Belt and Road

- 1074.728

- +13.679+1.29%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Mining equipment "going abroad" accelerates, Citic Heavy Industries' total overseas effective orders in 2024 hit a new high | Interpretations

① Citic Heavy Industries achieved a revenue of 8.034 billion yuan last year, a year-on-year decline of 15.93%. The net income after deduction for non-recurring gains and losses was 0.398 billion yuan, an increase of 34.41% year-on-year; ② The company's overseas revenue grew rapidly, with the company achieving over 80% year-on-year growth in overseas effective orders last year.

Are Steel stocks expected to stage a major reversal? Goldman Sachs: China State Construction Engineering Corporation's activity is showing preliminary signs of recovery, and steel demand is expected to rebound.

① Goldman Sachs stated that as the China State Construction Engineering Corporation activity shows preliminary signs of improvement, it could boost the prices of Steel and other CSI Commodity Equity Index. ② The Chinese government's work report emphasizes Real Estate efforts, proposing goals such as "stabilizing the Real Estate and stock markets" and "promoting the healthy development of the Real Estate and stock markets with greater efforts." ③ According to Goldman Sachs data, demand for CSI Commodity Equity Index related to infrastructure construction has slightly increased for the first time in three years, predicting that China may reduce Steel production by about 50 million tons to restore profitability.

New themes are gradually emerging as market styles shift between high and low, but the strength of the Technology mainline's recovery remains crucial.

Yesterday, the market continued to adjust, and all three major Indexes fell, returning to a consolidation structure in the short term.

Brokerage morning meeting highlights: It is recommended to pay attention to companies in the humanoid robot industry that have the capability for low stock price bulk supply of components.

In today's Brokerage morning meeting, China Securities Co.,Ltd. suggested focusing on companies in the humanoid robot Industry that have the capacity for low stock price mass supply of components; Tianfeng stated that the wind turbine Sector will undergo a value reassessment; Galaxy Securities believes that the peak season de-stocking turning point in the non-ferrous Industry is emerging, and the spring market is expected to unfold.

Shanghai Xuerong Bio-Technology changes ownership, new actual controller sets a "hundred billion Market Cap" flag | Quick read announcement.

① The control of Shanghai Xuerong Bio-Technology has changed, with chairman Yang Yongping relinquishing the position of the company's controlling Shareholder and actual controller. ② Jiang Zhi, an entrepreneur from the Online Games industry, will become the new actual controller. He stated that he hopes to build Shanghai Xuerong Bio-Technology into a publicly traded company with a revenue of 10 billion and a Market Cap of 100 billion in the next 3 to 5 years.

The "hot battle" of humanoid robots has begun: frequent release of new products. Is the year of mass production really here? | Industry observation

① Siasun Robot&Automation and Zhiyuan Robot both launched new humanoid robots, and related Concept stocks rose in response; ② mass production of humanoid robots still faces challenges, and domestic manufacturers aim to produce thousands of units this year; ③ there are also disputes within the Industry regarding the implementation scenarios.

Comments

$Nauticus Robotics (KITT.US)$ $BGI Genomics (300676.SZ)$ $Phio Pharmaceuticals (PHIO.US)$ Big mover tomorrow with $Allarity Therapeutics (ALLR.US)$ both at the same conference with news comin out be ready 1pm - 3pm s...

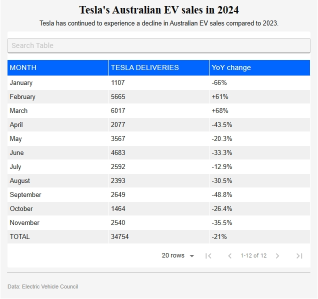

Tesla's Australian electric vehicle sales remain in free fall after Nov became the 8th-straight month of year-on-year sales decline for Elon Musk's autogiant amid a growing wave of competition from Chinese rivals.

Tesla sold 2540 vehicles in Australia in Nov, according to data released by the Electric Vehicle Council, resulting in a sales decline of 35.5% compared to the same time last year.

Tesla hasn't recorded year-on-...