Online Car-hailing

- 688.955

- -5.132-0.74%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Investing over 0.4 billion, Qiming Venture Capital enters Zhengzhou Tiamaes Technology. Is the "shell buying craze" restarting?

① After this Trade is completed, the controlling Shareholder of Zhengzhou Tiamaes Technology will change to Qiming Fund, and the actual controller of the listed company will change to Kuang Ziping. The latter is the founding managing partner of Qiming Venture Capital. ② People from the Venture Capital Institutions indicate that Qiming Venture Capital's entry into Zhengzhou Tiamaes Technology this time may ultimately aim to realize investment exit by injecting its Assets into the listed company. ③ A wave of "shell buying" by Venture Capital Institutions occurred in the A-share market in 2019.

Zhengzhou Tiamaes Technology's "change of ownership" plan has emerged: Trade sets "different pricing for the same shares" with well-known VC participating in the integration.

① The well-known VC Qiming Venture Capital founder Kuang Ziping is about to become the actual controller of Zhengzhou Tiamaes Technology; ② This Trade adopts differentiated pricing, and industry insiders indicate that differentiated pricing helps provide more negotiation space, which can facilitate the acquisition and achieve a fair Trade.

After building cars, will we create 'humans'? Over ten car companies are laying out plans, has it become a necessary option in the AI era?

① The Chairman of Ideal Automobile, Li Xiang, responded to whether there will be humanoid robots, stating that the probability is definitely 100%, but the timing is not now; ② Apart from Tesla, Chinese brands including BYD, Guangzhou Automobile Group, Chery Automobile, Xiaomi, Chongqing Sokon Industry Group Stock, Xpeng Motors, SAIC Motor, Chongqing Changan Automobile, and Dongfeng Automobile are all involved in the field of humanoid robots.

Zhiji and Avita have recently attracted significant investment, with 'state-owned investors' fully backing New energy Fund automobiles.

① The 9.4 billion yuan financing for Zhiji Autos has continued support from both state-owned investment Institutions and market-oriented investment Institutions. ② From Zhiji Autos in Shanghai to Avita in Chongqing, then to GAC Aion, NIO in Hefei, and Li Auto in Changzhou, the involvement of local state-owned assets reflects the demand for industry drive and regional development. ③ After the conclusion of the Central Economic Work Conference, local governments are actively promoting industrial upgrades, demonstrating their main roles and responsibilities in the transition between new and old drivers of growth.

Avita has become more aggressive.

Counterattack.

November electric vehicle delivery report: BYD's electric vehicle sales exceeded 0.5 million, Xiaopeng broke through 0.03 million for the first time, and Chongqing Sokon Industry Group Stock saw a year-on-year sales growth of 54.58%.

Last month, the delivery volume of the Xiaomi SU7 continued to exceed 20,000 units, and Xiaomi expressed confidence in achieving the new delivery target of over 130,000 units for the year.

Comments

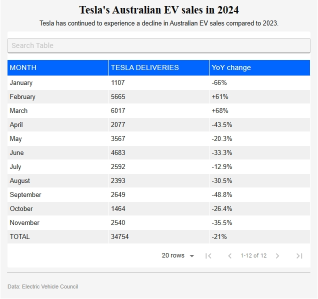

Tesla's Australian electric vehicle sales remain in free fall after Nov became the 8th-straight month of year-on-year sales decline for Elon Musk's autogiant amid a growing wave of competition from Chinese rivals.

Tesla sold 2540 vehicles in Australia in Nov, according to data released by the Electric Vehicle Council, resulting in a sales decline of 35.5% compared to the same time last year.

Tesla hasn't recorded year-on-...

Chinese electric vehicles are proving popular outside the local market and are gaining ground not only in Europe but also in Australia. The MG4 became the country's best-selling EV in Oct. With nearly 1,500 units sold last month, the MG4 dethroned the Tesla Model Y, which managed just over 1,000 sales (down from nearly 1,500 a month before).

In third place came the Model 3 with 422 sales, followed by the BYD Atto3 with 330 sales a...

GM's joint venture, SAIC-GM-Wuling (SGMW), is making a bid for attention with its first-ever new energy concept car, unveiled during the company's future strategy presentation for the ASEAN markets. And what better way to stand out than with a futuristic, low-slung coupe featuring gigantic gullwing doors?

Called the "Light of ASEAN," this concept serves as a preview of the des...

However, Ford CEO Jim Farley sees a bigger threat: Chinese EV companies. After a 2023 trip to China, where Farley and other executives were stunned by the quality of $Chongqing Changan Automobile (000625.SZ)$ 's elec...

1) The article reported that registrations for Chinese electric vehicles (EVs) like BYD and SAIC’s MG brand dropped by 45% compared to June. The decline in Chinese EV registrations has been linked to the Europe Commission (EC)’s provisional tariffs on China-made EV imports.

2) The EC imposed provisional tariffs of up to nearly 38% on EV imports m...

bullrider_21 OP : Tesla's Europe sales fell in 2024. Tesla's US sales fell in 2024. Tesla's Australia sales fell in 2024. Only Tesla's China sales are up.

74216494 bullrider_21 OP : And ? NIOs European sales are microscopic, US sales non-existant, Australias sales non-existant, China sales mediocre, compared to newcomers like XIAOMI or ZEEKR. TSLA still makes money; NIO never did.

bullrider_21 OP 74216494 : Comparing Nio and Tesla is like comparing apple and orange.