Core Stock Connect Assets

- 1856.199

- +21.534+1.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

IEA Monthly Report: Even if OPEC+ delays production increases, there will still be an oversupply of oil next year!

The IEA stated that if OPEC+ implements the production recovery plan starting in April, the Global market will face a surplus of 1.4 million barrels per day. The IEA has raised the forecast for global oil demand growth in 2025 by 90,000 barrels to 1.1 million barrels, mainly due to the economic stimulus measures recently announced by China.

ING: Next year, the CSI Commodity Equity Index will experience a "Put year," while Gold will still shine!

① ING expects that the Global situation will put pressure on the Energy and CSI Commodity Equity Index markets, but the outlook for Gold remains bright. ② The report points out that Trump's tariff plans may disrupt the oil, Metal, and Agriculture markets; ③ However, ING predicts that the average Gold price will rise to $2,760 per ounce by 2025, primarily influenced by central bank purchases of Gold and the appeal of Gold as a safe-haven asset.

Who might be the supplier for the Xiaomi YU7?

Xiaomi Autos is once again making waves in the automotive circle! The first SUV model, YU7, has been officially announced, and is expected to be launched in mid-2025. Xiaomi is ambitious and has raised its annual sales target to 120,000 units after completing a delivery volume of 100,000 units ahead of schedule. In a Research Report released on the 12th, UBS Group predicts that with the addition of the new model YU7 and the enhancement of production capacity, total sales of Xiaomi Autos in 2025 are expected to double to 260,000 units. The supply chain for the YU7 is gradually coming to light. UBS Group believes that companies such as Topband, FUYAO GLASS, Minth, Huayang, NEXTEER, and Keboda Technology are likely to become partners of Xiaomi, providing components for the YU7.

Will gold continue to shine next year? Goldman Sachs is listed as one of the “three major catalysts”: see you at $3,000!

① Goldman Sachs expects the price of gold to rise 11% to $3,000 per ounce by the end of 2025; ② Goldman Sachs believes that interest rate cuts by the Federal Reserve, increased gold purchases by central banks, and rising geopolitical uncertainty are the three major factors driving the price of gold higher.

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

Honeywell Upgraded at HSBC on Possibility of Breakup

Comments

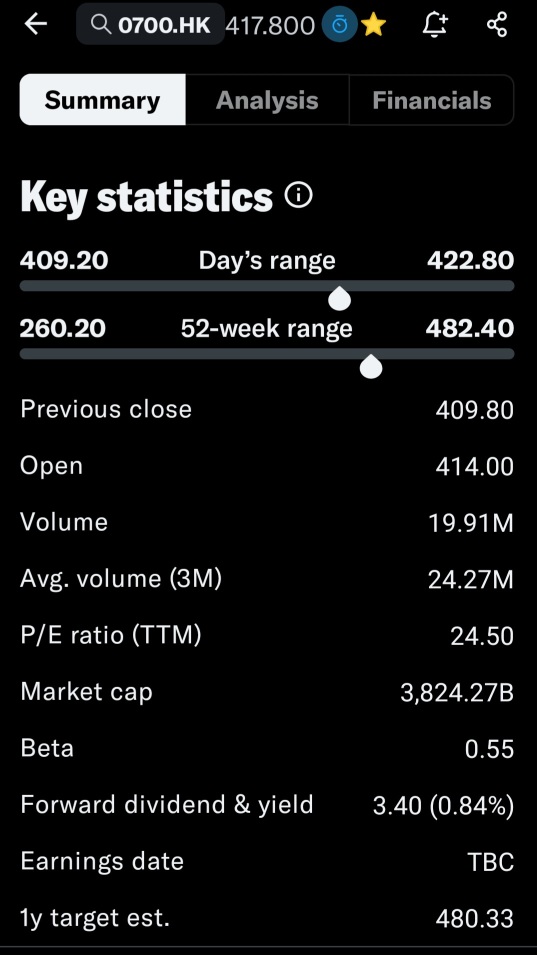

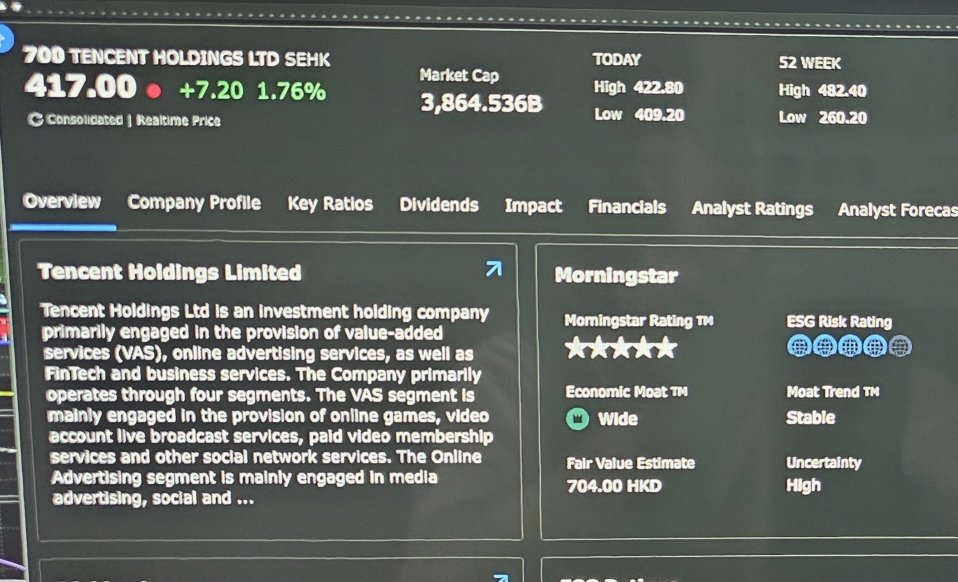

$BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $XIAOMI-W (01810.HK)$ $MEITUAN-W (03690.HK)$ $BILIBILI-W (09626.HK)$ $NTES-S (09999.HK)$

$HKD-RMB DUAL COUNTER MODEL (LIST1352.HK)$ $CNH/CNY (CNHCNY.FX)$ $BANK OF CHINA (03988.HK)$ $Global X MSCI China Consumer Discretionary ETF (CHIQ.US)$ $Hang Seng Index (800000.HK)$ $Hang Seng H-Share Index ETF (02828.HK)$

Xiaomi officials answered why the YU7 electric crossover will start sales in China in Jun or Jul 2025. The company's representatives said they applied for the sales license early to test the car without heavy camouflage. Despite the car being legally ready for market entry, it needs at least six more months to start sales.

The Xiaomi YU7 (codenamed Xiaomi MX11) appeared in the Chinese Ministry of Industry and...