The Concept of the Ningde Era

- 1300.648

- -42.055-3.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

[Market Data Analysis] IF and IM index futures bulls significantly increased their positions, and four Institutions jointly decided to Buy Guangdong Topstar Technology.

① If the Block Orders for the IF index futures increase by more than 5,000 contracts, and the IM contracts increase by more than 3,000 contracts, the increase in quantity is significantly greater than the short positions. ② The Robot Concept stock Guangdong Topstar Technology has been heavily purchased by four Institutions, with a total buying amount reaching 0.173 billion.

The secondary listing of Hong Kong stocks has signaled the start of the "second wave of growth" by Ning Wang.

Morgan Stanley believes that Contemporary Amperex Technology's second listing in Hong Kong may raise between 6.8 to 7.7 billion US dollars. This funding will support its global capacity expansion, battery swap station construction, and Solid State Battery layout, initiating a second wave of growth.

Brokerage morning meeting highlights: It is expected that 2025 will be the first year when the Real Estate Industry truly achieves stability and long-term development.

At today's Brokerage morning meeting, CITIC SEC proposed that 2025 will be the year when the Real Estate Industry truly stabilizes and moves forward; Tianfeng stated that industry demand is expected to recover, and the Autos Sector may gradually become optimistic; China Securities Co.,Ltd. pointed out that the current valuation of the Baijiu(Chinese Liquor) Sector remains low overall, highlighting its long-term investment value.

The expectation of rising prices for Anode Material is gradually emerging, and Analysts say that the prices of Lithium Batteries may have already bottomed out.

① According to multiple interviews by the Financial Association reporters, the expectation of price increases in the Anode Material industry is gradually emerging. An Analyst predicts that some models of Anode Material may see slight increases in Q1 next year, with leading companies' processing fees expected to rise by 500 to 1000 yuan/ton in January. ② Citibank Analysts released a research report stating that Lithium Battery prices may have bottomed out and could see slight increases by 2025.

Automakers are accelerating the research and development of their own chips! Great Wall Motor's chip company has established a presence in Nanjing.

① Recently, Great Wall Motor signed a strategic cooperation agreement with Nanjing Jiangbei New Area, and the RISC-V automotive chip design company cultivated by Great Wall Motor, Zijing Semiconductors, established its presence in Nanjing Jiangbei New Area; ② In recent years, domestic car manufacturers, both new forces in vehicle manufacturing and traditional car companies, have been actively engaged in chip research and development.

The number has reached a historical high! So far this year, 17 A-share listed companies have announced special dividend plans, including Contemporary Amperex Technology and Yunnan Baiyao Group.

① According to incomplete Statistics, as of the time of publication, 17 A-share listed companies have announced special dividend plans for 2024 this year (attached table), setting a record high for the year. Among them, the special dividend amounts of Contemporary Amperex Technology, Yunnan Baiyao Group, S.F. Holding, and others exceed 2 billion yuan. ② In addition, listed companies such as Fuhua, Three Squirrels Inc., and Chongqing Qin'an M&E PLC have announced special dividend plans before the Spring Festival.

Comments

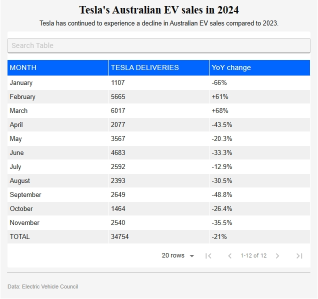

Tesla's Australian electric vehicle sales remain in free fall after Nov became the 8th-straight month of year-on-year sales decline for Elon Musk's autogiant amid a growing wave of competition from Chinese rivals.

Tesla sold 2540 vehicles in Australia in Nov, according to data released by the Electric Vehicle Council, resulting in a sales decline of 35.5% compared to the same time last year.

Tesla hasn't recorded year-on-...

CATL going to build swap stations = Nio is dead, going to have more competition.

I just married and F my wife, tomorrow my son is graduating and going to have a good job, I am going to retire after tomorrow.

Nio dump so much money into R&D, waste of money and resources.

We should do away with National Service, waste of money, no economical output.

We don’t need defence, we just need to increase GDP.

Kuwait invaded by Iraq.

Xiaomi just produced cars a...

On Dec 19, the Financial News reported (Reporter Xu Hao) that in one day, the two major leaders in the New Energy Vehicle battery swap market sent signals to the outside world that they would 'carry out battery swapping to the end', seemingly indicating that this energy replenishment model, which has been questi...

Who is CATL and why is this such a big deal? Well CATL has the world's fastest batteries, charging in under 5 minutes. Tesla is its biggest customer, accounting for 13% of its revenue, Alfa Romeo, Fiat, Jeep owner-Stellantis is its second-biggest customer...

$Contemporary Amperex Technology (300750.SZ)$ $BYD COMPANY (01211.HK)$ $BYD Company Limited (002594.SZ)$ $XPeng (XPEV.US)$ $XPENG-W (09868.HK)$ $NIO Inc (NIO.US)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$ $Tesla (TSLA.US)$

bullrider_21 OP : Tesla's Europe sales fell in 2024. Tesla's US sales fell in 2024. Tesla's Australia sales fell in 2024. Only Tesla's China sales are up.

74216494 bullrider_21 OP : And ? NIOs European sales are microscopic, US sales non-existant, Australias sales non-existant, China sales mediocre, compared to newcomers like XIAOMI or ZEEKR. TSLA still makes money; NIO never did.

bullrider_21 OP 74216494 : Comparing Nio and Tesla is like comparing apple and orange.