Carbon Neutral

- 1994.818

- +16.009+0.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Brokerage morning meeting highlights: The construction of a national unified electrical utilities market is accelerating, bullish on three main lines.

In today's brokerage morning meeting, htsc stated that the construction of a national unified electrical utilities market is accelerating, with a bullish outlook on three main lines; Galaxy Securities indicated that 5G applications are expected to develop on a large scale, selecting high-quality symbols with improved marginal prosperity; haitong sec expressed a bullish view on the steady rise of rare earth prices.

At the end of the year, the "sales boost battle" in the car market has begun: multiple car companies have updated the December car purchase benefits, with BYD's terminal prices showing a slight loosening.

BYD has launched various popular car models with different levels of discount policies in December. leapmotor, which has already completed its annual sales target ahead of schedule, updated the car purchase benefits for December on December 2nd.

Bank of America's outlook for the bulk market in 2025: Tariffs cast a shadow over the global market, crude oil enters an oversupply cycle, with gold shining alone, soaring straight to $3,000.

Bank of America Merrill Lynch expects that due to a significant increase in production from non-OPEC countries, coupled with the possibility of OPEC+ releasing more supply, the crude oil market may enter a surplus cycle, with the average annual price of Brent crude oil expected to be $65 per barrel. Basic metals are experiencing price fluctuations amid differentiated supply and demand. Driven by macroeconomic uncertainty and risk aversion sentiment, gold remains one of the most attractive precious metals in 2025.

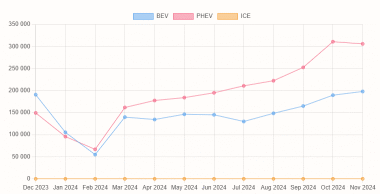

November electric vehicle delivery report: BYD's electric vehicle sales exceeded 0.5 million, Xiaopeng broke through 0.03 million for the first time, and Chongqing Sokon Industry Group Stock saw a year-on-year sales growth of 54.58%.

Last month, the delivery volume of the Xiaomi SU7 continued to exceed 20,000 units, and Xiaomi expressed confidence in achieving the new delivery target of over 130,000 units for the year.

Both supply and demand are expected to decrease. The industry predicts that the price of photovoltaic glass will mainly stabilize in the short term. | Industry Observation

①The photovoltaic glass continues the previous downturn trend, with major manufacturers taking price increase actions, but the upward support is insufficient, and short-term price stability is expected to be the main focus; ②Leading companies indicate that the top two leading positions are still stable, including looking into the future, the change in market structure will not be significant.

Hefei issued 44 million yuan in consumer vouchers and Ideal launched a zero-interest financial plan. Local governments and car companies are competing for the year-end "consumption wave".

① On November 29, according to the Hefei Municipal Bureau of Commerce, from November 29 to December 8, 2024, new consumer vouchers for autos will be issued in Hefei, totaling 44 million yuan. ② On the same day, Li Auto announced a limited-time 0% interest policy until the end of the year. From now until December 31, users purchasing the Li L-series and Li MEGA can enjoy a minimum down payment financing plan with 0% interest for 3 years.

Comments

Longtime Tesla bear Craig Irwin, from Roth Capital, who has frequently appeared on CNBC to speak negatively about Tesla, just raised his Tesla share price target by a whopping 347% to $380 (from $85). For years, he had called Tesla "egregiously overvalued." Now, he has a BUY rating on the stock.

Here's what he said today about Tesla:

"This quarter is probably...

$BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$ $Tesla (TSLA.US)$ $NIO Inc (NIO.US)$ $NIO Inc. USD OV (NIO.SG)$ $NIO-SW (09866.HK)$

😃

BYD sold 504,003 passenger vehicles in Nov, up 67.2% from 301,378 units last year and 0.7% from the previous Oct, creating a new monthly record. BYD sales are over half a million vehicles a second consecutive month.

In 2024 (Jan to Nov), BYD sold 3,740,930 passenger vehicles, up 40.0% from the same period last year. BYD's official target is to d...

SPACELIGHT : Well, so what, $85 was ridiculous.

129455432345 : This guy is an absolute joke $85 lol. He need some milk such a baby

ZnWC OP SPACELIGHT : Someone said Tesla will be like Enron and become bankrupt not long ago.