Energy Storage Concept

- 2662.510

- +0.321+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Electrolyte is trapped in a low stock price competition dilemma, with Rui Tai New Materials expecting a decline in net profit for two consecutive years | Interpretations

① Rui Tai New Material's projected Net income for 2024 is expected to decrease by about 80%, and the company will experience a decline in Net income for two consecutive years; ② The continuous release of production capacity for Battery materials has led to intensified competition in the Industry, with a noticeable decrease in product prices last year; ③ Due to substantial losses from the affiliated listed company Tonze New Energy Technology, the company expects to recognize investment losses of 0.075 billion yuan to -0.09 billion yuan.

Peking University has made breakthroughs in Solid State Battery materials technology, which is expected to bring new development opportunities to the Industry.

According to reports, journalists learned from Peking University that the team led by Pang Quanquan at the School of Materials Science and Engineering has developed a new type of Glass phase sulfide solid electrolyte material, and used this material to create an all-solid-state lithium-sulfur battery with excellent fast-charging performance and ultra-long cycling life.

ICL Expands Joint Venture With Shenzhen Dynanonic With Additional Investment €285 Million For European LFP Cathode Material Production

BYD's overseas strategy: Brazil is a top priority, ASEAN is the present, Europe is the future.

Morgan Stanley stated that exports remain a key pillar for BYD to achieve sales growth in 2025, until its overseas production bases are fully operational. Amid escalating geopolitical tensions in other regions, ASEAN and the Americas will become major sales markets for BYD.

Cailian Press Autos Morning Report [January 16]

① The Ministry of Commerce: This week, detailed implementation rules for new purchase subsidies for mobile phones and other digital products will be issued successively; ② Guangdong: The production of New energy Fund vehicles will grow by 43% in 2024, accounting for a quarter of the national total; ③ Chongqing Changan Automobile: It will enter the Europe market in 2025;

Premium rate of 200%, valuation increased fivefold. Eve Energy Co., Ltd. intends to acquire employee-held subsidiary equity for 0.579 billion yuan | Quick announcement read.

① Eve Energy Co.,Ltd. (300014.SZ) plans to acquire part of the equity of its subsidiaries held by the employee stock ownership platform for 0.579 billion yuan; ② A report by Caixin found that the employees spent 0.193 billion yuan to acquire this part of the equity that year, with a premium rate of 200%, but the valuation of the equity subsidiaries has increased fivefold compared to that year.

Comments

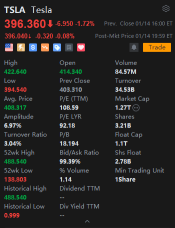

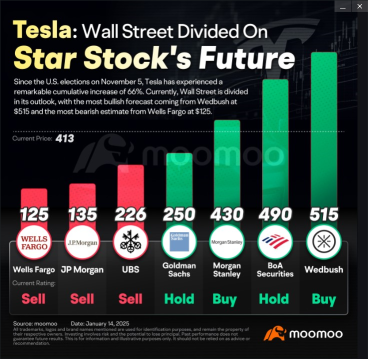

Recently, Tesla's stock price has been quite active. At the close of trading on January 14, 2025, Eastern Time in the United States, the stock price was $396.36. Compared with the previous day, it dropped by $6.95, with a decline of 1.72%. During that day, the stock price soared to a maximum of $422.64 and dropped to a minimum of $394.54. It fluctuated quite significantly.

Moreover, from the perspective of some technical in...

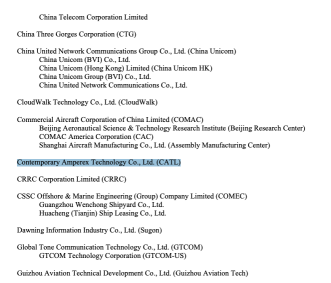

this morning $TENCENT (00700.HK)$ and $Contemporary Amperex Technology (300750.SZ)$ was hit, so tonight is the chance to take profit, it's natural .

plus $Bitcoin (BTC.CC)$ is down, so it's natural.

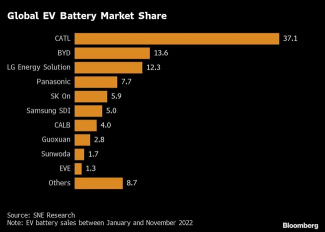

Tencent’s shares dropped over 7% in Hong Kong (and 8% in US trading), while CATL fell 5%. Not exactly minor hits for two global heavywei...

CATL going to build swap stations = Nio is dead, going to have more competition.

I just married and F my wife, tomorrow my son is graduating and going to have a good job, I am going to retire after tomorrow.

Nio dump so much money into R&D, waste of money and resources.

We should do away with National Service, waste of money, no economical output.

We don’t need defence, we just need to increase GDP.

Kuwait invaded by Iraq.

Xiaomi just produced cars a...

103998930 : Tesla seems too expensive, the rise is due to Trump buddy

Nonver 103998930 : but trump buddy drop. shd follow