Steel

- 692.412

- +12.299+1.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

In the third quarter, the loss amount is close to the annual level of last year. How to solve the "dilemma" of the steel industry? Suggestions from the industry recommend actively reducing production.

①In the third quarter, the losses in the steel industry worsened, with 21 out of 27 listed steel smelting companies experiencing losses, totaling over 14.5 billion yuan, with the total quarterly loss amount almost approaching that of the entire previous year. ②Industry experts believe that the main reason for the losses is the overcapacity in the steel industry itself, poor industry self-discipline, failure to actively limit production, oversupply of products, continuous decline in steel prices, slow decrease in raw material prices, and severe industry profit compression.

Who is the main player in the csi commodity equity index in the fourth quarter? Wait patiently for the "landing" of the Fed rate cut.

Can gold continue to lead the way? Will crude oil, iron ore, and other big losers be able to turn the tide?

Steel companies are issuing warnings about a "severe winter"! The market cap of the world's four largest iron ore miners has evaporated by over 100 billion US dollars.

Many steel companies' predictions about the severe industry outlook have made several major international iron ore suppliers, who are upstream industries, begin to have a difficult time in recent days. Since the beginning of this year, the price of this key steelmaking raw material has fallen by more than one-third. The market capitalization of the "four major" global iron ore miners has evaporated by about 100 billion US dollars in total.

China Oriental Group Company Limited Goes Ex Dividend Tomorrow

Sustainability Column: How is the Chinese market for geothermal power generation, which Buffett is interested in?

The electric energy hidden underground is becoming a clean resource mine in the eyes of technology giants and conglomerates.

HK SH ALLIANCE: INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED 30TH SEPTEMBER 2023

Comments

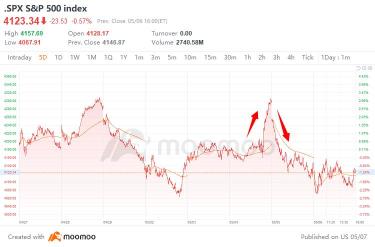

On Wednesday, May 4, the US stock market surged as investors looked at the expected and more pronounced interest rate policy, and those gains were erased by hawkish voices from some Fed officials late Thursday, May 5.

Some investors got caught up in dumping all their holdings, while others stuck to their dip-buying strategy. Being a risk-taker or risk-ave...

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

The steel sector in Hong Kong stockmarkerts plummets over 9%, dragged by the Angang Steel, Maanshan Iron.

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

Iron ore spot and swaps surge over the weekend, soar over 10%.

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

SpyderCall : Good article. Main point to take from this article is that some of the best buying opportunities in stock market history are immediately after a stock market crash.