Tesla

- 1448.781

- +10.254+0.71%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

"Withstanding" the decline in lithium carbonate prices, Sichuan Yahua Industrial Group is expected to turn losses into profits in its 2024 net profit excluding non-recurring items year-on-year | Interpretations

① Sichuan Yahua Industrial Group announced that the expected net income for 2024 is between 0.28 billion and 0.33 billion yuan, a year-on-year increase of 596.26% to 720.60%; the non-recurring net income is expected to be between 0.185 billion and 0.235 billion yuan, achieving a turnaround from losses to profit year-on-year; ② For the whole year, the price of lithium carbonate in 2024 is expected to show a trend of rising first and then falling, continuing the downward trend of 2023.

[Data Watch] Renowned capital with over 100 million yuan aggressively invests in Shenzhen Woer Heat-shrinkable Material, with Zhejiang XCC Group being jointly bought by two Algo seats.

① The Copper cable high-speed connection concept stock Shenzhen Woer Heat-shrinkable Material received a Buy of 0.125 billion from the Dalian Huanghe Road office of Galaxy Securities. ② The Robot Concept stock Zhejiang XCC Group received a total Buy of over 0.2 billion from two Algo seats.

Another 20 companies added this week! Zhejiang Huayou Cobalt and several other stocks have disclosed shareholding repurchase and loan plans, a list of related A-shares is provided.

① The number of A-share listed companies receiving special loan support continues to expand. According to incomplete Statistics, as of this report, 20 listed companies have disclosed information regarding share repurchase and increased shareholding related to re-loaning this week (attached table); ② Zhejiang Huayou Cobalt has the highest amount of special loan funds, with a loan of 0.36 billion yuan.

First loss since going public, Cybrid Technologies Inc.: Actively expanding overseas Business with higher margins and innovative products | Interpretations

① According to the performance forecast, Cybrid Technologies Inc. may experience its first loss since going public in 2024, which company personnel attribute to competition within the photovoltaic Industry. ② According to the announcement, the sales prices of Cybrid Technologies Inc.'s two main products - photovoltaic encapsulants and photovoltaic backsheets - both saw a decline last year. ③ The personnel indicated that the company achieved growth in non-photovoltaic Sectors last year and is also expanding into higher-margin overseas Businesses and innovative products.

Significant fluctuations: LONGi Green Energy Technology expects a loss of over 8 billion yuan last year, and the company's BC production capacity will be ramped up this year | Interpretations

① Considering the company's net income attributable for the first three quarters of -6.505 billion yuan, the company's Q4 loss is estimated to be between 1.695 billion yuan and -2.295 billion yuan; ② LONGi Green Energy Technology is the only company in the top tier of photovoltaic modules that actively promotes BC technology, and the company expects to enter a phase of large-scale BC production capacity deployment by 2025.

[Data View] Institutions and speculative funds are selling off Leo Group Co., Ltd. with powerful positions exceeding 0.4 billion to seize Zhejiang XCC Group.

① Leo Group Co., Ltd. under the Douyin concept stocks was sold by Institutions for 0.319 billion, with two major speculative seats combined selling 0.265 billion. ② Zhejiang XCC Group under the Robot Concept stocks was purchased by GTJA's Shanghai Haiyang West Road branch for 0.421 billion, and was bought by Huaxin Securities' Shanghai Wanping South Road branch for 0.204 billion.

Comments

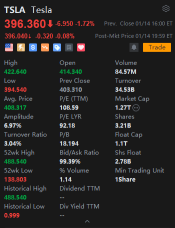

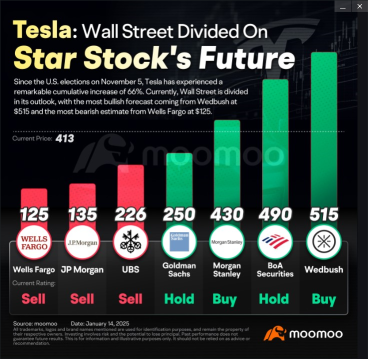

Recently, Tesla's stock price has been quite active. At the close of trading on January 14, 2025, Eastern Time in the United States, the stock price was $396.36. Compared with the previous day, it dropped by $6.95, with a decline of 1.72%. During that day, the stock price soared to a maximum of $422.64 and dropped to a minimum of $394.54. It fluctuated quite significantly.

Moreover, from the perspective of some technical in...

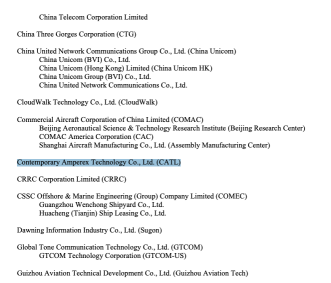

this morning $TENCENT (00700.HK)$ and $Contemporary Amperex Technology (300750.SZ)$ was hit, so tonight is the chance to take profit, it's natural .

plus $Bitcoin (BTC.CC)$ is down, so it's natural.

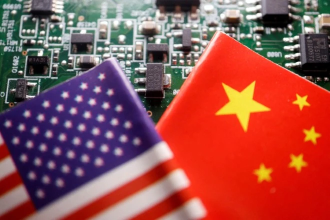

Tencent’s shares dropped over 7% in Hong Kong (and 8% in US trading), while CATL fell 5%. Not exactly minor hits for two global heavywei...

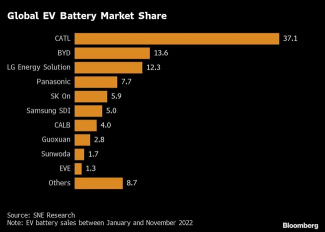

CATL going to build swap stations = Nio is dead, going to have more competition.

I just married and F my wife, tomorrow my son is graduating and going to have a good job, I am going to retire after tomorrow.

Nio dump so much money into R&D, waste of money and resources.

We should do away with National Service, waste of money, no economical output.

We don’t need defence, we just need to increase GDP.

Kuwait invaded by Iraq.

Xiaomi just produced cars a...

103998930 : Tesla seems too expensive, the rise is due to Trump buddy

Nonver 103998930 : but trump buddy drop. shd follow