Ports & Shipping

- 1328.079

- +0.441+0.03%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

"The offshore money printer" reappears! COSCO Shipping Holdings expects its annual net profit attributable to the parent to double year-on-year | Quick read announcement.

① COSCO Shipping Holdings' container shipping business achieved growth in both volume and price compared to the previous year, with a year-on-year increase of 105.71% in Net income for 2024; ② One of the uncertainties in the shipping market for 2025, the strike at the East Coast ports of the United States, has been avoided, and freight rates on the US routes have already decreased.

Volume increases and prices remain low as the express delivery industry competes to reduce costs. The application of autonomous vehicles and Drones is expected to accelerate next year | Year-end review.

① Since the beginning of the year, the growth rate of express delivery volume has exceeded 20%; the operating situation of "the two logistics giants and one delivery company" in the first 11 months shows volume increase and low prices, with ZTO achieving year-on-year revenue growth per package in Q3. ② Industry insiders say that the growth rate of express delivery volume will still be double-digit in the next 1-2 years. It is expected that next year, Drones and unmanned vehicles will accelerate their application in various express delivery scenarios, further reducing social Logistics costs.

Cosco Ship Engy welcomes Taibao's shareholding, frequent institutions' shareholding within the year.

Cosco Ship Engy (1138.HK) received further shareholding. On December 5th, China Pacific Insurance (601601.SH) disclosed that as of November 29th...

China Pacific Insurance announced a stake in cosco ship engy listed in hong kong. Since November, there have been 7 instances of insurance capital acquiring stakes, possibly preparing for asset allocation next year.

① china pacific insurance announced that it has acquired shares in cosco ship engy listed in hong kong, with the company and its associates and concerted parties collectively holding 5.04%; ② china pacific insurance indicated that it does not rule out the possibility of further investment in the future; ③ insurance capital's enthusiasm for acquiring shares has increased towards the end of the year, with a total of 7 acquisitions since November, and industry insiders believe that insurance companies are beginning to prepare for asset allocation for next year.

Share buyback shareholding loans quickly landed! ICBC, BOC, ABC, CMB, CITIC and other first batch of multiple banks announced progress. Some banks have already shown cooperation intentions with nearly a hundred listed companies.

1. As of now, Bank of China has reached cooperation intentions with nearly a hundred listed companies, with 32 listed companies explicitly promised loans, covering multiple industries such as integrated circuits, transportation, high-end manufacturing, and business services; 2. The banks stated that they will strictly adhere to the risk compliance bottom line, rigorously prevent crediting funds that do not meet the conditions of stock increase stake & buyback and refinancing policies from illegally flowing into the stock market.

China Merchants Port: The fundamental problem of port supply chain disruption has not been solved. The budget for Phase II of Dachan Bay is approximately 6 billion yuan | Directly covering the earnings conference.

①The situation in the Red Sea has led to disruptions in port supply chains, driving an increase in container volume at the company's CICT terminal. The throughput of this terminal in the first 7 months of this year has reached 2 million TEU (annual target of 3 million TEU); ②Disruption in ship schedules and the phenomenon of ships being stuck at port have not been fundamentally changed; ③ The budget for the company's Da Chan Bay Phase II project is approximately 6 billion yuan.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We stay neutral with a slight bearish bias as price is currently hovering between 6000 resistance and 5870 support level. A 4 hour candlestick closing below 5870 support level would open drop towards 5820 support level. Technical indicators advocate for a bearish scenario as well.

Alternatively: A 4 hour candlestick closing above 6000 resist...

Deckers Outdoor Corporation (DECK US) $Deckers Outdoor (DECK.US)$

Daily Chart -[BULLISH ↗ **]DECK US is currently moving towards an uptrend. We maintain a bullish directional bias as long as price holds above 199.15 support level. We expect price to push towards 217.13 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 199.15 support level would open drop ...

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

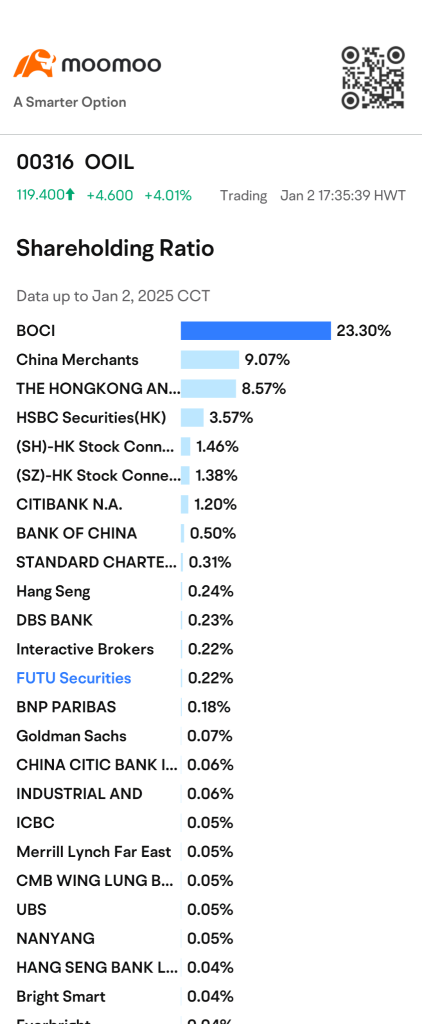

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

Securities & Brokerage: $HTSC (06886.HK)$ $CMSC (06099.HK)$

Gaming Software: $NTES-S (09999.HK)$ $XD INC (02400.HK)$ $NETDRAGON (00777.HK)$

Digital Solutions: $TENCENT (00700.HK)$ $TRAVELSKY TECH (00696.HK)$ $CHINASOFT INT'L (00354.HK)$

Online Retailer: $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$ $JD-SW (09618.HK)$

Insurer: $PING AN (02318.HK)$ $AIA (01299.HK)$ $CHINA LIFE (02628.HK)$

Telecommunication: $CHINA MOBILE (00941.HK)$ $CHINA TELECOM (00728.HK)$

���������...