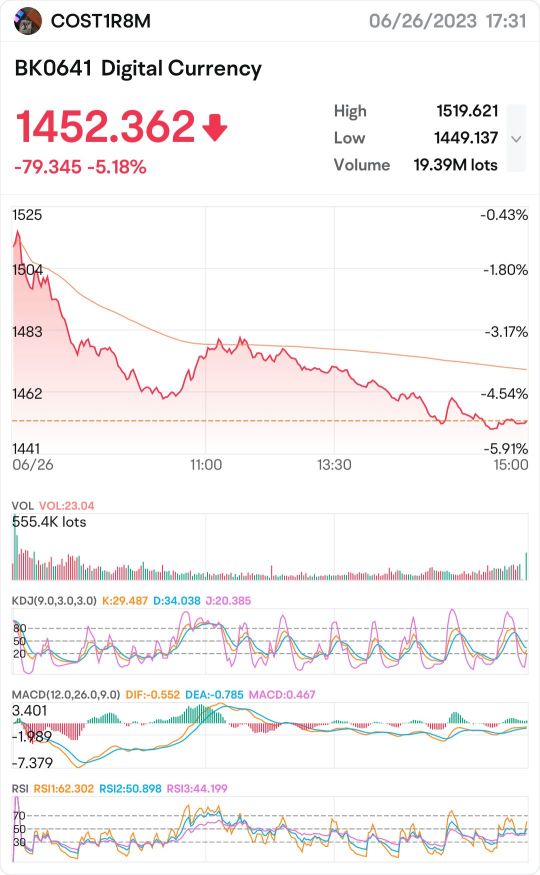

digital currency

- 1975.355

- +14.020+0.71%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The breeze of the short play blows towards the usa

kunlun tech enters the usa short drama market.

[Data Analysis] The trading volume of multiple gfnz100 ETFs has increased significantly. Well-known speculative funds have been aggressively investing in shenzhen ysstech info-tech for two consecutive days, exceeding hundreds of millions of yuan.

①The trading volume of multiple US stock-related stock index ETFs has increased significantly, with the trading volume of gfnz100 (513100) increasing by 273% month-on-month. ②Major financial stocks of shenzhen ysstech info-tech have been bought continuously for two days by the china merchants Fuzhou June 1 Middle Road branch, with purchase amounts exceeding one billion yuan each time.

The latest trends in retirement funds' holdings revealed: In the third quarter, 51 new stocks were added to the top ten list of shareholders by outstanding shares, with unigroup guoxin microelectronics holding the highest market value.

① A-shares third quarter report has been disclosed, and the latest shareholding trends of retirement funds have also emerged; ② The list of the top ten circulating shareholders of 51 new stocks; ③ Attached is the list of A-shares with retirement funds' third quarter additional shareholding market cap exceeding 0.1 billion yuan (see table).

verisilicon microelectronics (shanghai) co., ltd. narrowed its Q3 loss by nearly 30% to 0.111 billion, while gross profit continued to be under pressure.

verisilicon microelectronics (shanghai) co., ltd. stated that the decrease in production business revenue is mainly due to factors such as some downstream customers being affected by destocking cycle; In the first three quarters of 2024, the company achieved a gross profit of 0.702 billion yuan, a decrease of 8.43% year-on-year.

cnpc capital's long-term private equity investment reached 15.196 billion in the third quarter, with Kunlun Capital, a subsidiary, actively involved.

① Cnpc Capital achieved a revenue of 29.215 billion yuan in the first three quarters, a year-on-year increase of 3.55%; net income attributable to the parent company was 4.342 billion yuan, a year-on-year decrease of 17.55%. ② Kunlun Capital, a subsidiary of CNPC Capital, focuses on serving the strategic transformation of PetroChina Group, adopting a "fund + direct investment" model, and deploying strategic emerging industries such as new energy, new materials, energy-saving and environmentally friendly, intelligent manufacturing.

SOE is deploying quantum technology and other future industries in advance. The quantum industry is expected to embrace huge development opportunities.

1. The Party Building Research recently published an article signed by the Party Committee of the State-owned Assets Supervision and Administration Commission of the State Council, stating the need to accelerate the cultivation and growth of strategic emerging industries and future industries. The article proposes forward-looking layout, phased cultivation of quantum technology, nuclear fusion, biomanufacturing, 6G, and other future industries. 2. Guotou Securities' research report pointed out that quantum technology has made significant progress in multiple subdivisions, and quantum technology will become an important driving force for future technological revolution and industrial transformation.

Comments

$Shanghai Baosight Software (600845.SH)$

$Unisplendour Corporation (000938.SZ)$

$iSoftStone Information Technology (301236.SZ)$

$Jiangsu Hoperun Software (300339.SZ)$

$Thunder Software Technology (300496.SZ)$

���������...

Software Developers in China

$Beijing Kingsoft Office Software, Inc (688111.SH)$

$Hithink RoyalFlush Information Network (300033.SZ)$

$Iflytek Co.,ltd. (002230.SZ)$

���������...

Securities: $CITIC (600030.SH)$ $East Money Information (300059.SZ)$

Insurance: $China Life Insurance (601628.SH)$ $Ping An Insurance (601318.SH)$

Auto Parts: $Fuyao Glass Industry Group (600660.SH)$ $Weichai Power (000338.SZ)$ $Ningbo Tuopu Group (601689.SH)$

Cars: $BYD Company Limited (002594.SZ)$

Software: $Beijing Kingsoft Office Software, Inc (688111.SH)$ $Hithink RoyalFlush Information Network (300033.SZ)$ $Iflytek Co.,ltd. (002230.SZ)$

���������...

$JPY/EUR (JPYEUR.FX)$

$digital currency (LIST0641.SH)$

Link to Spotware cTrader:

http://ct.spotware.com?simpleShare=yes&brokername=Spotware

$Bitcoin (BTC.CC)$

$digital currency (LIST0641.SH)$

$Coinbase (COIN.US)$