Online Education

- 1066.079

- -11.796-1.09%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Brokerage morning meeting highlights: The effect of the real estate market stabilizing after the decline may gradually become apparent, and the Industry valuation may rise.

At today's Brokerage morning meeting, HTSC proposed that the enhancement of Technology attributes may elevate the valuation levels of symbols related to the gaming Industry; Soochow believes that the short-term adjustment in the Construction Machinery Sector does not change the positive trend for the entire year; Galaxy Securities stated that the effects of the real estate market stabilizing may gradually become apparent, and the Industry valuation may rise.

Brokerage morning meeting highlights: remain bullish on Publishing and AI+Education investment opportunities.

In today's Brokerage morning meeting, Zhongtai stated that it remains Bullish on Publishing and AI+Education investment opportunities; CITIC SEC pointed out that it is important to focus on the valuation increase of the Education Sector; China Securities Co.,Ltd. noted that the price increase of Cement and fiberglass continues, and the timing for allocating cyclical sectors has arrived.

Driven by technology and policy, the Education Industry pattern and valuation are expected to be restructured.

At the economic themed press conference on March 5, Zheng Zhanjie, the director of the National Development and Reform Commission, introduced plans to expand the supply of high-quality Education resources, continue to promote the quality upgrade of higher education, and further increase the scale of undergraduate enrollment in 'Double First Class' Universities.

The game licenses were issued in February! 110 domestic games and 3 imported games were approved.

① This evening, the February game license approvals were released, with 113 new games approved. New products from listed companies like NetEase, G-bits Network Technology, and Kingnet Network are included; ② A total of 249 new games have received licenses this year. Including this month, licenses for domestic and imported games have been issued simultaneously for five consecutive months.

Affected by the spin-off and the impact of joining hands with Hui! EAST BUY disclosed losses, while self-operated and e-commerce Business grew steadily.

①The latest Earnings Reports show that EAST BUY achieved revenue of 2.187 billion yuan, a year-on-year decline of 21.75%; the Net income attributable to the company's owners reported a loss of 96.799 million yuan. However, after excluding the expenses related to the separation of 'Travel with Glory', its e-commerce and self-operated Business remained profitable. ②After Dong Yuhui's departure, EAST BUY has achieved a steady transition, but it is still difficult to find new breakthroughs in the self-operated and live broadcast Operation model.

The three major A-share indexes showed mixed results, with the micro-index leading the decline, Hong Kong stocks fell, and the Hang Seng Tech Index dropped by more than 2%.

Hong Kong stocks fell, with the Hang Seng Index down 1.93% and the Hang Seng TECH Index down 2.04%. EAST BUY fell nearly 5%, and BYD Electronics dropped over 4%. Oil & Gas stocks opened with a significant rise, with Xinjiang Zhundong Petroleum Technology hitting the limit up, while Sino Geophysical, Tong Petrotech Corp., XinJiang Beiken Energy Engineering, and Zhongman Petroleum And Natural Gas Group Corp.,Ltd. all opened high.

Comments

Securities & Brokerage: $HTSC (06886.HK)$ $CMSC (06099.HK)$

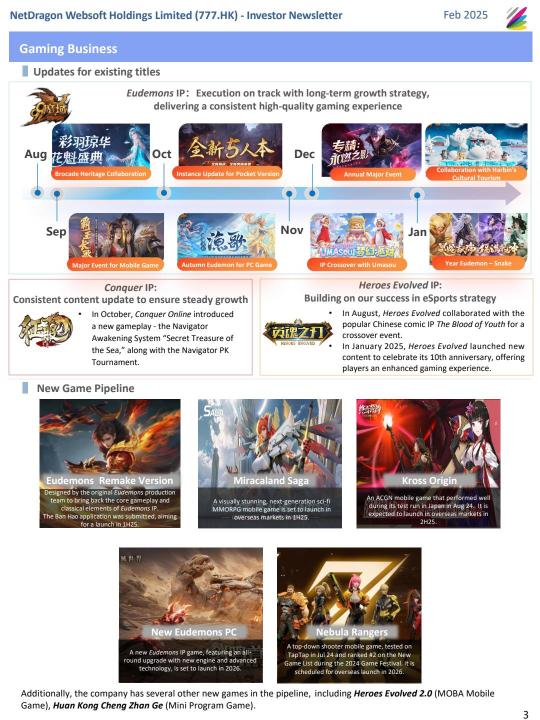

Gaming Software: $NTES-S (09999.HK)$ $XD INC (02400.HK)$ $NETDRAGON (00777.HK)$

Digital Solutions: $TENCENT (00700.HK)$ $TRAVELSKY TECH (00696.HK)$ $CHINASOFT INT'L (00354.HK)$

Online Retailer: $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$

Insurer: $PING AN (02318.HK)$ $AIA (01299.HK)$ $CHINA LIFE (02628.HK)$

Telecommunication: $CHINA MOBILE (00941.HK)$ $CHINA TELECOM (00728.HK)$

���������...

$New Oriental (EDU.US)$ $EAST BUY (01797.HK)$ $NEW ORIENTAL-S (09901.HK)$ $TAL Education (TAL.US)$ $Gaotu Techedu (GOTU.US)$

Paul bin Anthony