Carbon Neutral

- 2008.243

- -56.987-2.76%

Market Closed Dec 13 16:00 CST

2047.320High2003.105Low

2047.320Open2065.231Pre Close929.61MVolume4Rise12.00P/E (Static)6.28BTurnover6Flatline0.50%Turnover Ratio3.36TMarket Cap38Fall1.19TFloat Cap

$Tesla (TSLA.US)$ $Toyota Motor (TM.US)$

Tesla is running the richest ever set of incentives and discounts for its bestselling Model Y and Model 3 vehicles globally, aiming to finish the last quarter of the year with a bang and a record number of shipments.

All the 0% APR financing and free Supercharging offers may not be enough for the Model Y to regain its spot as the world's most popul...

Tesla is running the richest ever set of incentives and discounts for its bestselling Model Y and Model 3 vehicles globally, aiming to finish the last quarter of the year with a bang and a record number of shipments.

All the 0% APR financing and free Supercharging offers may not be enough for the Model Y to regain its spot as the world's most popul...

1

1

1

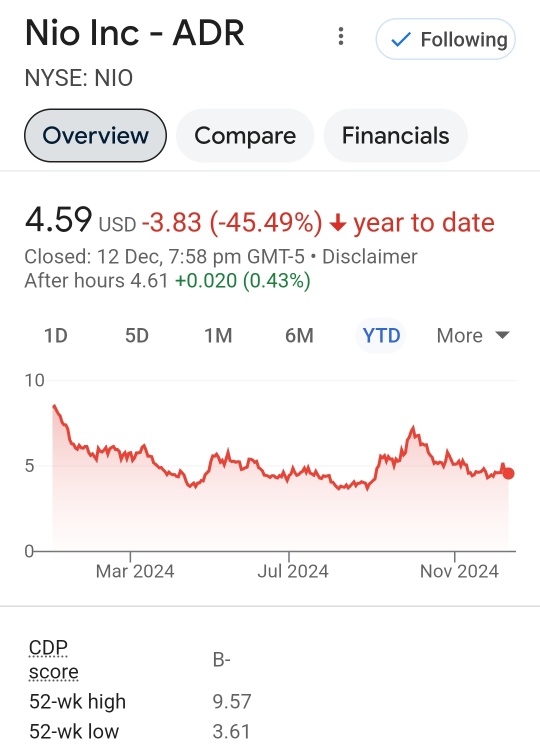

$NIO Inc (NIO.US)$ $Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $XPeng (XPEV.US)$

The article highlighted 4 reasons why you should avoid Nio stock:

1) Outperformance Fizzled Out

NIO's outperformance has fizzled out as the market sent its investors back to reality on its unprofitable business.

However, the company's optimism about its updated product cycle and lower-priced segments has failed to follow through. Accordingly, NIO's revised guidance for Q4 revenue i...

The article highlighted 4 reasons why you should avoid Nio stock:

1) Outperformance Fizzled Out

NIO's outperformance has fizzled out as the market sent its investors back to reality on its unprofitable business.

However, the company's optimism about its updated product cycle and lower-priced segments has failed to follow through. Accordingly, NIO's revised guidance for Q4 revenue i...

10

2

$BYD COMPANY (01211.HK)$ $BYD Company ADR (BYDDY.US)$

BYD is expanding to every corner of the globe.

BYD has entered the Peruvian passenger car market as the Chinese new energy vehicle (NEV) maker continues to expand its international presence.

The company recently held a brand launch in Peru and rolled out the BYD Song Pro, Tang, Yuan Up, Seal, and BYD Shark, according to an announcement.

BYD has entered into a strategic partnership with local dealer Mo...

BYD is expanding to every corner of the globe.

BYD has entered the Peruvian passenger car market as the Chinese new energy vehicle (NEV) maker continues to expand its international presence.

The company recently held a brand launch in Peru and rolled out the BYD Song Pro, Tang, Yuan Up, Seal, and BYD Shark, according to an announcement.

BYD has entered into a strategic partnership with local dealer Mo...

3

$Tesla (TSLA.US)$

Tesla has been touted by Tesla bulls as the market leader in humanoid robots. While Tesla is in the top 10, this is not true. There are others that are better.

The most advanced humanoid robots of 2024 are listed below in no particular order.

AMECA

AMECA by Engineered Arts is widely regarded as the "world’s most advanced humanoid." AMECA is engineered to be modular and upgradeable in both hardware and s...

Tesla has been touted by Tesla bulls as the market leader in humanoid robots. While Tesla is in the top 10, this is not true. There are others that are better.

The most advanced humanoid robots of 2024 are listed below in no particular order.

AMECA

AMECA by Engineered Arts is widely regarded as the "world’s most advanced humanoid." AMECA is engineered to be modular and upgradeable in both hardware and s...

+7

5

4

3

$GOLDWIND (02208.HK)$ can it break its recent peak of hkd7.85? sign of inflow

$Tesla (TSLA.US)$

Tesla doesn't seem on track to meet its 2024 sales targets. Now it's leaning hard on holiday lease deals and offers to meet its goals.

It's a hypocrisy of epic proportions. A company led by a CEO who vehemently opposes federal incentives is now leveraging them aggressively as 2024 draws to a close. Musk supports ending the consumer EV credits, arguing they would ultimately benefit his company and hurt competitors - b...

Tesla doesn't seem on track to meet its 2024 sales targets. Now it's leaning hard on holiday lease deals and offers to meet its goals.

It's a hypocrisy of epic proportions. A company led by a CEO who vehemently opposes federal incentives is now leveraging them aggressively as 2024 draws to a close. Musk supports ending the consumer EV credits, arguing they would ultimately benefit his company and hurt competitors - b...

39

1

$BYD COMPANY (01211.HK)$ $BYD Company ADR (BYDDY.US)$

BYD targets a 15% cost reduction for its second-generation blade battery, which will launch in the first half of 2025, a source familiar with the matter told CarNewsChina. BYD's blade battery 2.0 will have an energy density of up to 210 Wh/kg and support 16C peak discharge.

BYD will offer a short blade format for its second-gen lithium iron phosphate battery (LFP) with 160 Wh/kg energy density...

BYD targets a 15% cost reduction for its second-generation blade battery, which will launch in the first half of 2025, a source familiar with the matter told CarNewsChina. BYD's blade battery 2.0 will have an energy density of up to 210 Wh/kg and support 16C peak discharge.

BYD will offer a short blade format for its second-gen lithium iron phosphate battery (LFP) with 160 Wh/kg energy density...

22

1

$BYD COMPANY (01211.HK)$ $BYD Company ADR (BYDDY.US)$

China's top electric vehicle maker BYD gained market share as the world's largest auto market recorded its fastest-growing month in 2024, setting BYD up to exceed its global annual sales goal and overtake Ford and Honda.

BYD has been on an extraordinary expansion this year, growing capacity and undertaking a massive hiring spree to turbocharge revenue that surpassed Tesla in the third qu...

China's top electric vehicle maker BYD gained market share as the world's largest auto market recorded its fastest-growing month in 2024, setting BYD up to exceed its global annual sales goal and overtake Ford and Honda.

BYD has been on an extraordinary expansion this year, growing capacity and undertaking a massive hiring spree to turbocharge revenue that surpassed Tesla in the third qu...

13

3

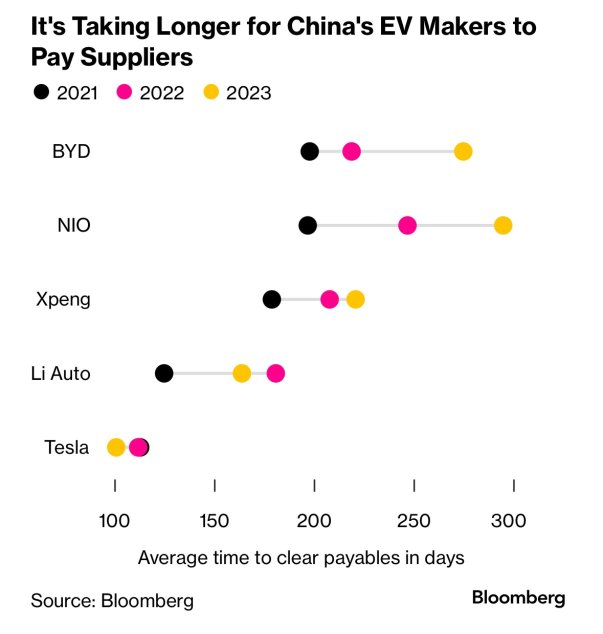

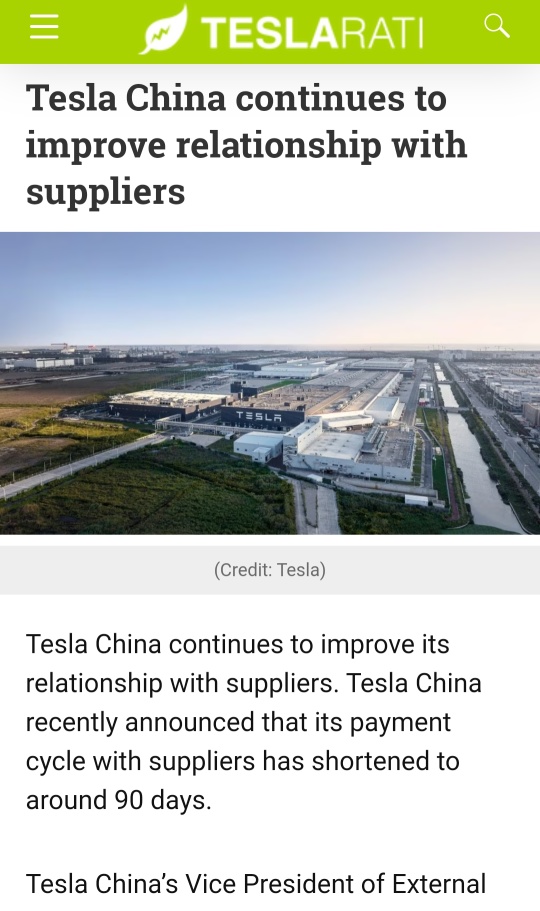

$Tesla (TSLA.US)$ $BYD COMPANY (01211.HK)$ $NIO Inc (NIO.US)$ $XPeng (XPEV.US)$

The 2 articles showed how the two major EV makers treat their suppliers - Tesla shortens supplier payment cycle and BYD pressurized suppliers to slash cost:

1) Carscoops:

A leaked email from BYD executive vice president He Zhiqi recently surfaced on Chinese social media, revealing the company’s aggressive cost-cutting plans. The email, titled “BY...

The 2 articles showed how the two major EV makers treat their suppliers - Tesla shortens supplier payment cycle and BYD pressurized suppliers to slash cost:

1) Carscoops:

A leaked email from BYD executive vice president He Zhiqi recently surfaced on Chinese social media, revealing the company’s aggressive cost-cutting plans. The email, titled “BY...

16

4

No comment yet

103553115 : this is absolutely amazing