Core Stock Connect Assets

- 1866.445

- +20.875+1.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

As soon as the news of Japan easing tourist visas for people from China was released, local retail travel stocks surged immediately.

① The Japanese Foreign Minister, Toshimitsu Motegi, announced the relaxation of visa requirements for Chinese tourists to Japan, expected to be implemented in spring 2025. ② After the announcement, retail and tourism-related stocks in Japan rose, with J. Front Retailing Co. soaring by 8.38%, while Isetan Mitsukoshi Holdings and Takashimaya increased by 6.98% and 3.69%, respectively.

After building cars, will we create 'humans'? Over ten car companies are laying out plans, has it become a necessary option in the AI era?

① The Chairman of Ideal Automobile, Li Xiang, responded to whether there will be humanoid robots, stating that the probability is definitely 100%, but the timing is not now; ② Apart from Tesla, Chinese brands including BYD, Guangzhou Automobile Group, Chery Automobile, Xiaomi, Chongqing Sokon Industry Group Stock, Xpeng Motors, SAIC Motor, Chongqing Changan Automobile, and Dongfeng Automobile are all involved in the field of humanoid robots.

Li Xiang discusses the latest Global Strategy of "Ideal" - transforming into an AI company, aiming for the top three domestic large models, and in the future, building a unified VLA model to become your silicon-based family.

Recently, Li Xiang announced that Li Auto is no longer just an automobile manufacturer but an AI company. "ChatGPT has ushered in a new AI era, which has strengthened our belief - Smart Automobile must focus on AI as its core, not just the intelligence of Hardware."

Research and development investments are close to the combined sum of BAT! Does ByteDance want to become China's OpenAI?

Zheshang stated that ByteDance has made huge investments in AI, with capital expenditures reaching 80 billion yuan in 2024, approaching the total of Baidu, Alibaba, and Tencent (about 100 billion yuan). Research and development investments significantly lead their peers; analogously, just as Microsoft is strongly investing in OpenAI, ByteDance in China may be comparable to OpenAI in the USA.

Zhiji and Avita have recently attracted significant investment, with 'state-owned investors' fully backing New energy Fund automobiles.

① The 9.4 billion yuan financing for Zhiji Autos has continued support from both state-owned investment Institutions and market-oriented investment Institutions. ② From Zhiji Autos in Shanghai to Avita in Chongqing, then to GAC Aion, NIO in Hefei, and Li Auto in Changzhou, the involvement of local state-owned assets reflects the demand for industry drive and regional development. ③ After the conclusion of the Central Economic Work Conference, local governments are actively promoting industrial upgrades, demonstrating their main roles and responsibilities in the transition between new and old drivers of growth.

Caixin Auto Morning News [December 26th]

① Passenger Vehicle market retail from December 1-22 was 1.692 million vehicles; ② Chongqing Changan Automobile's Zhu Huarong: Huawei has reserved a 20% equity stake for Changan, and appropriate arrangements will be made in the future; ③ Zhi Mi Automobile completed a 9.4 billion yuan Series B financing;

Comments

1) Visual Capitalist:

• This graphic illustrates the projected growth of per-capita GDP for selected Asian nations between 2023 and 2026, based on data compiled by HSBC as of November 2024.

• China is forecasted to experience an average per-capita GDP growth of just 3.9%. China’s economy is facing a series of significant challenges, including a property crisis and high yo...

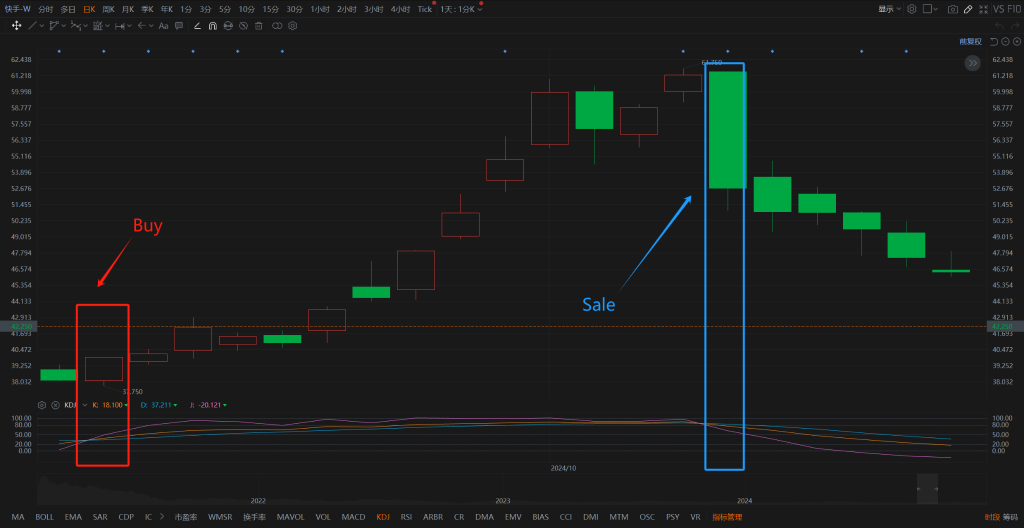

First, we need to understand the components of the KDJ indicator:

K Line: The fast line, which reflects short-term market price changes. It is typically calculated using the Stochastic Oscillator. The K line is derived from a series of price ranges, showing the current price relative to the highest and lowest prices in the recent period.

D Line: The slow line, which is a smoothed version of the K line and reflects the market's medium-t...

bullbearnme : I dont believe in this estimate projection

DoRaeMi : Bro, their growth is indeed 3.9%, but the method of how they calculate is different from the rest of the world? Don't tell me u never noticed that?

China growth is based on the amount of "goods produce", but in actual fact not sold or exported. Thus, they are known for "over-producing" just like their EV

The world GDP Calculation is based on sold product or goods exported. That's why u can see US GDP is decreasing while China GDP is increasing even during COVID-19 period, which made no absolute sense

ZnWC OP bullbearnme : Someone may say the projected GDP is biased as it is different from China official forecast. Gao (economist at SDIC security and based in China) also projected a similar GDP figure based on his analysis data.

Due to strict censorship in China, it is difficult to find other opposing voices. I have provided a YouTube video link which explained in clarity on how Gao used analysis data to point out the official GDP is not accurate.

- YouTube

Lewis TEG : report show purchasing power parties drop to the lowest in 12 years. This matches the forecast of GDP. Well, it looks like consumer goods are going to get a hit.