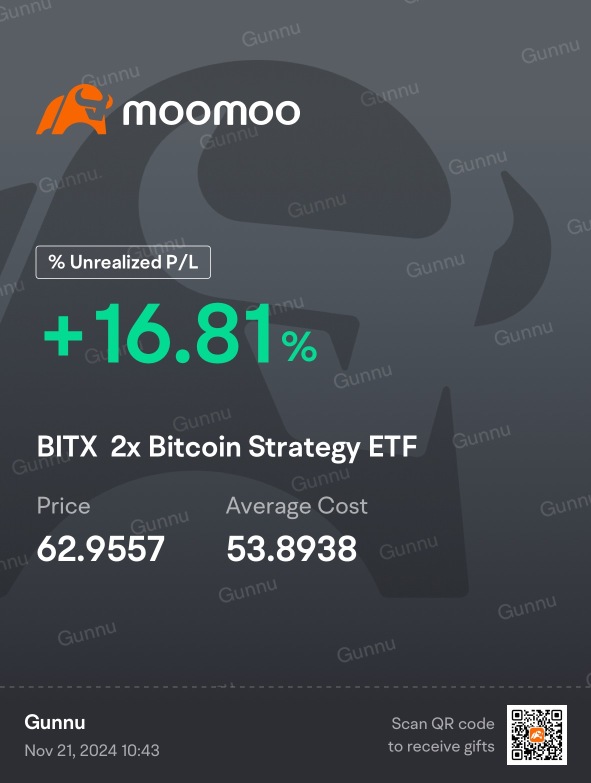

$2x Bitcoin Strategy ETF (BITX.US)$

I don't understand where the dividends come from? this is not a business. this is just a derivatives play on $Bitcoin (BTC.CC)$

I don't understand where the dividends come from? this is not a business. this is just a derivatives play on $Bitcoin (BTC.CC)$

2

4

$2x Bitcoin Strategy ETF (BITX.US)$ bitx, was the worst investment of my life. instead of the profits doubling for me with the price of Bitcoin, it halved. this should be investigated.

2

$2x Bitcoin Strategy ETF (BITX.US)$ ching ching ~ cashing out cashing out 💲💲💲 Bitcoin is always a hype. Hypes need fluctuations & range to make it attractive 💲💲💲 $Bitcoin (BTC.CC)$

9

2

$Bitcoin (BTC.CC)$ Too fast, too rush, safer to take half of the gain first. $2x Bitcoin Strategy ETF (BITX.US)$ $NVIDIA (NVDA.US)$

10

2

$2x Bitcoin Strategy ETF (BITX.US)$

IF WE SELL ALL AND STAY OUT TO WATCH THEN PRICE WILL GO UP or DOWN 🤔

IF WE SELL ALL AND STAY OUT TO WATCH THEN PRICE WILL GO UP or DOWN 🤔

1

No comment yet

Enjoy & good luck bros

Enjoy & good luck bros

Actually, ran already for days

Actually, ran already for days

inventive Iguana_6oh : that's the leverage ETF decay for you.

BFSkinner : It’s trading btc futures-

Lambert AI : It's the scale of ratio issue. BTC's USD 100K goes to USD 80K is a 20% drop, but when it goes back up from USD 80K to USD 100K (same amount within a day), it is a 25% increase. The ratio is linked & not proportional. Good to pick it up when BTC drops to lower range of fluctuation, then your gain will be good when it goes back up. If you pick it up when it's at higher price, when it drops then rebound back to the original price tag, you actually will lose $$. Good luck bro.