Tesla

- 1462.950

- +33.044+2.31%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Both "dual giants" suffered huge losses, with GANFENGLITHIUM expected to incur a loss of over 1.4 billion in 2024 | Interpretations

① GANFENGLITHIUM expects a net loss of 1.4 billion to -2.1 billion yuan last year, compared to a net income of 4.95 billion yuan in the same period last year; ② GANFENGLITHIUM stated that the performance change was mainly affected by the decline in sales prices of lithium salts and Lithium Battery products, the decline in the prices of financial assets held by the company, and additionally, the company made provisions for depreciation of inventory and other related Assets; ③ Known as the "Twin Heroes", both Tianqi Lithium Corporation and GANFENGLITHIUM have encountered losses, resulting in their worst performance since going public.

Year-on-year loss reversal, Tianqi Lithium Corporation is expected to lose over 7 billion in 2024 and plans to terminate the construction of the second phase lithium hydroxide project in Australia | Interpretations

① Tianqi Lithium Corporation expects a net loss of 7.1 billion yuan to -8.2 billion yuan in 2024, compared to a profit of 7.297 billion yuan in the same period last year; ② The company states that the reasons for the performance change are mainly the decline in lithium product prices and mismatch in pricing mechanisms, a drop in performance from the important associate company SQM, as well as an increase in asset impairment losses and foreign exchange losses; ③ The company plans to terminate the investment in the second phase of the lithium hydroxide project in Australia.

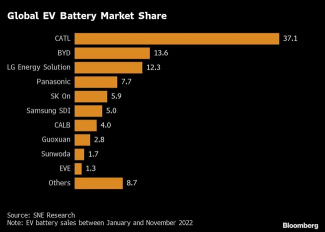

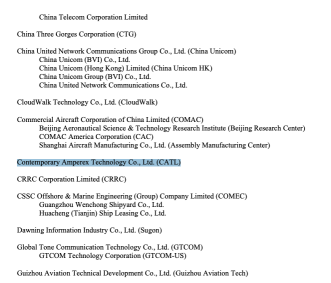

Target Price raised by 33%! JPMorgan is bullish on Contemporary Amperex Technology: technological innovation and global market expansion drive growth.

JPMorgan believes that due to the accelerated growth in sales, potential increases in unit economic efficiency, and its position as a CSI Leading Technology Index, the core competitive advantages of Contemporary Amperex Technology are promising. The target price has been significantly raised from 300 yuan to 400 yuan, indicating a potential increase of 53.9% compared to Tuesday's closing price.

JD.com's domestic mobile phone sales have increased by 200% month-on-month, and mobile phone supply chain manufacturers are expected to release performance elasticity.

According to media reports, as of January 20th at 12:00, the national subsidy activities in Peking, Hubei, Jiangsu, Zhejiang, and Shaanxi are fully launched on JD.com, and activities in other provinces and cities are also being rolled out. Among the provinces and cities where the national subsidy is launched, smartphone sales have increased by 200% month-on-month, and tablet sales have increased by 300%.

"Withstanding" the decline in lithium carbonate prices, Sichuan Yahua Industrial Group is expected to turn losses into profits in its 2024 net profit excluding non-recurring items year-on-year | Interpretations

① Sichuan Yahua Industrial Group announced that the expected net income for 2024 is between 0.28 billion and 0.33 billion yuan, a year-on-year increase of 596.26% to 720.60%; the non-recurring net income is expected to be between 0.185 billion and 0.235 billion yuan, achieving a turnaround from losses to profit year-on-year; ② For the whole year, the price of lithium carbonate in 2024 is expected to show a trend of rising first and then falling, continuing the downward trend of 2023.

[Data Watch] Renowned capital with over 100 million yuan aggressively invests in Shenzhen Woer Heat-shrinkable Material, with Zhejiang XCC Group being jointly bought by two Algo seats.

① The Copper cable high-speed connection concept stock Shenzhen Woer Heat-shrinkable Material received a Buy of 0.125 billion from the Dalian Huanghe Road office of Galaxy Securities. ② The Robot Concept stock Zhejiang XCC Group received a total Buy of over 0.2 billion from two Algo seats.

Comments

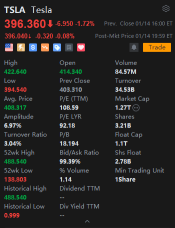

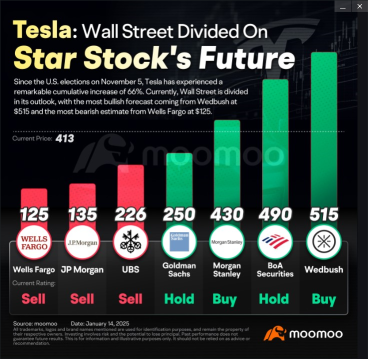

Recently, Tesla's stock price has been quite active. At the close of trading on January 14, 2025, Eastern Time in the United States, the stock price was $396.36. Compared with the previous day, it dropped by $6.95, with a decline of 1.72%. During that day, the stock price soared to a maximum of $422.64 and dropped to a minimum of $394.54. It fluctuated quite significantly.

Moreover, from the perspective of some technical in...

this morning $TENCENT (00700.HK)$ and $Contemporary Amperex Technology (300750.SZ)$ was hit, so tonight is the chance to take profit, it's natural .

plus $Bitcoin (BTC.CC)$ is down, so it's natural.

Tencent’s shares dropped over 7% in Hong Kong (and 8% in US trading), while CATL fell 5%. Not exactly minor hits for two global heavywei...

CATL going to build swap stations = Nio is dead, going to have more competition.

I just married and F my wife, tomorrow my son is graduating and going to have a good job, I am going to retire after tomorrow.

Nio dump so much money into R&D, waste of money and resources.

We should do away with National Service, waste of money, no economical output.

We don’t need defence, we just need to increase GDP.

Kuwait invaded by Iraq.

Xiaomi just produced cars a...

103998930 : Tesla seems too expensive, the rise is due to Trump buddy

Nonver 103998930 : but trump buddy drop. shd follow