WIFI6

- 1420.396

- -31.132-2.14%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Net profit increased by 149%! Espressif Systems saw significant growth in non-intelligent fields last year, and there are major developments in edge chips?

① Espressif Systems achieved revenue of 2.007 billion yuan in 2024, an increase of 40.04% year-on-year; net income attributable to the parent company reached 0.339 billion yuan, up 149.13% year-on-year; comprehensive gross margin rose to 43.91%; ② Espressif Systems stated that the growth is primarily due to the continuous improvement of digital and Asia Vets penetration rates across various industries, as well as the gradual expansion of new potential customers, while the company's product lines and R&D continue to expand.

After a continuous reduction in market trading volume, a short-term directional choice may be faced, waiting for new hotspots to break through.

Yesterday, the market continued a low-volume consolidation structure. From the Index perspective, although it is still in a relatively strong consolidation structure, the narrow fluctuations over the past three days may indicate that the market is facing a new round of directional choices. If it cannot attack with increased volume again, the probability of subsequent corrective consolidation may further increase.

Hand in hand with Dalian Haosen Equipment Manufacturing Co., Ltd. to layout embodied intelligence with a 20CM limit up. Chuangyao Technology issued an announcement about the irregular movement: there are still uncertainties in research and development, as

① Chuangyao Technology stated in the announcement that the current collaboration with Dalian Haosen Equipment Manufacturing Co., Ltd. has no impact on performance, and there are also significant uncertainties in future product R&D pace, sales scale, and other aspects; ② The news is true that the Chuangyao Technology SLE series-TR5310 Star Flash chip integrates a high-performance 32-bit Microprocessor based on RISC-V.

The market continues to shrink and fluctuate, and after the acceleration of themes rotation, funds are expected to flow back to the core main lines.

As the premium for new themes decreases, some funds still choose to flow back into the two major core directions of Siasun Robot&Automation and AI.

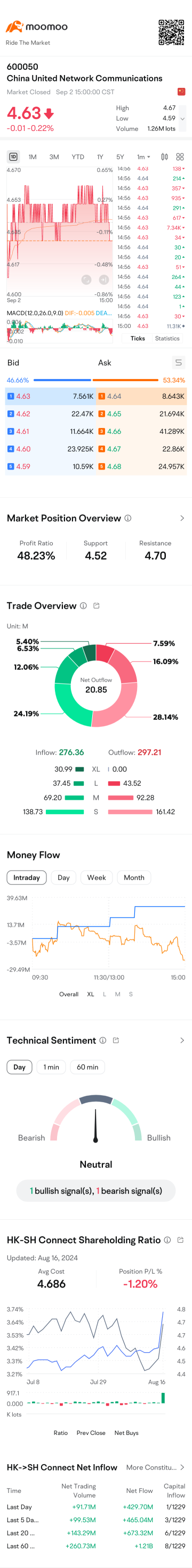

China United Network Communications: Last year's Q4 single-quarter net profit excluding non-recurring items showed a loss. It is expected that this year's investment in computing power will grow by nearly 30% year-on-year | Interpretations

① China United Network Communications released its 2024 annual report, showing that the year-on-year growth rates of revenue and net profit saw little change compared to the previous four years, although in Q4, there was a rare loss in non-deficient net profit for the single quarter. ② China United Network Communications expects its computing power investment to increase by nearly 30% year-on-year this year. ③ China United Network Communications will seize AI opportunities in five areas: AI Infra, datasets, large models, intelligent agents, and AI security, with a focus on building 10 national-level intelligent computing Datacenters.

The "hot battle" of humanoid robots has begun: frequent release of new products. Is the year of mass production really here? | Industry observation

① Siasun Robot&Automation and Zhiyuan Robot both launched new humanoid robots, and related Concept stocks rose in response; ② mass production of humanoid robots still faces challenges, and domestic manufacturers aim to produce thousands of units this year; ③ there are also disputes within the Industry regarding the implementation scenarios.

Comments

$Shanghai Baosight Software (600845.SH)$

$Unisplendour Corporation (000938.SZ)$

$iSoftStone Information Technology (301236.SZ)$

$Jiangsu Hoperun Software (300339.SZ)$

$Thunder Software Technology (300496.SZ)$

���������...

Securities: $CITIC (600030.SH)$ $East Money Information (300059.SZ)$

Insurance: $China Life Insurance (601628.SH)$ $Ping An Insurance (601318.SH)$

Auto Parts: $Fuyao Glass Industry Group (600660.SH)$ $Weichai Power (000338.SZ)$ $Ningbo Tuopu Group (601689.SH)$

Cars: $BYD Company Limited (002594.SZ)$

Software: $Beijing Kingsoft Office Software, Inc (688111.SH)$ $Hithink RoyalFlush Information Network (300033.SZ)$ $Iflytek Co.,ltd. (002230.SZ)$

���������...