Carbon Neutral

- 2065.231

- +13.368+0.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

ING: Next year, the CSI Commodity Equity Index will experience a "Put year," while Gold will still shine!

① ING expects that the Global situation will put pressure on the Energy and CSI Commodity Equity Index markets, but the outlook for Gold remains bright. ② The report points out that Trump's tariff plans may disrupt the oil, Metal, and Agriculture markets; ③ However, ING predicts that the average Gold price will rise to $2,760 per ounce by 2025, primarily influenced by central bank purchases of Gold and the appeal of Gold as a safe-haven asset.

Will gold continue to shine next year? Goldman Sachs is listed as one of the “three major catalysts”: see you at $3,000!

① Goldman Sachs expects the price of gold to rise 11% to $3,000 per ounce by the end of 2025; ② Goldman Sachs believes that interest rate cuts by the Federal Reserve, increased gold purchases by central banks, and rising geopolitical uncertainty are the three major factors driving the price of gold higher.

Aim for 30 million vehicles for the whole year, with RBOB Gasoline vehicles experiencing a "four consecutive months increase". The China Association of Automobile Manufacturers calls for early implementation of consumer promotion policies next year.

1. The domestic sales of traditional fuel Passenger Vehicles reached 1.21 million units, a decrease of 0.105 million units compared to the same period last year, with a month-on-month growth of 16.2% and a year-on-year decline of 8%. 2. Chen Shihua, deputy secretary-general of the China Automobile Industry Association, urged that relevant policies to promote Consumer spending on Autos continue next year and be implemented as soon as possible.

After the peak of the Robot Concept stocks, be wary of short-term divergences. AI and CSI Consumer 360 index may still have rotational opportunities.

Track the entire lifecycle of the main Sector.

The trend of steel companies becoming more "outward" is significant, with steel exports exceeding 100 million tons, setting an eight-year record high.

① Due to the continuous decline in domestic Steel consumption, companies in the Steel Industry Chain are focusing on overseas markets as a key area for development. This year, steel exports exceeded 100 million tons, reaching a new high in eight years. ② Under policy guidance, the proportion of exports of medium to high value-added products has increased, showing a trend of change in the overall structure of domestic Steel exports from long products to flat products.

A significant bullish announcement is coming! Which directions might be the core of capital's attention?

Track the entire lifecycle of the main sector.

Comments

Tesla doesn't seem on track to meet its 2024 sales targets. Now it's leaning hard on holiday lease deals and offers to meet its goals.

It's a hypocrisy of epic proportions. A company led by a CEO who vehemently opposes federal incentives is now leveraging them aggressively as 2024 draws to a close. Musk supports ending the consumer EV credits, arguing they would ultimately benefit his company and hurt competitors - b...

BYD targets a 15% cost reduction for its second-generation blade battery, which will launch in the first half of 2025, a source familiar with the matter told CarNewsChina. BYD's blade battery 2.0 will have an energy density of up to 210 Wh/kg and support 16C peak discharge.

BYD will offer a short blade format for its second-gen lithium iron phosphate battery (LFP) with 160 Wh/kg energy density...

China's top electric vehicle maker BYD gained market share as the world's largest auto market recorded its fastest-growing month in 2024, setting BYD up to exceed its global annual sales goal and overtake Ford and Honda.

BYD has been on an extraordinary expansion this year, growing capacity and undertaking a massive hiring spree to turbocharge revenue that surpassed Tesla in the third qu...

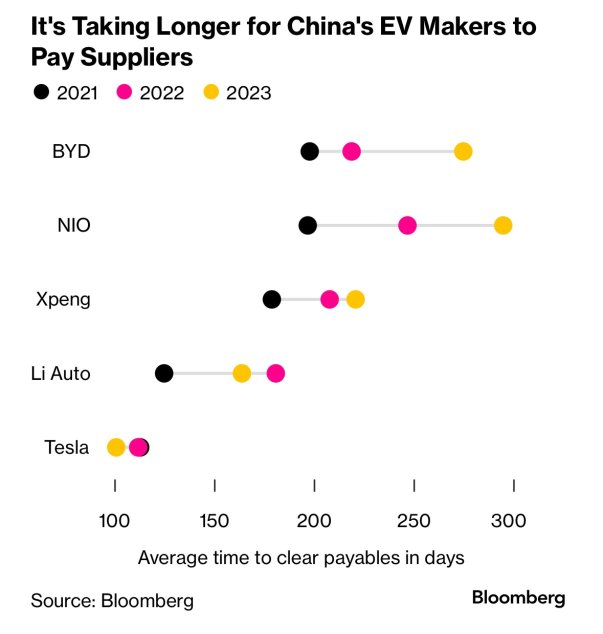

The 2 articles showed how the two major EV makers treat their suppliers - Tesla shortens supplier payment cycle and BYD pressurized suppliers to slash cost:

1) Carscoops:

A leaked email from BYD executive vice president He Zhiqi recently surfaced on Chinese social media, revealing the company’s aggressive cost-cutting plans. The email, titled “BY...