Steel

- 666.337

- +21.205+3.29%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

In December, China's import volume of CSI Commodity Equity Index showed a mixed trend, with iron ore remaining at a high level, while the import volume of Coal and Soybean reached a record high for the year.

In December, the year-on-year increase in unrefined Copper and copper materials, integrated circuits, iron ore and its concentrates ranked first, while the decline in finished oil was the largest. The import volume of iron ore has remained above 0.1 billion tons for six consecutive months, and the import volume of Coal has remained above 45 million tons for the sixth consecutive month.

The trend of steel companies becoming more "outward" is significant, with steel exports exceeding 100 million tons, setting an eight-year record high.

① Due to the continuous decline in domestic Steel consumption, companies in the Steel Industry Chain are focusing on overseas markets as a key area for development. This year, steel exports exceeded 100 million tons, reaching a new high in eight years. ② Under policy guidance, the proportion of exports of medium to high value-added products has increased, showing a trend of change in the overall structure of domestic Steel exports from long products to flat products.

The steel industry has faced downward pressure for three years; under the new cycle, calls for "production cuts" are increasing, and there is a need for "synchronous resonance" to respond to challenges and opportunities.

① The steel industry has been declining for three consecutive years, with the market experiencing a negative feedback cycle. It is expected that the apparent consumption of crude steel will be about 0.9 billion tons in 2024, and demand may continue to decline in 2025. The industry is facing various challenges and continues to move forward under pressure while actively seeking new development opportunities; ② "My Steel" predicts a 3% increase in steel for machinery in 2025, a 1.5% increase for autos, a 6.4% increase for shipbuilding, a 2.8% increase for home appliances, and a 5.5% increase for energy.

Brokerage Morning Meeting Highlights: The historical bottom of real estate stock valuation may have been established.

At today's brokerage morning meeting, China Securities Co.,Ltd. proposed supply-side optimization, suggesting to focus on industries such as steel, photovoltaic, cement, coal, and rare earths; htsc stated that domestic sales of household appliances are improving with stable exports, focusing on two major themes for the year 2025; China International Capital Corporation believes that the historical bottom of real estate stock valuation may have been established.

In the third quarter, the loss amount is close to the annual level of last year. How to solve the "dilemma" of the steel industry? Suggestions from the industry recommend actively reducing production.

①In the third quarter, the losses in the steel industry worsened, with 21 out of 27 listed steel smelting companies experiencing losses, totaling over 14.5 billion yuan, with the total quarterly loss amount almost approaching that of the entire previous year. ②Industry experts believe that the main reason for the losses is the overcapacity in the steel industry itself, poor industry self-discipline, failure to actively limit production, oversupply of products, continuous decline in steel prices, slow decrease in raw material prices, and severe industry profit compression.

Who is the main player in the csi commodity equity index in the fourth quarter? Wait patiently for the "landing" of the Fed rate cut.

Can gold continue to lead the way? Will crude oil, iron ore, and other big losers be able to turn the tide?

Comments

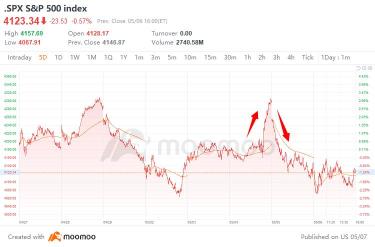

On Wednesday, May 4, the US stock market surged as investors looked at the expected and more pronounced interest rate policy, and those gains were erased by hawkish voices from some Fed officials late Thursday, May 5.

Some investors got caught up in dumping all their holdings, while others stuck to their dip-buying strategy. Being a risk-taker or risk-ave...

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

The steel sector in Hong Kong stockmarkerts plummets over 9%, dragged by the Angang Steel, Maanshan Iron.

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

Iron ore spot and swaps surge over the weekend, soar over 10%.

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

SpyderCall : Good article. Main point to take from this article is that some of the best buying opportunities in stock market history are immediately after a stock market crash.