Nonferrous Metals

- 6631.297

- -80.321-1.20%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

In November, China's industrial added value above the designated size increased by 5.4% year-on-year, with New energy Fund, Siasun Robot&Automation, and integrated circuits leading the growth.

From January to November, the added value of large-scale industries grew by 5.8% year-on-year. Among them, the production of New energy Fund vehicles, Siasun Robot&Automation, and integrated circuit products increased by 51.1%, 29.3%, and 8.7% respectively.

ING: Next year, the CSI Commodity Equity Index will experience a "Put year," while Gold will still shine!

① ING expects that the Global situation will put pressure on the Energy and CSI Commodity Equity Index markets, but the outlook for Gold remains bright. ② The report points out that Trump's tariff plans may disrupt the oil, Metal, and Agriculture markets; ③ However, ING predicts that the average Gold price will rise to $2,760 per ounce by 2025, primarily influenced by central bank purchases of Gold and the appeal of Gold as a safe-haven asset.

Will gold continue to shine next year? Goldman Sachs is listed as one of the “three major catalysts”: see you at $3,000!

① Goldman Sachs expects the price of gold to rise 11% to $3,000 per ounce by the end of 2025; ② Goldman Sachs believes that interest rate cuts by the Federal Reserve, increased gold purchases by central banks, and rising geopolitical uncertainty are the three major factors driving the price of gold higher.

After the peak of the Robot Concept stocks, be wary of short-term divergences. AI and CSI Consumer 360 index may still have rotational opportunities.

Track the entire lifecycle of the main Sector.

A significant bullish announcement is coming! Which directions might be the core of capital's attention?

Track the entire lifecycle of the main sector.

The robot concept is experiencing increased short-term volatility; can AI application directions take the lead in growth?

Track the entire lifecycle of the main sector.

Comments

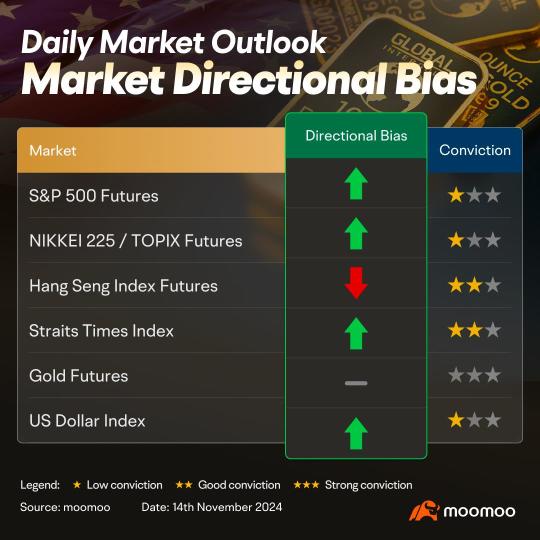

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We maintain neutral with a slight bullish bias as price is currently hovering around 5955 resistance level. A 4 hour candlestick closing above 5955 resistance level would open push towards 6035 resistance level. Technical indicators are mixed for now, with price holding above 21-EMA.

Alternatively: A 4 hour candlestick closing below 5880 support level...

Coterra Energy Inc (CTRA US) $Coterra Energy (CTRA.US)$

Daily Chart -[BULLISH ↗ **]CTRA US pushed higher after shaping a bullish breakout. As long as price is holding above 25.20 support, a further push higher towards 26.95 resistance is expected. Technical indicators are advocating for a bullish scenario as well with bullish momentum building and MA golden cross is seen.

Alternatively: A daily candlestick closing below 25.20...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We continue to stay bullish as price is holding above 6000 support level. We expect the price to push towards 6050 resistance level. Technical indicators are leaning towards a bullish scenario.

Alternatively: A 4 hour candlestick closing below 6000 support level would open next drop towards 5940 support level.

$USD (USDindex.FX)$(4 Hour Ch...

Policymakers plan to increase gold inventory facilities and accelerate the development of related businesses, such as trading, insurance and logistics, according to Chan. The city’s government will also expand gold-related derivatives trading to satisfy mortgage and hedging needs.

$CHOW TAI FOOK JEWE (CJEWY.US)$ $CHOW TAI FOOK (01929.HK)$ $CHOW SANG SANG (00116.HK)$ $ZIJIN MINING (02899.HK)$ $MMG (01208.HK)$ $CHINAHONGQIAO (01378.HK)$ $CHINA TOWER (00788.HK)$ $Golden Minerals (AUMN.US)$ $DB GOLD DOUBLE LONG EXCH TRADED NOTES (DGP.US)$

103677010 : notes