SSE 50

- 1095.357

- -4.328-0.39%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Selling ATU's USA and United Kingdom Business, the strategy behind WUXI APPTEC.

There is gain in loss.

Breaking the "involutionary" competition! The two major photovoltaic leaders announce "production reduction and control of output."

Tongwei Co.,Ltd's subsidiary Yongxiang Co. and Daqo Energy have a total production capacity of over 1.2 million tons. Analysts expect that this production cut will reach at least 0.8 million tons, leading to a significant decline in silicon material output from December to January. Despite the production cut being initiated, the current Industry still faces considerable inventory pressure.

The sudden production cuts by leading silicon material manufacturers are expected to drive price and profitability recovery through industry self-discipline.

On the evening of December 24th, Tongwei Co., Ltd and Daqo Energy announced via their official accounts that to actively respond to the spirit of the Central Economic Work Conference and to eliminate "involution" vicious competition, the two silicon material companies will carry out orderly production cuts and production control. A research report from Huachuang Securities pointed out that if the subsequent industry self-discipline agreement progresses smoothly, the current supply and demand surplus is expected to be significantly alleviated, driving price and profit recovery.

WUXI APPTEC will transfer the WuXi ATU Business to a USA Fund. Is the "optimal solution" for the "gray rhino" of the Biological Safety Act?

① This evening, WUXI APPTEC announced that it will transfer its WuXi ATU Business in the USA and United Kingdom to the USA Private Equity Fund Altaris in exchange for Cash.; ② In the first three quarters, WuXi ATU achieved revenue of 0.853 billion, accounting for only about 3% of the total revenue for the first three quarters.; ③ After the transfer of this Business, the accusations and suspicions related to its gene business may be cleared under the Biosecurity Act.

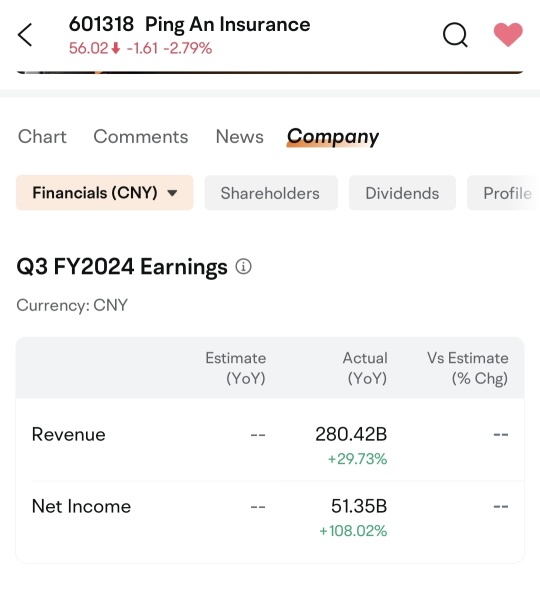

Four executives have new positions, and Ping An Insurance has made adjustments to some executive roles.

Fu Xin also serves as the Chief Financial Officer, Fang Fang concurrently acts as the Chief Risk Officer, and Zhang Zhichun takes on the role of General Assistant and is responsible for auditing.

2024 Year-End Review | Honda and Nissan Merger, Volkswagen "Internal Slimming" Global Car Market Faces Layoffs and Factory Closures Frenzy.

On December 23, Honda Motor and Nissan Motor jointly announced that they have signed a memorandum of understanding regarding a merger, which will officially initiate merger negotiations; Previously, Volkswagen issued a statement that it would reduce more than 0.035 million employees at its German factories by 2030; According to incomplete Statistics by reporters, in just a few months approaching the end of the year, nearly 10 companies in the Global automotive Industry are experiencing painful layoffs or have already made corresponding decisions.

Comments

$Bank Of China (601988.SH)$ $BANK OF CHINA (03988.HK)$ $iShares MSCI China ETF (MCHI.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $NASDAQ Golden Dragon China (.HXC.US)$

$BANK OF CHINA (03988.HK)$ $Bank Of China (601988.SH)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $XIAOMI-W (01810.HK)$ $JD-SW (09618.HK)$ $Hang Seng TECH Index (800700.HK)$ $KraneShares CSI China Internet ETF (KWEB.US)$

This stock has high dividends among others... Think is a good investment if you have RMB to park here. Local RMB fixed deposit rate keep coming down 🙏

Am looking at this stock 🙆

Correct me if I am wrong 😉💯

Chinese electric vehicles are proving popular outside the local market and are gaining ground not only in Europe but also in Australia. The MG4 became the country's best-selling EV in Oct. With nearly 1,500 units sold last month, the MG4 dethroned the Tesla Model Y, which managed just over 1,000 sales (down from nearly 1,500 a month before).

In third place came the Model 3 with 422 sales, followed by the BYD Atto3 with 330 sales a...

103352769ARI : how many Times need to get 1 years?

103352769ARI : remember stimulus you just from my wihtdrawall.

stimulus 2 USD500 BILLION.YOU JUST TAKE FROM ME WITHDRAWALL,

I SAY STOP,BUT JUST NEED STIMULUS 3 NOTE MORE THEN USD,

AND THEN NEED GET LOAN...

NO!!!

103352769ARI : China you must to 1 POEPLE there,

and talk about this your strategi

bisness...